Step-by-Step Guide to Configuring Tax Settings in Your Dashboard

6 mins read · Updated 29 Sep, 2025

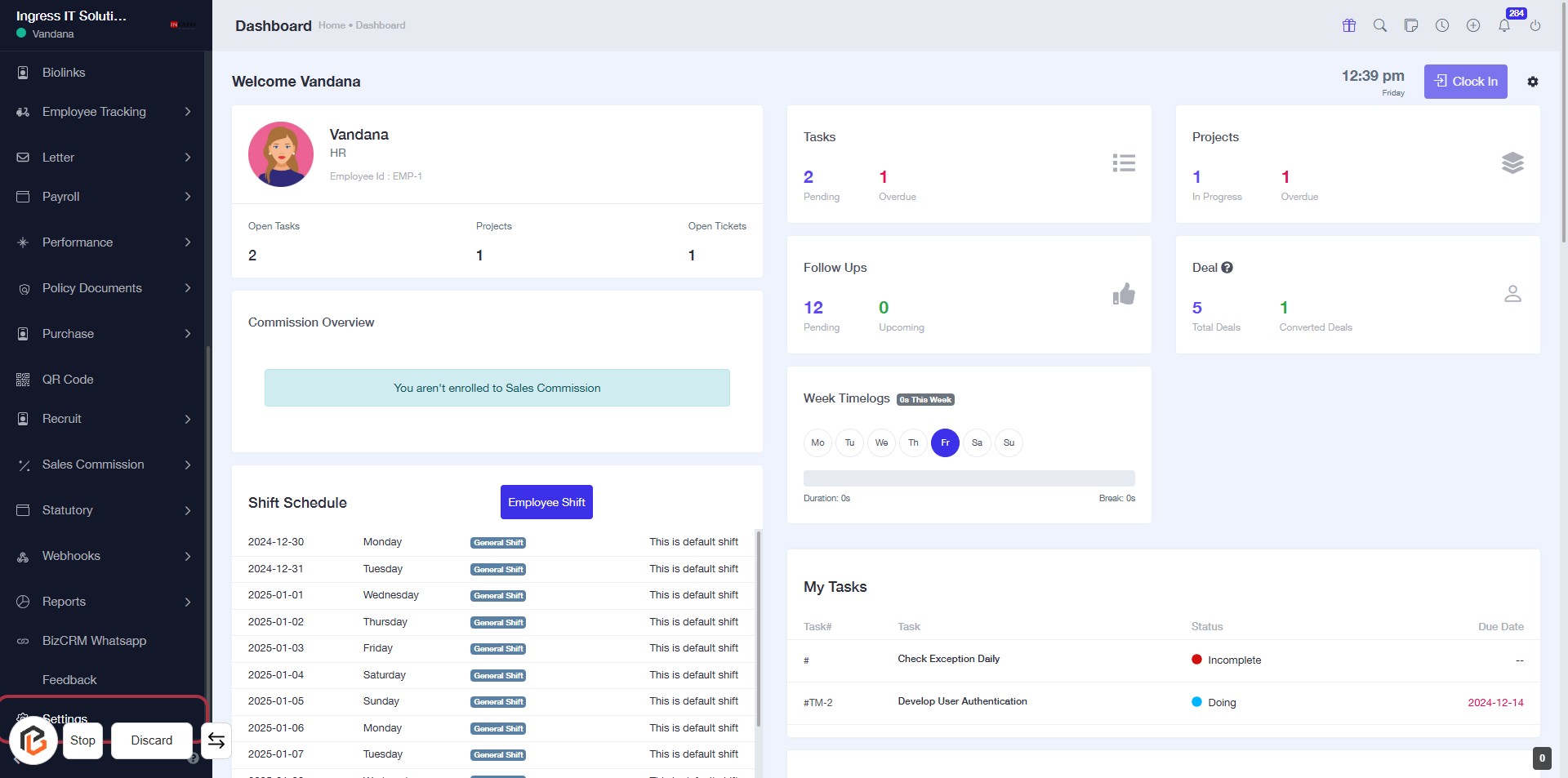

STEP 1: Click on "Settings" to Access Configuration Options

- Navigate to the left sidebar of the dashboard.

- Click on the Settings link to open the settings menu.

