Step-by-Step Guide to Configuring Your Company and GST Settings on the Dashboard

9 mins read · Updated 29 Sep, 2025

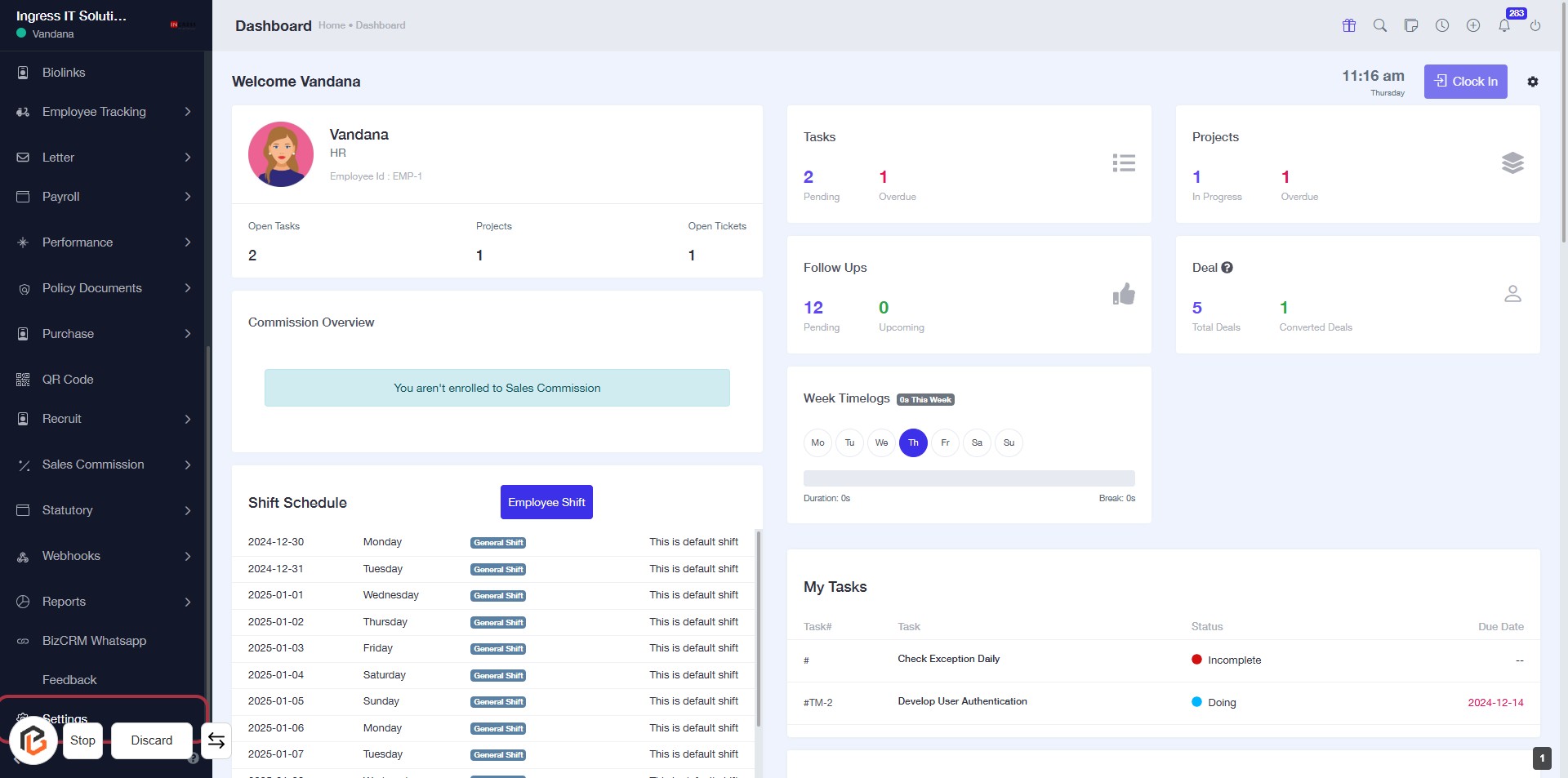

STEP 1: Click on "Settings" to Access Configuration Options

- Navigate to the left sidebar of the dashboard.

- Click on the Settings link to open the settings menu.

- Ensure you are on the correct page before proceeding to the next step.

- This action will lead you to the configuration options for your account.

