Step-by-Step Guide to Configuring Salary TDS in Payroll Settings

13 mins read · Updated 29 Sep, 2025

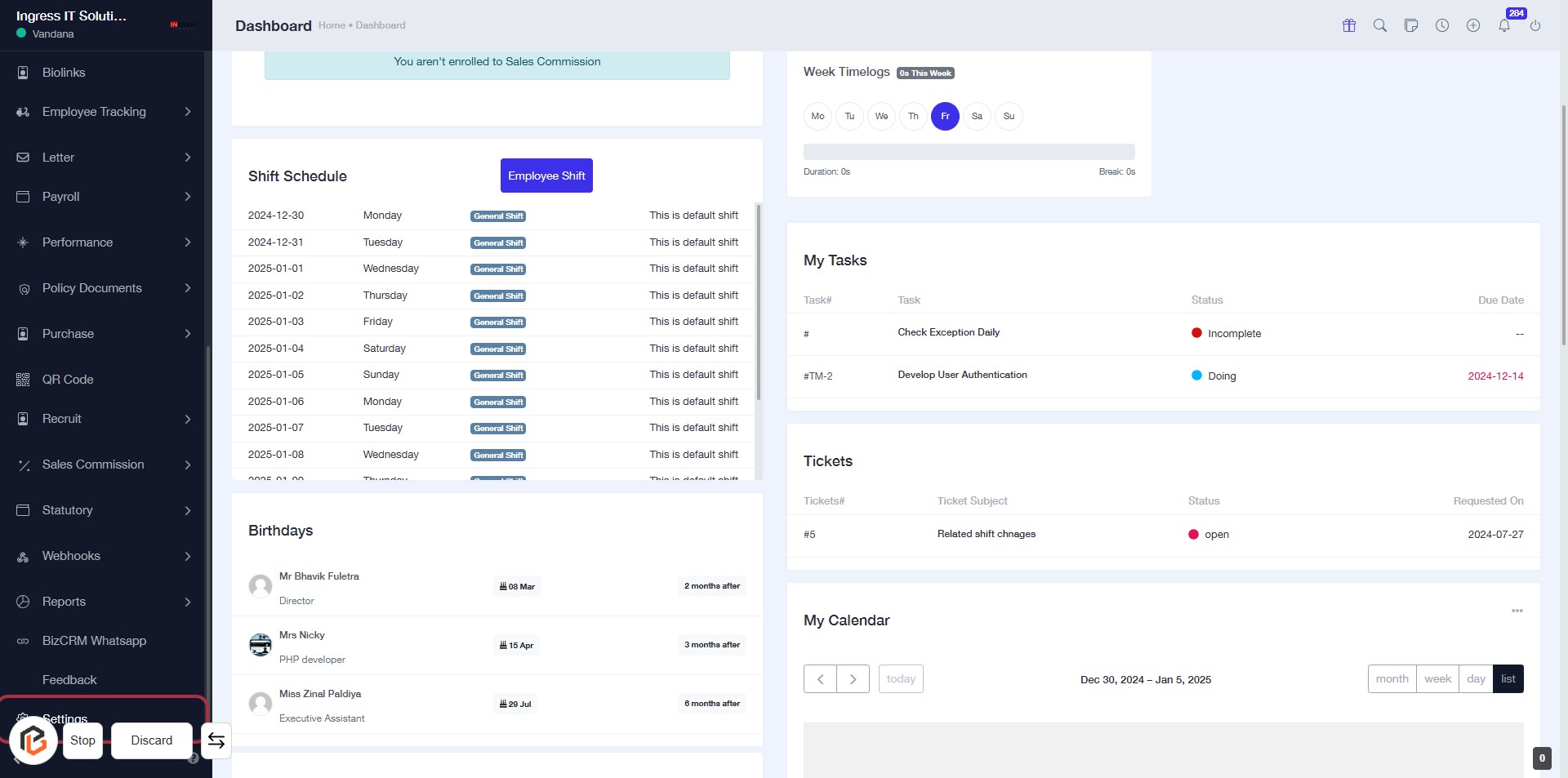

STEP 1: Click on "Settings" to Access Configuration Options

- Navigate to the left sidebar of the dashboard.

- Locate and click on the "Settings" option highlighted in red.