- Ensure you are on the Dashboard page before proceeding.

- This action will lead you to further configuration options, including Tax Settings.

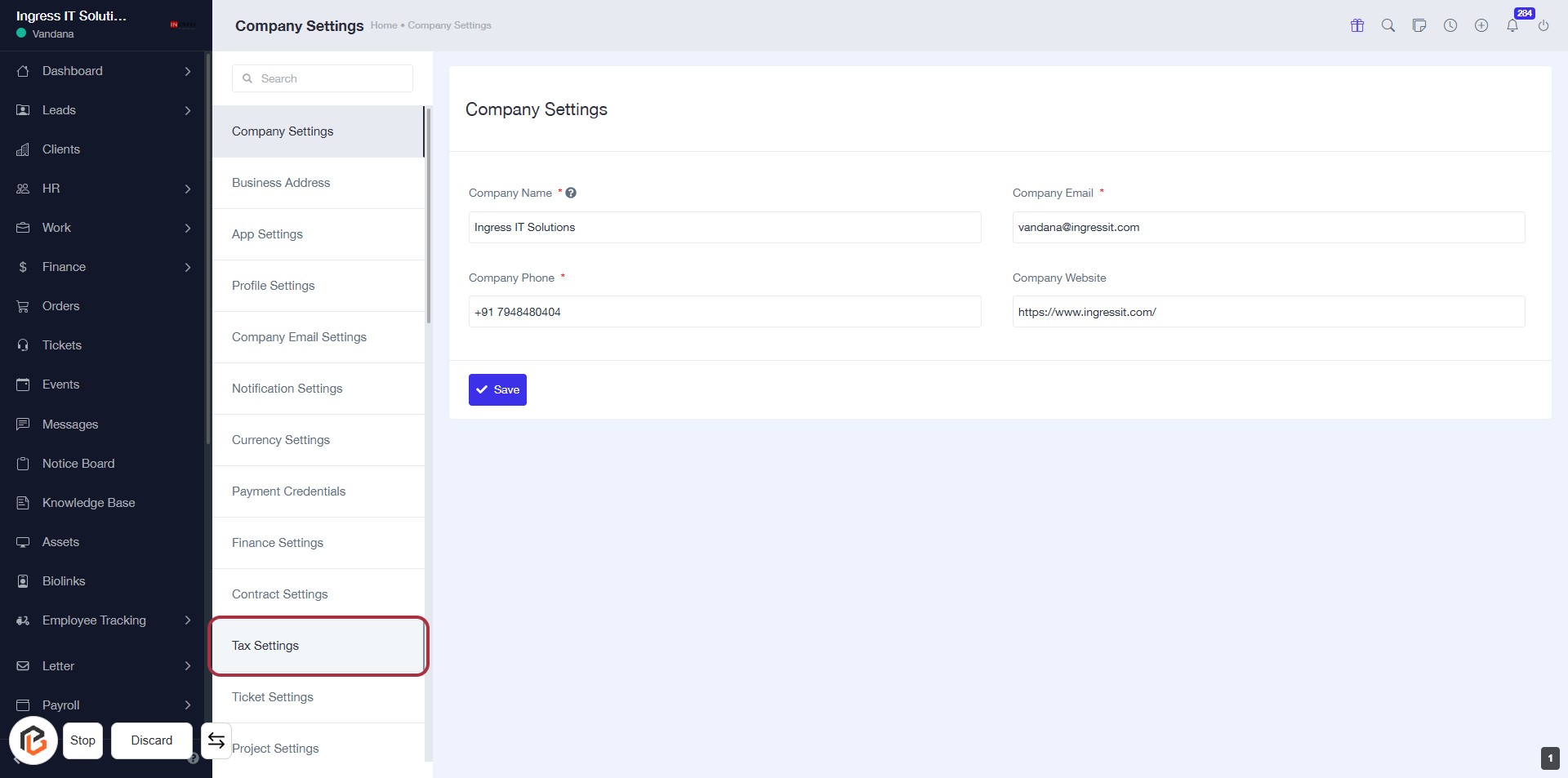

STEP 2: Click on "Tax Settings"

- Navigate to the "Tax Settings" option in the sidebar.

- Click on the highlighted "Tax Settings" link to access tax configuration.