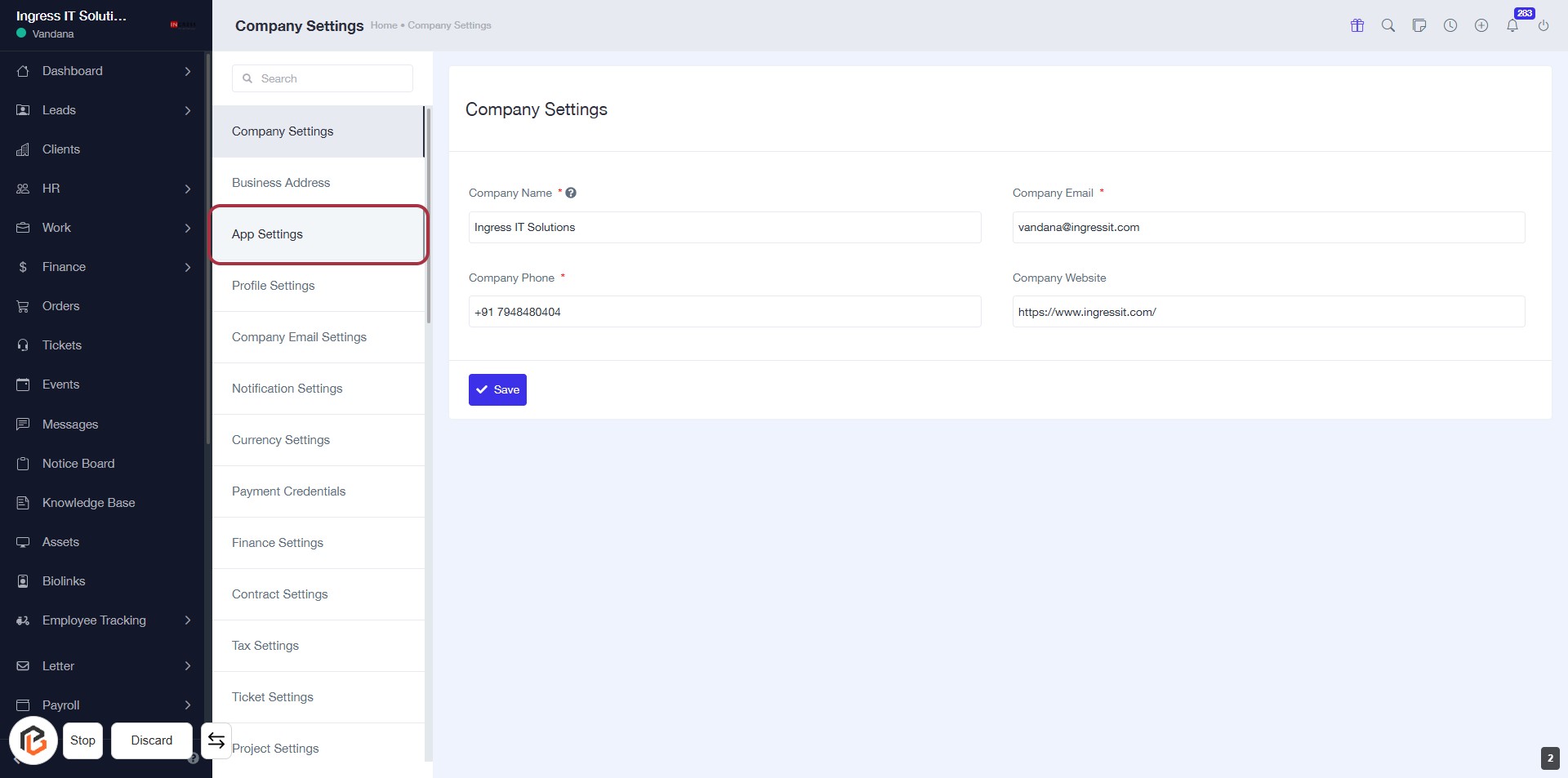

STEP 2: Click on "App Settings" to Access Company Configuration

- Click on the App Settings link in the sidebar.

- Ensure you are on the Company Settings page.

- Fill in the required fields marked with an asterisk (*):

- Company Name

- Company Phone

- Company Email

- Optionally, provide the Company Website.

- Click Save to apply changes.