- This will direct you to the settings page where you can manage various configurations.

- Ensure you are ready to proceed to the next step for "Payroll Settings."

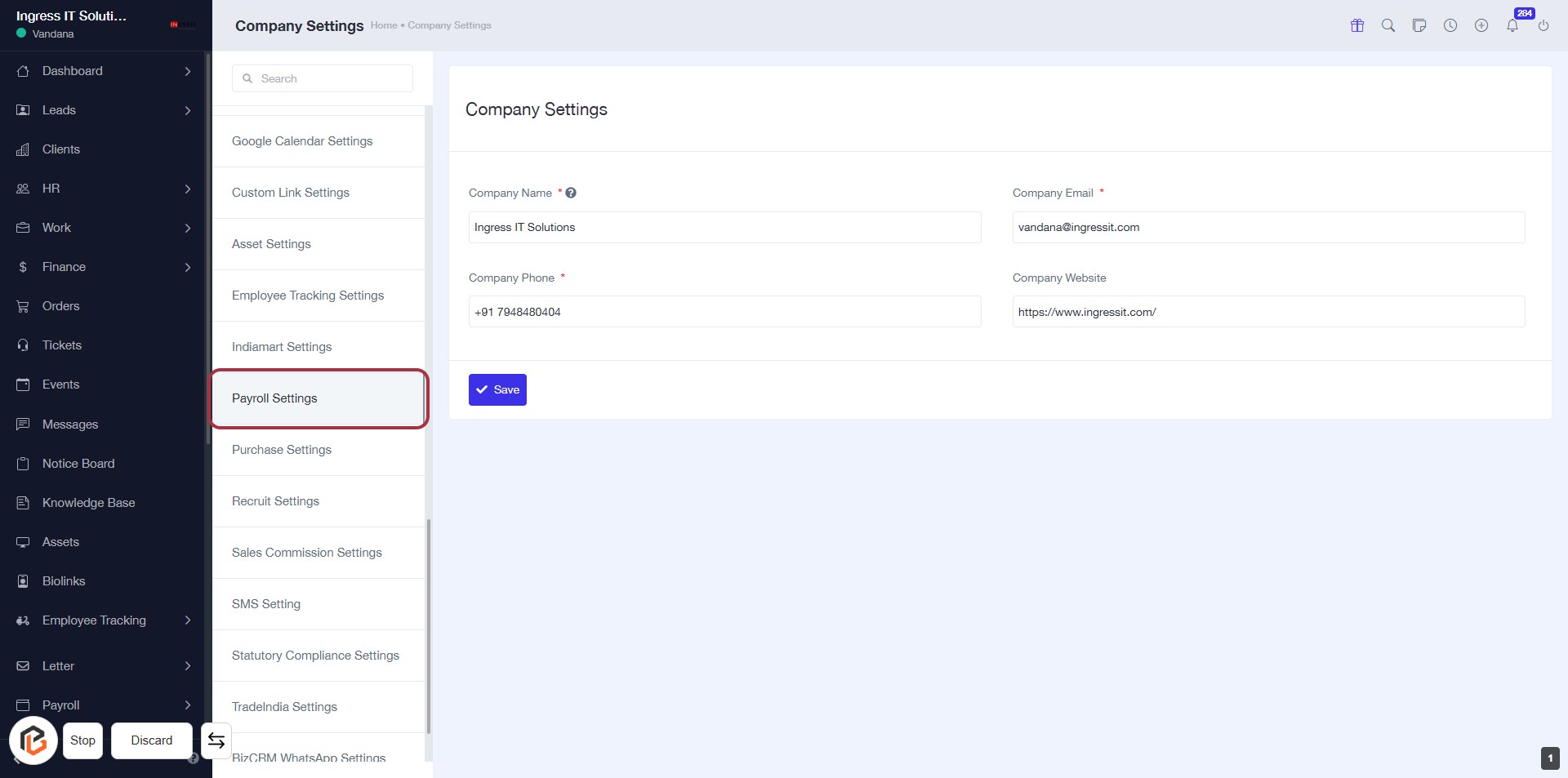

STEP 2: Click on "Payroll Settings"

- Navigate to the Payroll Settings option in the sidebar menu.

- Click on the Payroll Settings link to access the payroll configuration options.

- Ensure you have the necessary permissions to modify payroll settings.