- Ensure you have the necessary permissions to modify tax settings.

- After clicking, you will be directed to the tax settings page for further actions.

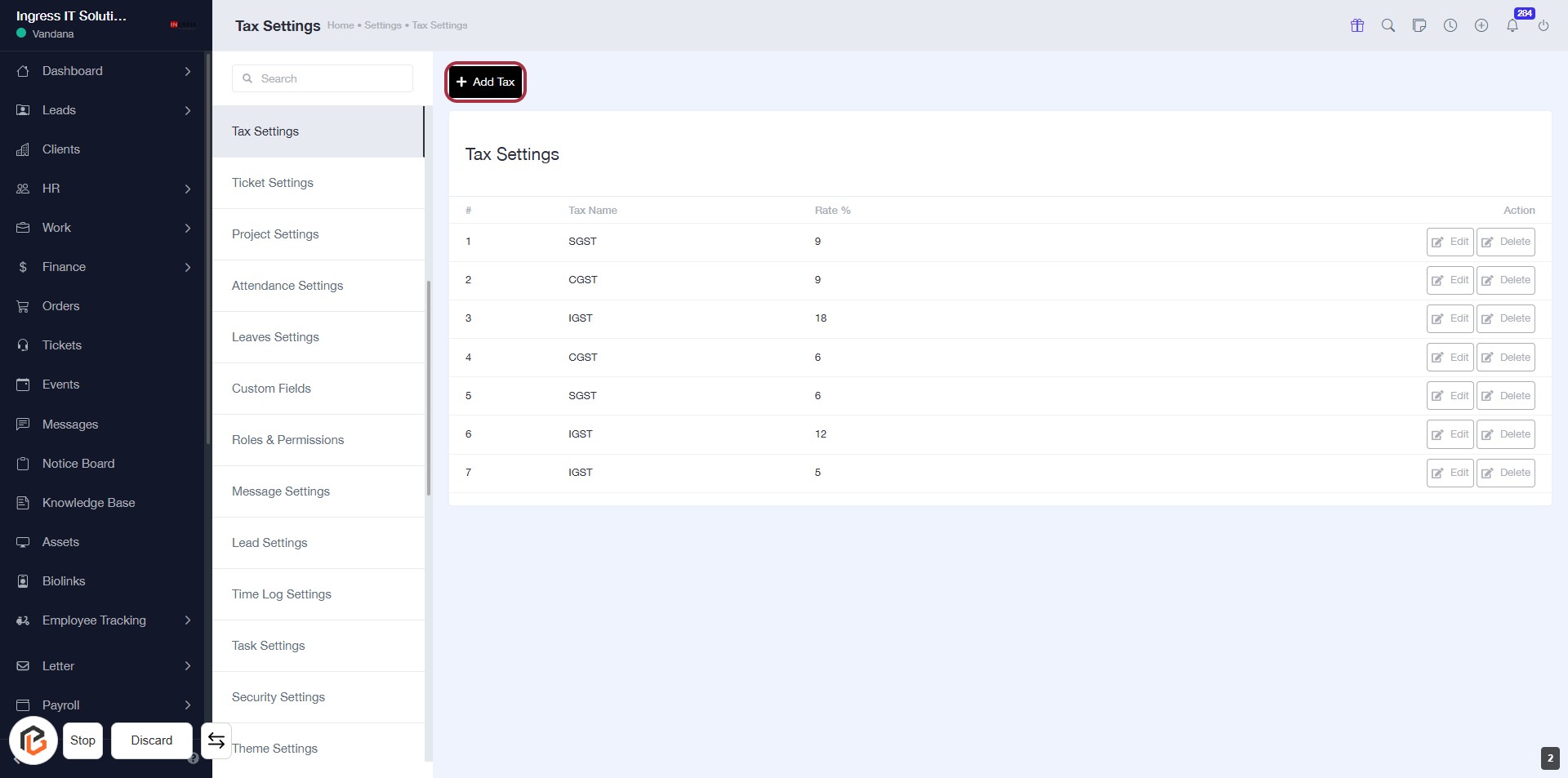

STEP 3: Click on "Add Tax"

- Navigate to the Tax Settings page.

- Locate the Add Tax button highlighted in red.

- Click on the Add Tax button to proceed.