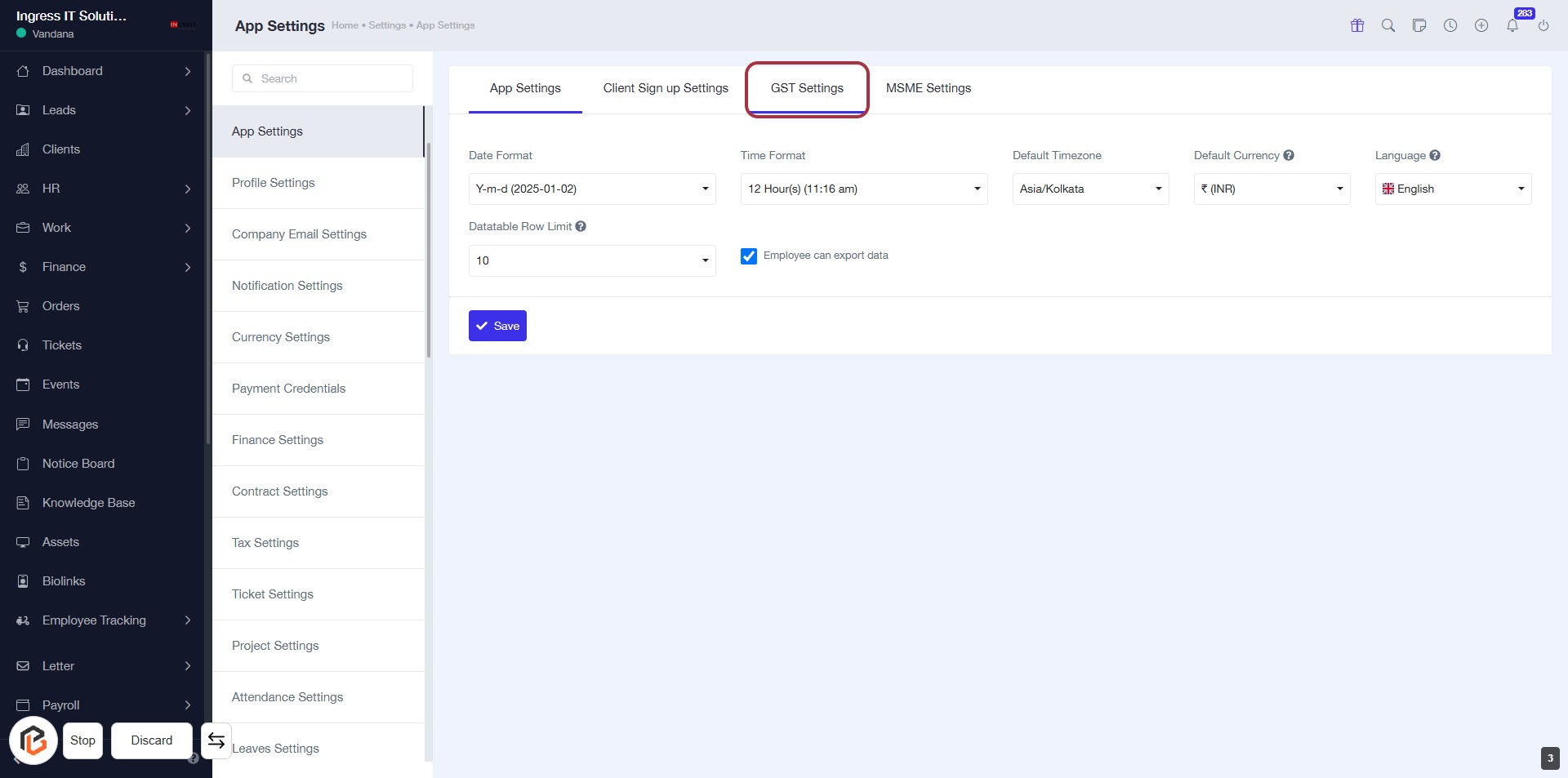

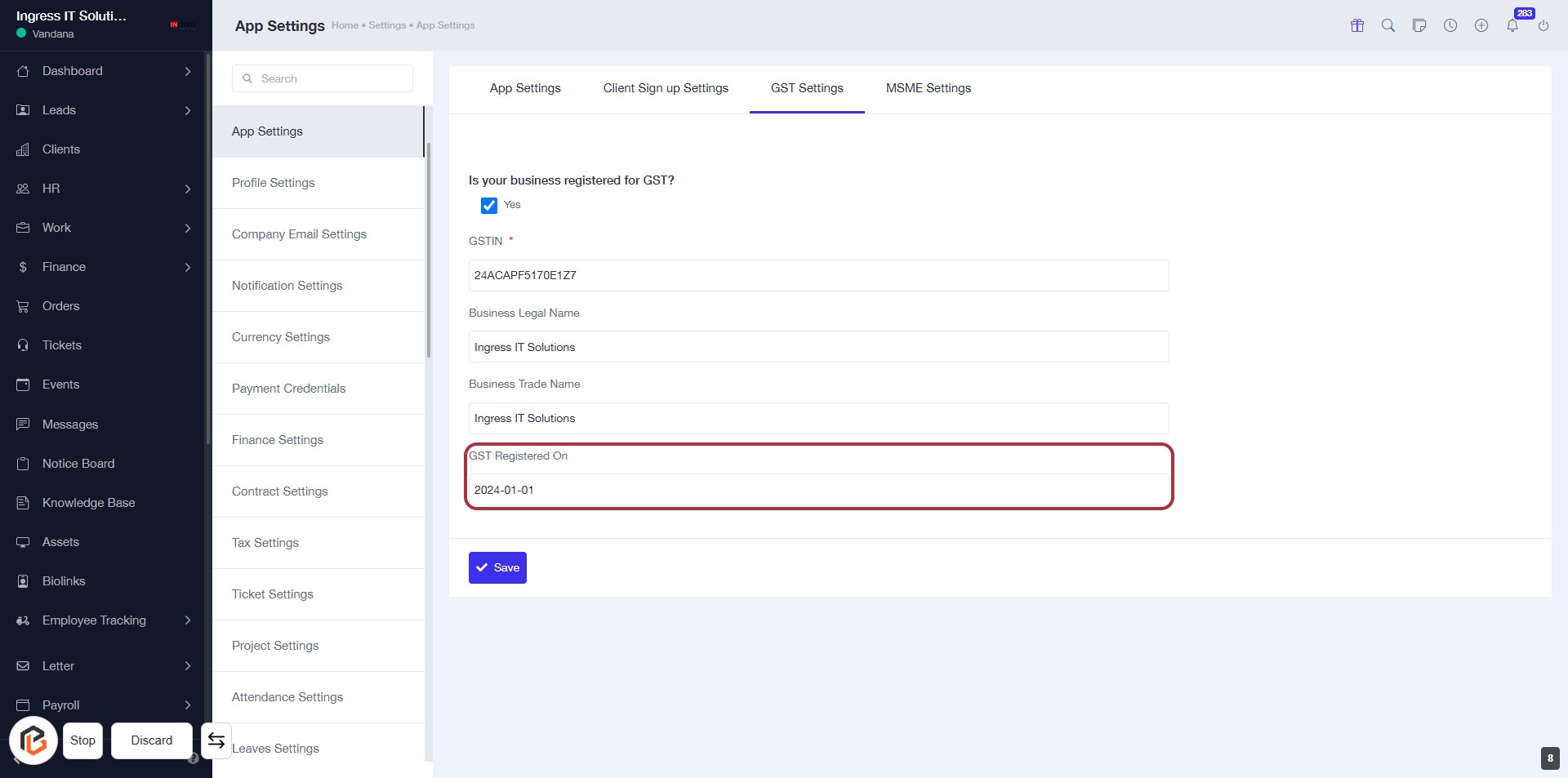

STEP 3: Click on "GST Settings" to Access GST Configuration

- Navigate to the "GST Settings" tab in the App Settings.

- Ensure you review the following input fields:

- Date Format: Choose your preferred date format.

- Time Format: Select the desired time format.

- Datatable Row Limit: Specify the number of rows to display.

- Default Timezone: Set your default timezone.

- Default Currency: Choose your default currency.

- Language: Select your preferred language.

- Click "Save" to apply changes.

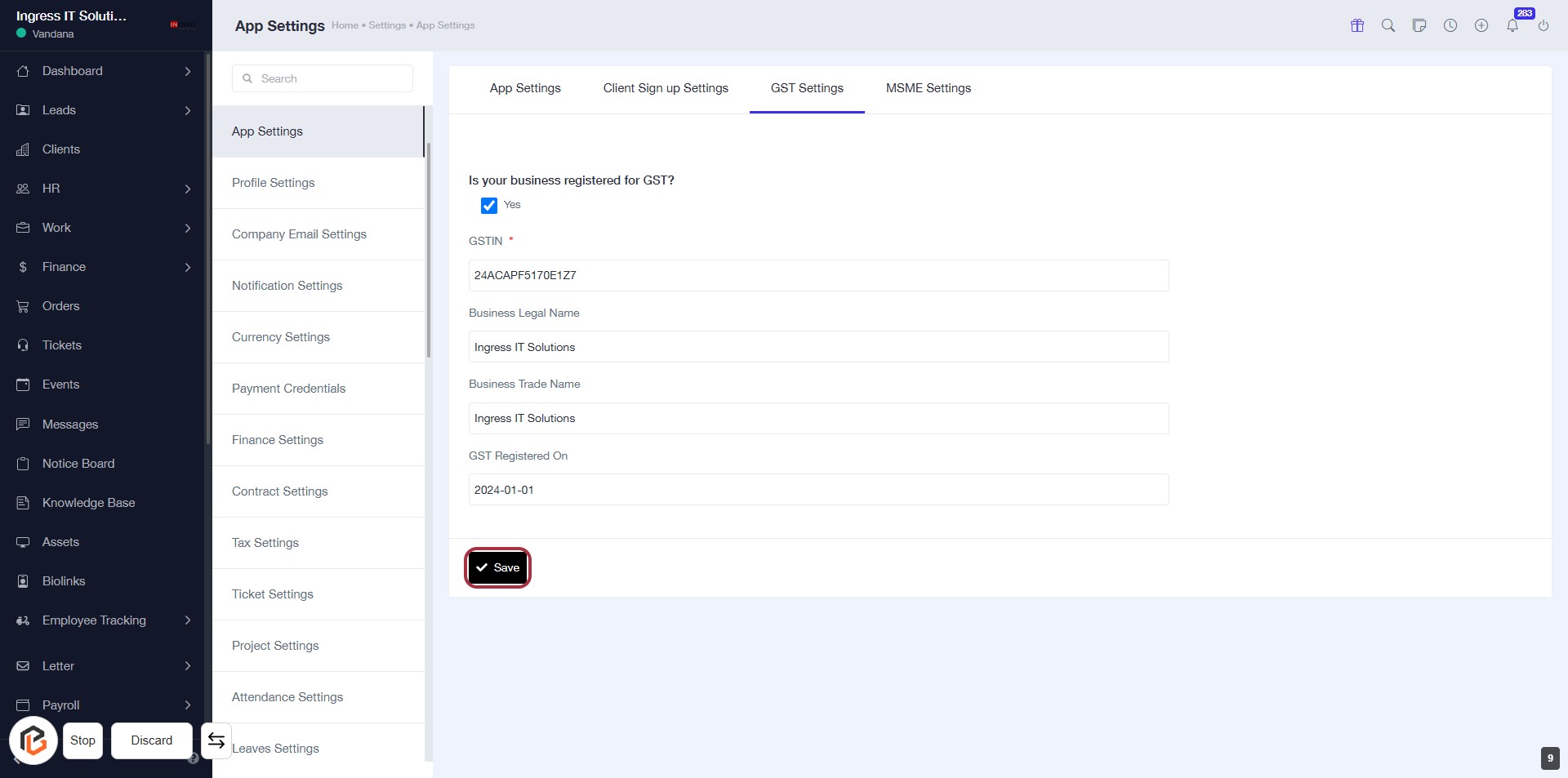

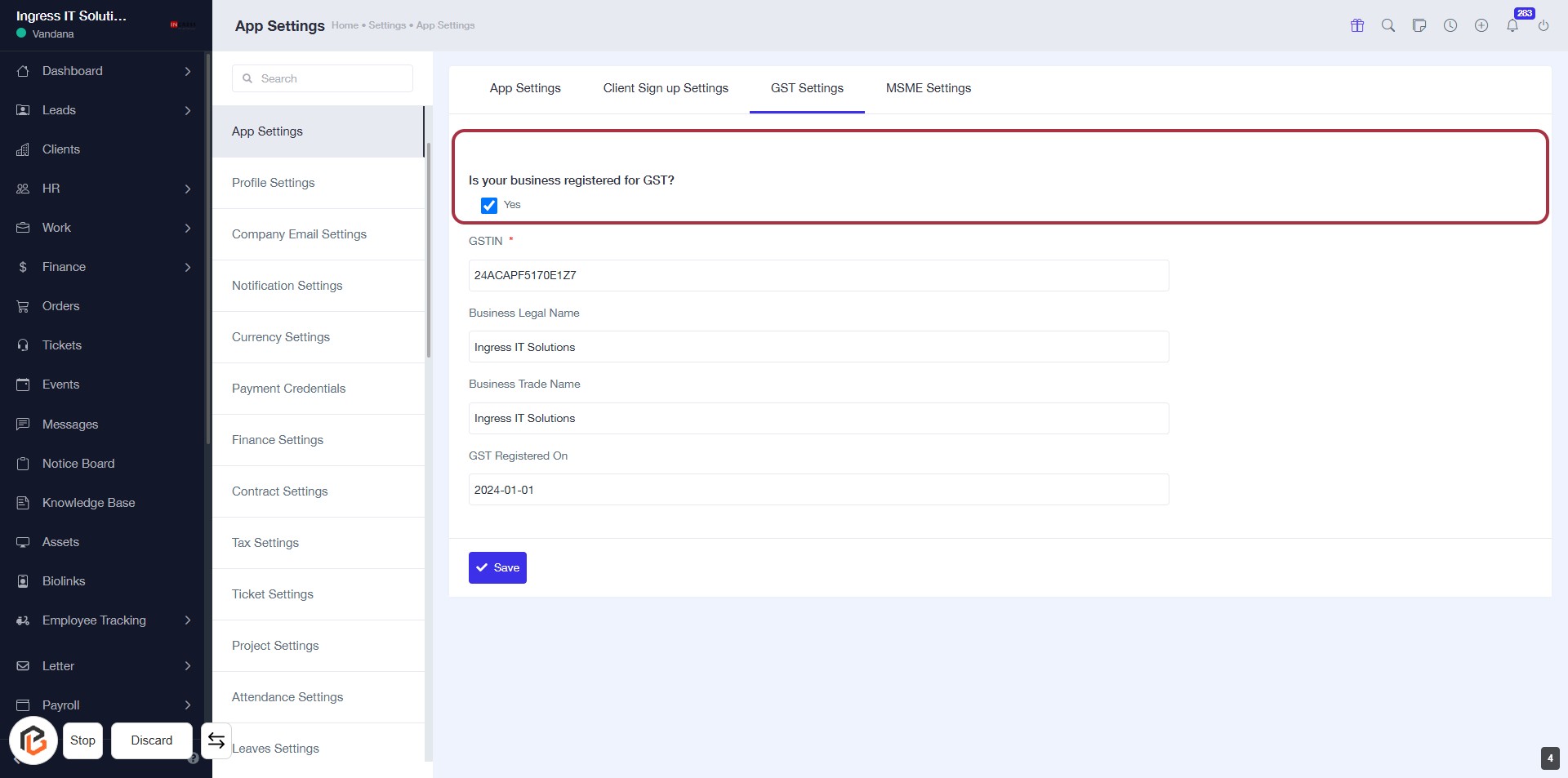

STEP 4: Select "Is your business registered for GST?"

- Click on the option "Is your business registered for GST?" in the highlighted area.

- Ensure to select either "Yes" or "No" based on your business status.