- This action will allow you to enter the details for a new tax entry.

Next, you will need to enter the "Tax Name."

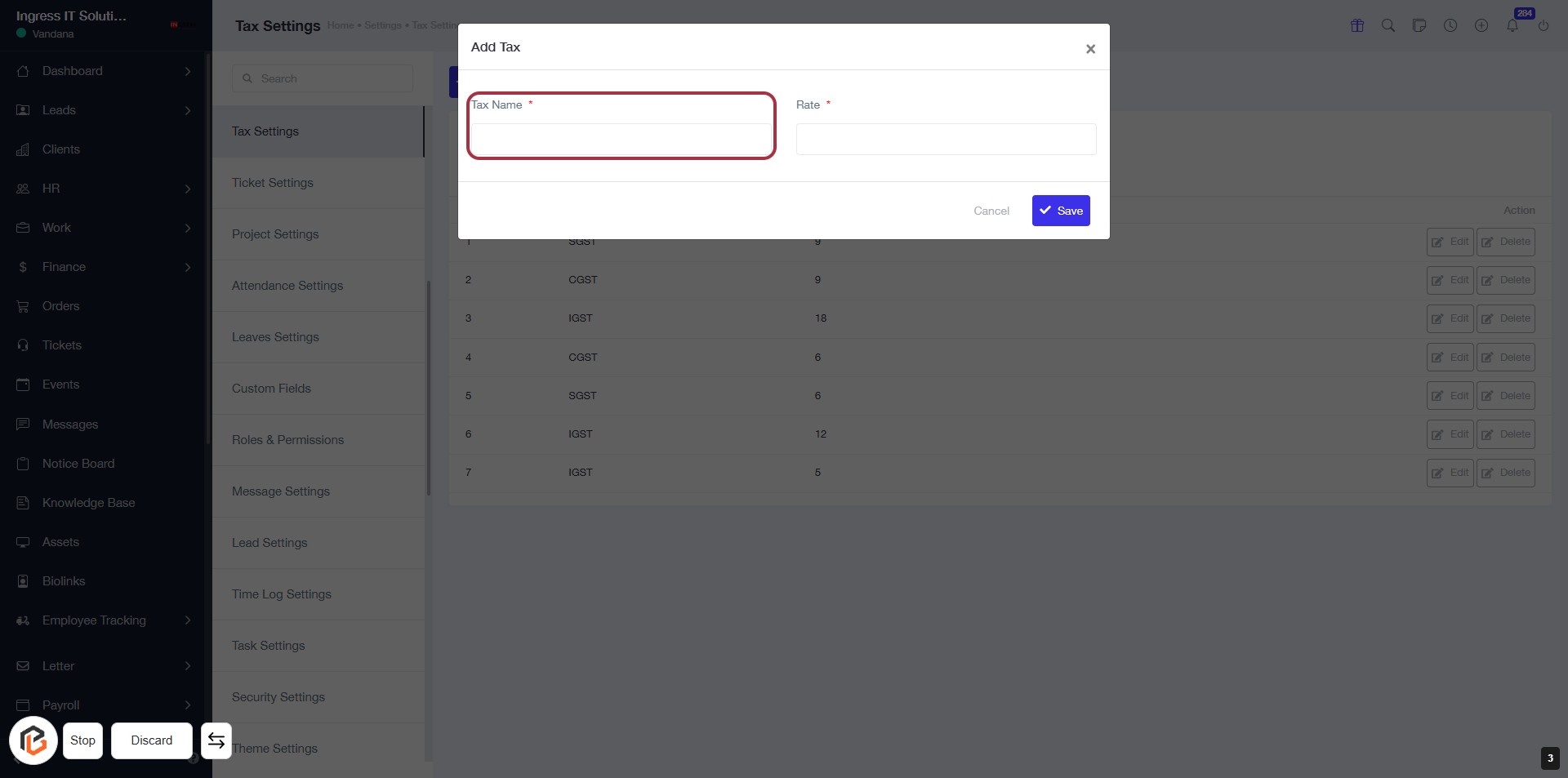

STEP 4: Enter Tax Name

- Click on the highlighted area labeled "Tax Name" to input the name of the tax.

- Ensure that the field marked with an asterisk (*) is filled, as it is required.

- After entering the tax name, proceed to the next step to enter the "Rate".

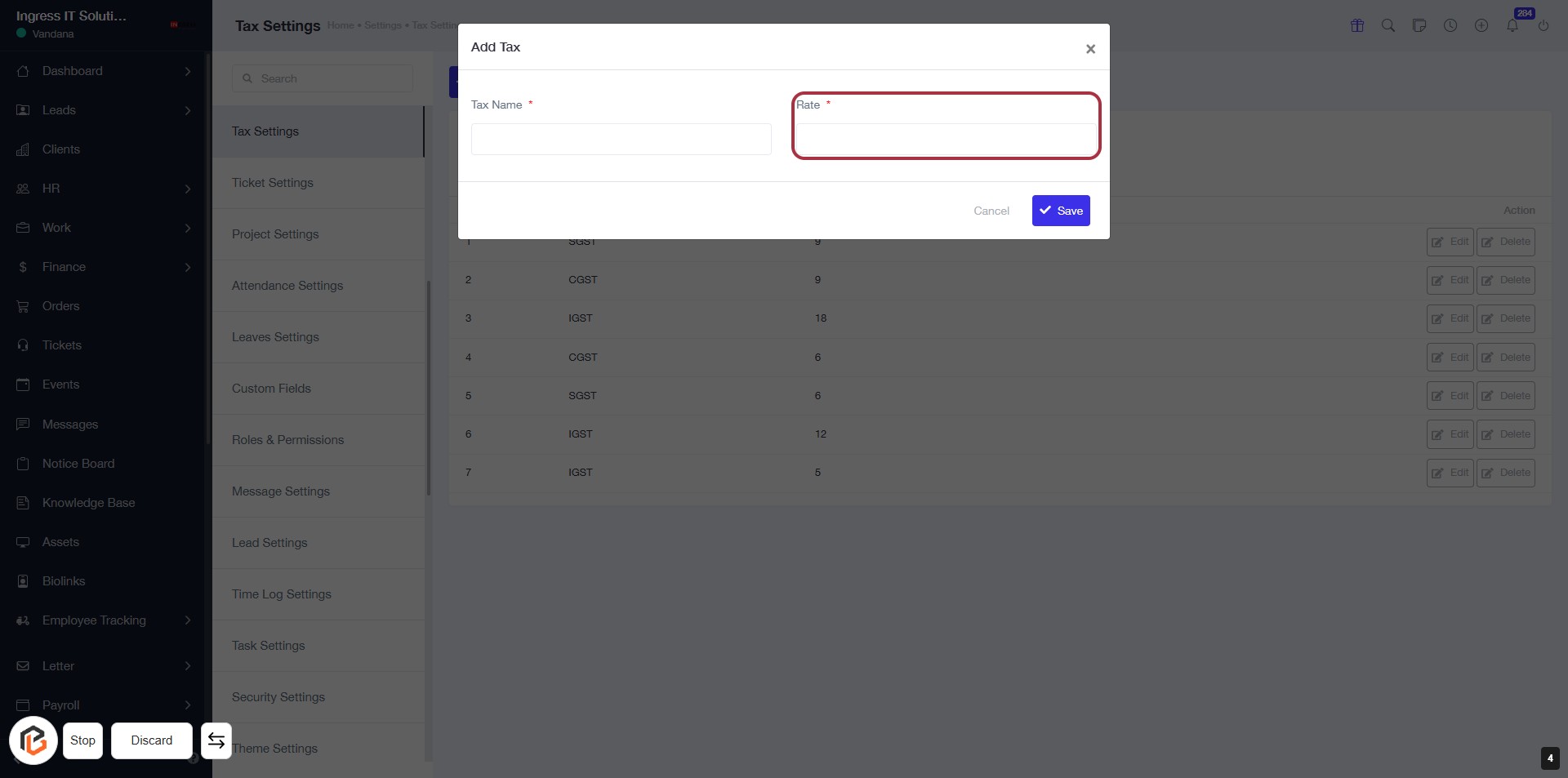

STEP 5: Enter Rate for Tax Configuration

- Click on the highlighted "Rate" field to input the tax rate.

- Ensure to fill in this field as it is marked with an asterisk (*), indicating it's a required field.

- Review your entries before proceeding to the next step.