- This selection is crucial for proceeding with GST-related configurations.

- After making your selection, continue to the next step to enter your GSTIN number.

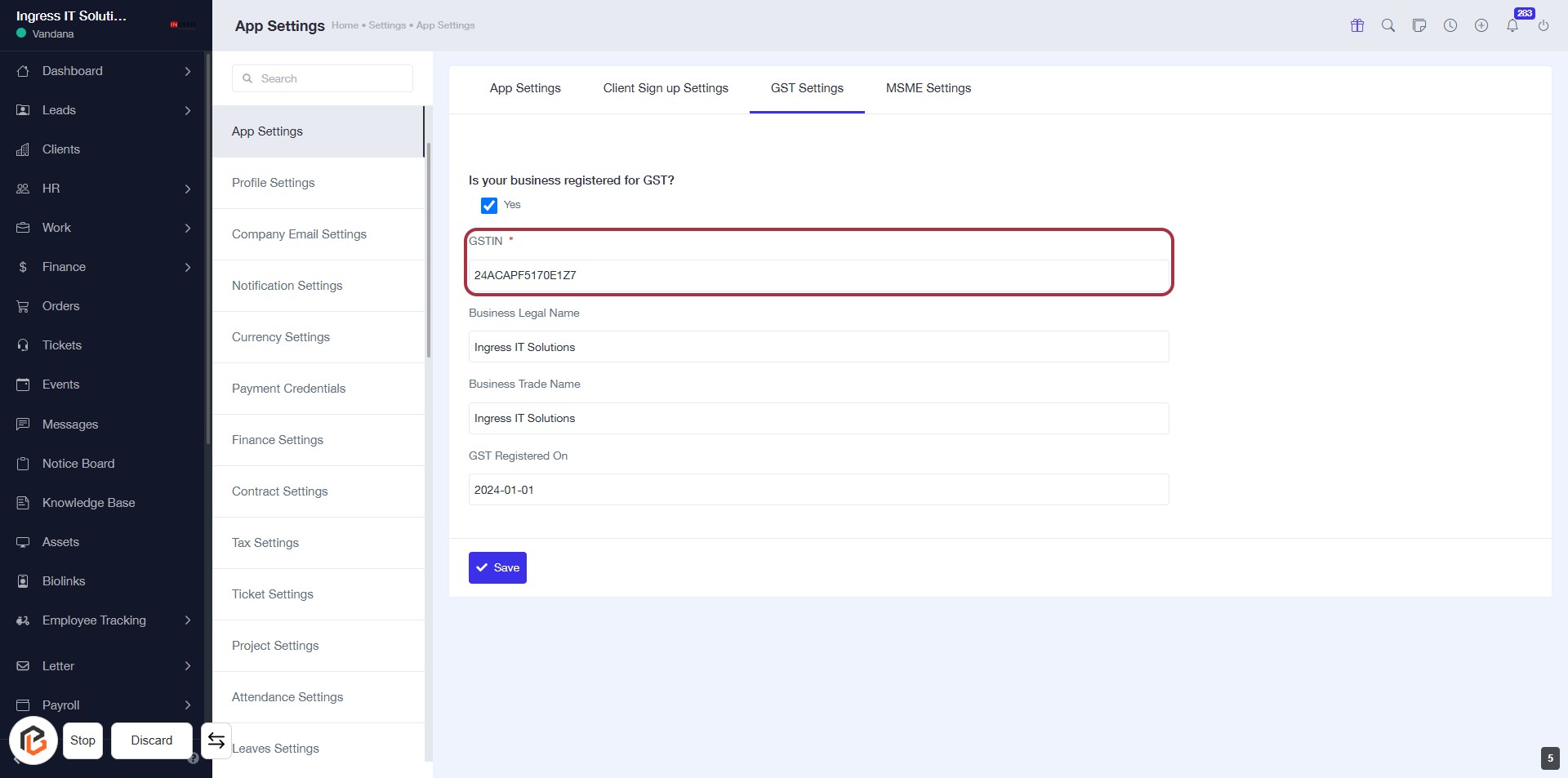

STEP 5: Enter "GSTIN" Number

- Click on the "GSTIN" field (marked with a red border).