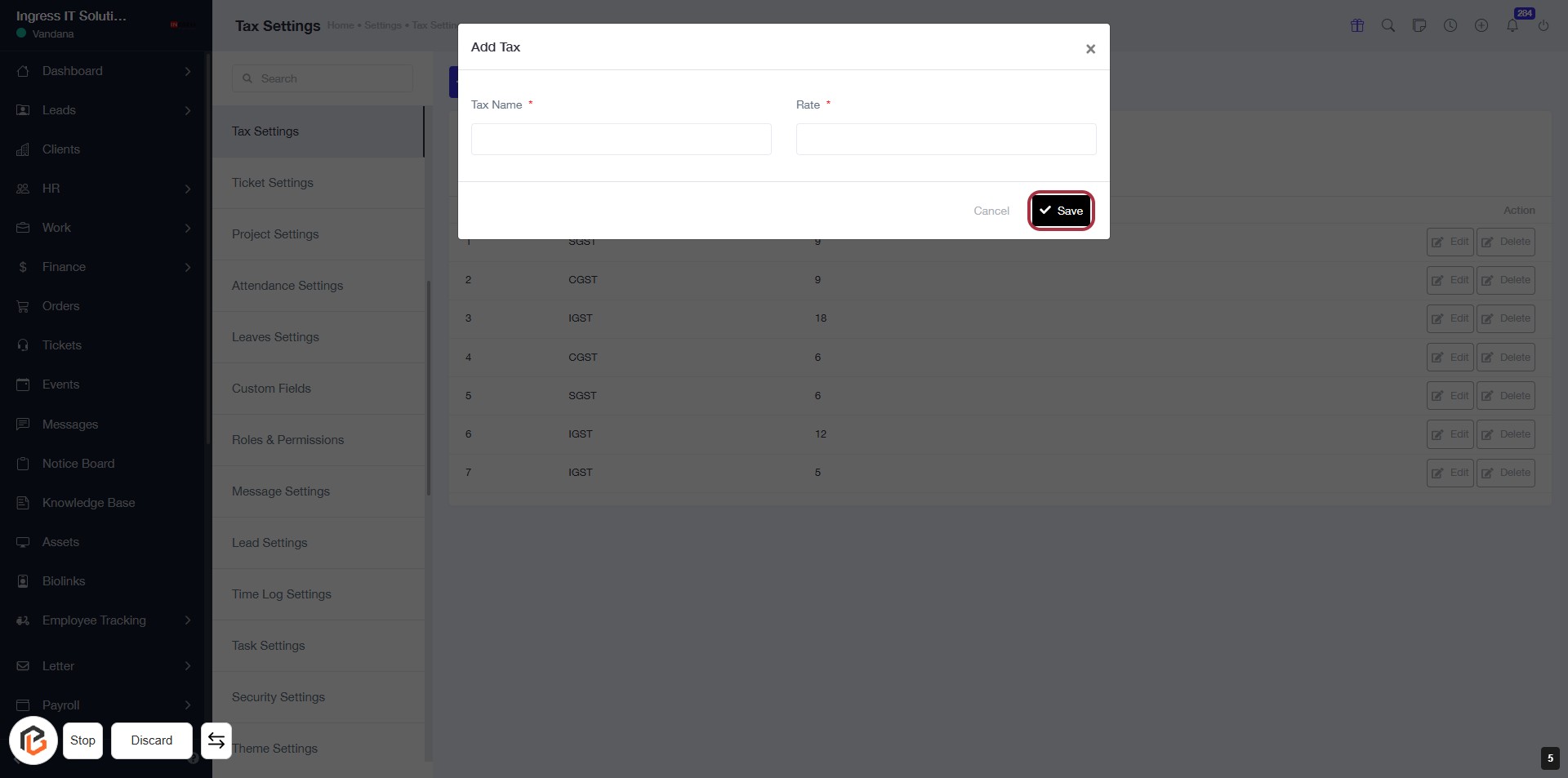

STEP 6: Click on "Save" to Finalize Tax Configuration

- Ensure all required fields (Tax Name and Rate) are filled.

- Locate the "Save" button in the dialog box.

- Click on the "Save" button to save your tax configuration.

- Confirm that a success message appears, indicating the configuration has been saved.