- Ensure the field is marked with an asterisk (*) indicating it's required.

- Input your GSTIN number in the provided space.

- Proceed to the next step by entering the "Business Legal Name."

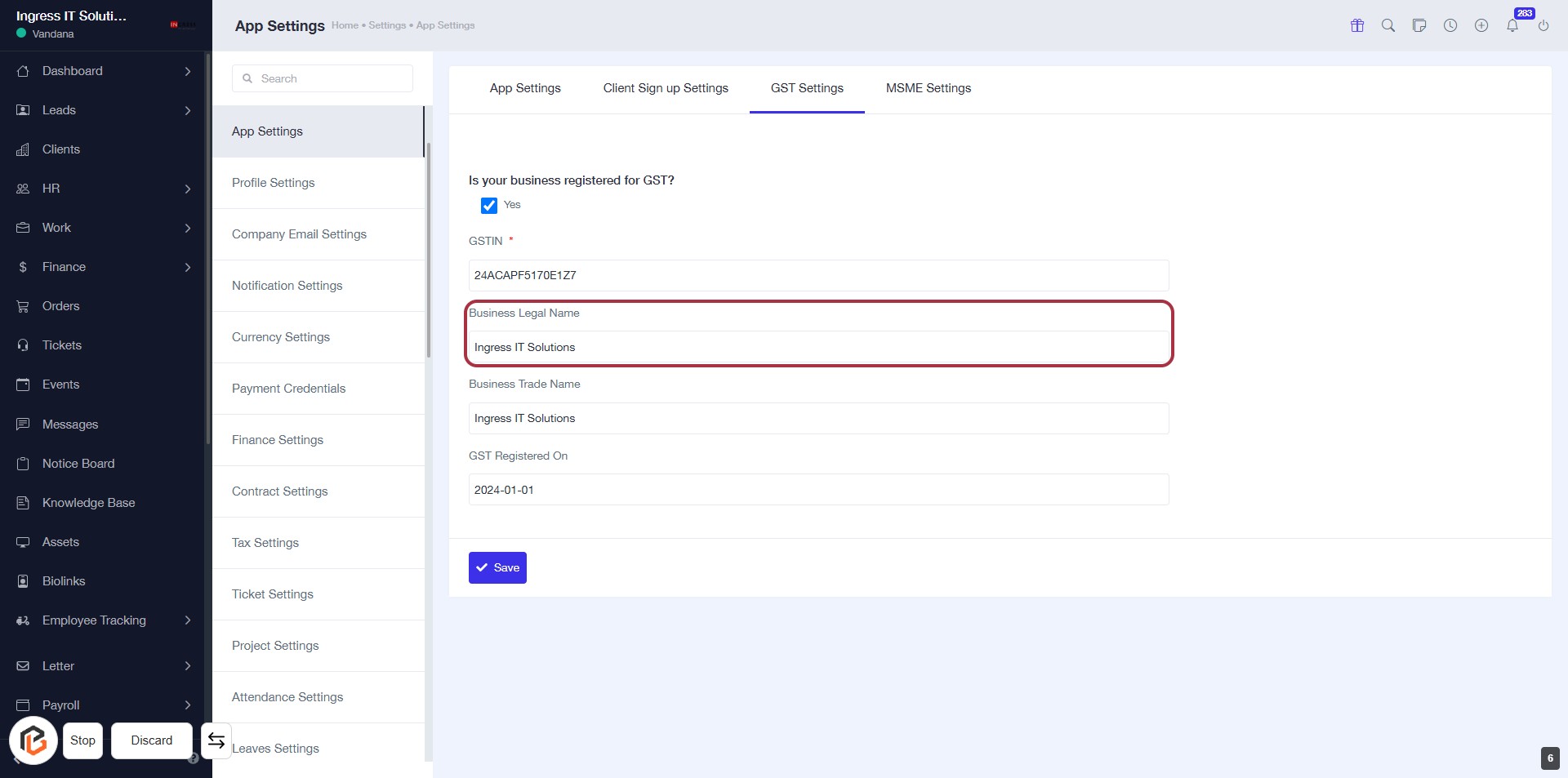

STEP 6: Enter "Business Legal Name"

- Click on the "Business Legal Name" field highlighted in red.

- Ensure the field is empty before entering your business's legal name.

- This field is mandatory, indicated by the asterisk (*).

- After entering the name, proceed to the next step by filling in the "Business Trade Name."

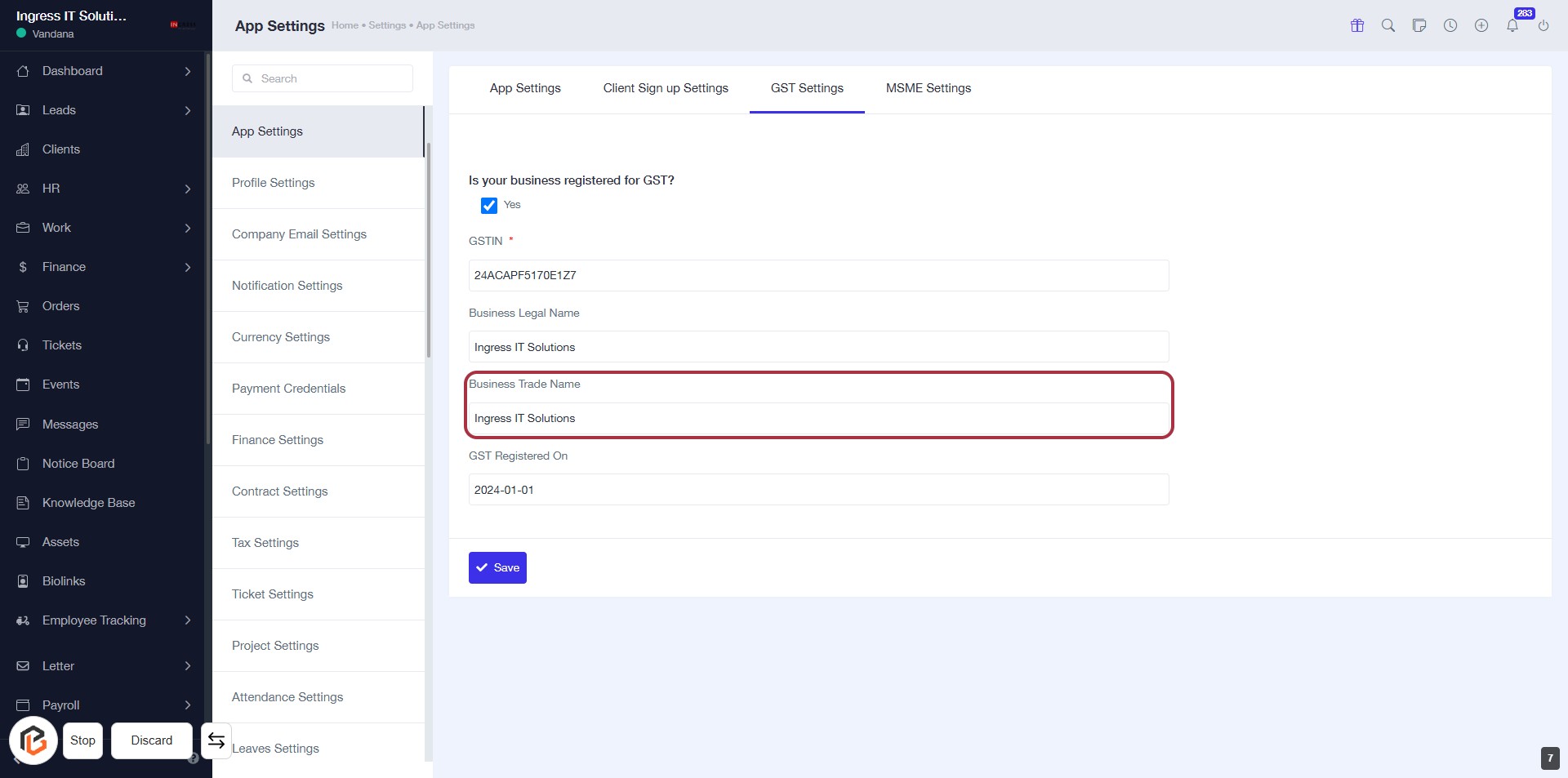

STEP 7: Enter "Business Trade Name"

- Click on the "Business Trade Name" field highlighted in red.

- Input the trade name of your business.

- Ensure all required fields marked with an asterisk (*) are filled out.

- Review your entries before proceeding to the next step.

STEP 8: Enter "GST Registered Date"

- Click on the highlighted area labeled "GST Registered On" to input the date.

- Ensure the date format is correct (YYYY-MM-DD).

- Review other fields for completeness, especially those marked with an asterisk (*).

- Proceed to the next step by clicking the "Save" button.

STEP 9: Click on "Save" to Finalize GST Settings

- Ensure all required fields are filled, including GSTIN and GST Registered Date.

- Review the information entered for accuracy.

- Click the Save button at the bottom of the form to save your settings.

- Confirmation of successful saving may appear afterward.