- After clicking, you will be directed to the payroll settings page for further adjustments.

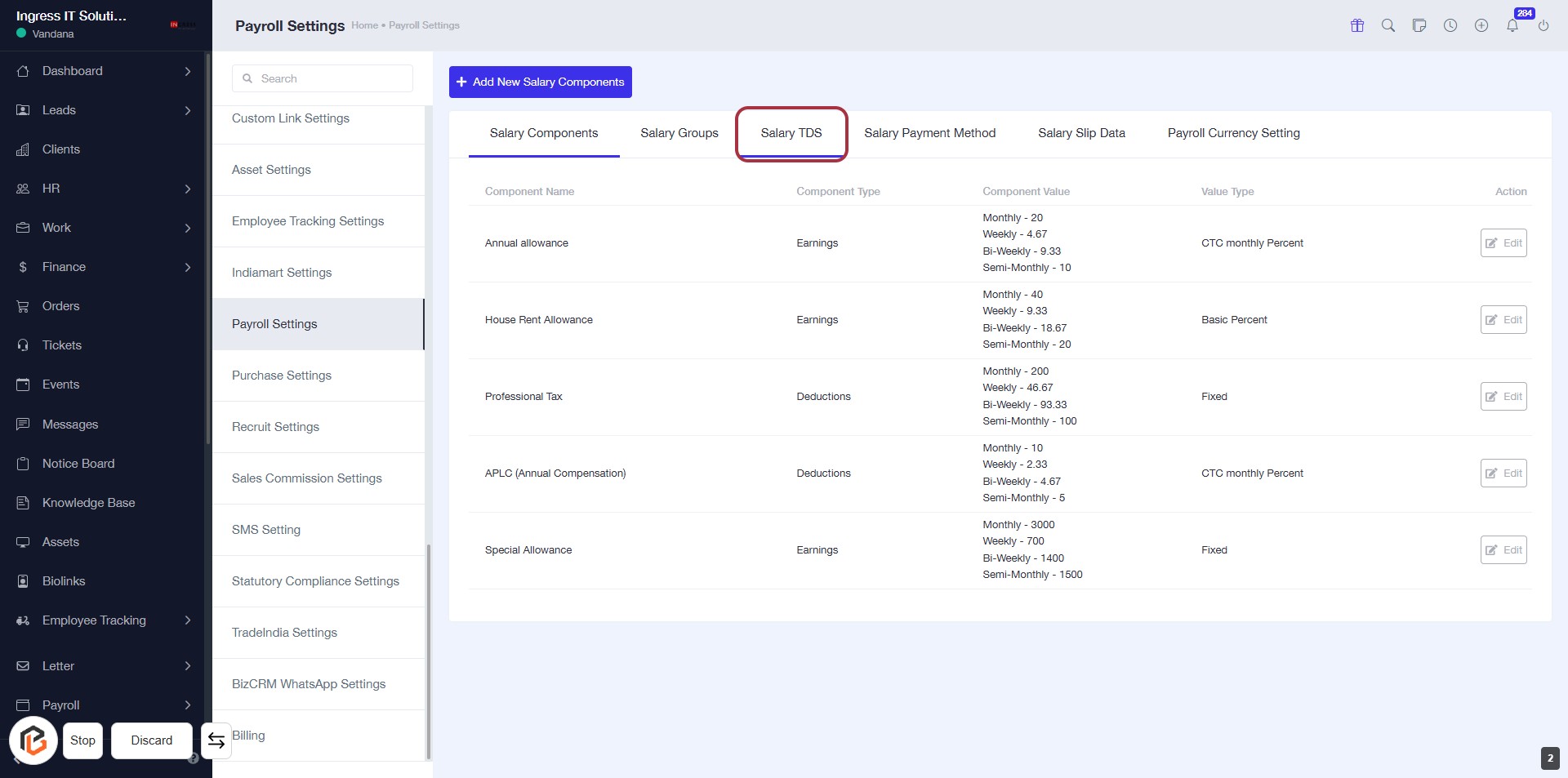

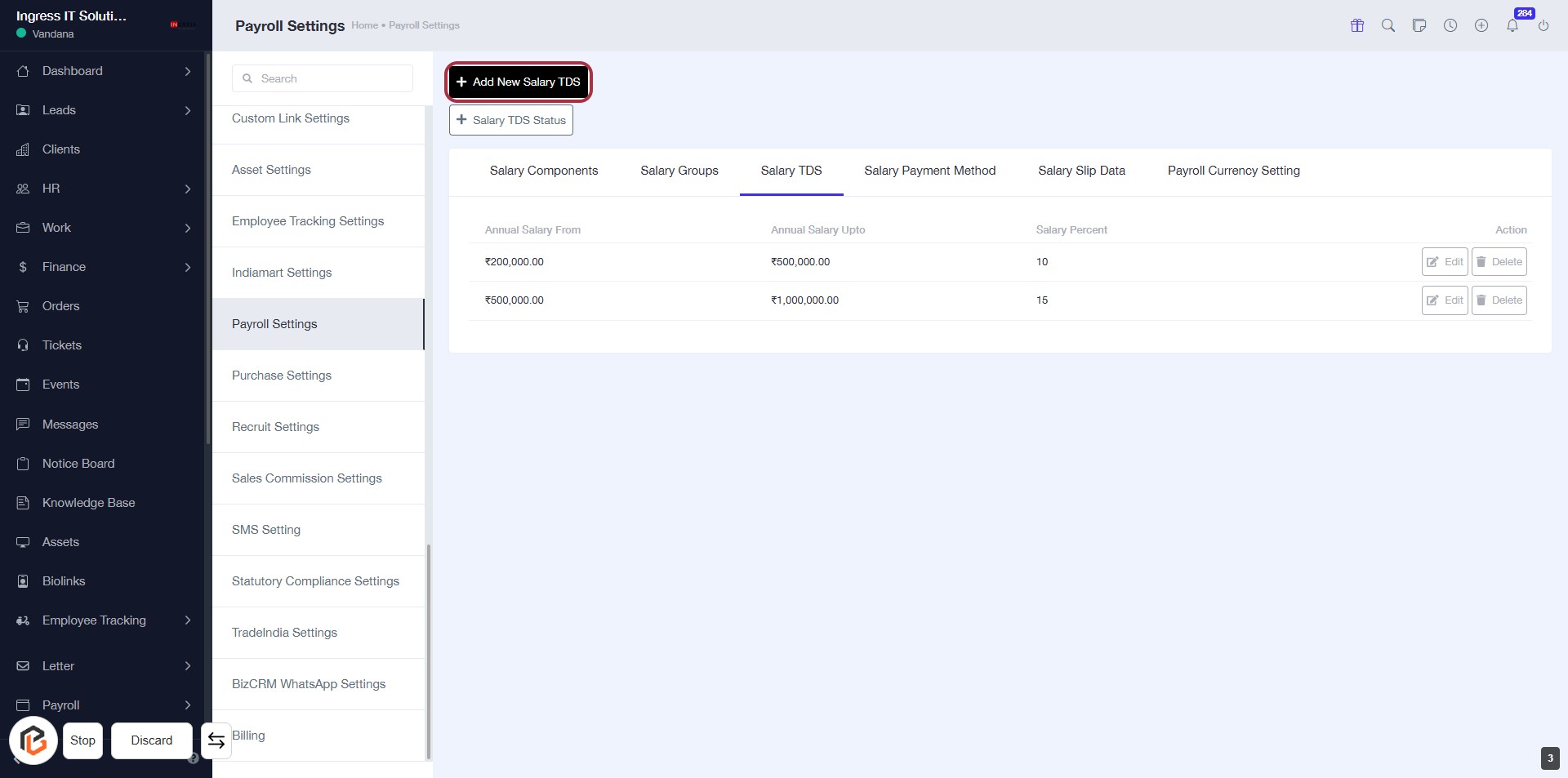

STEP 3: Select "Salary TDS"

- Click on the "Salary TDS" tab in the Payroll Settings section.

- This will display the relevant salary components related to TDS.

- Ensure to review the listed components for accuracy before proceeding.

- Next, you can click on "Add New Salary TDS" to continue.

STEP 4: Click on "Add New Salary TDS"

- Navigate to the Payroll Settings page.

- Locate the Add New Salary TDS button highlighted in red.

- Click on the button to proceed to the next step.

- Ensure you have the necessary information ready for the upcoming fields, especially Annual Salary From.

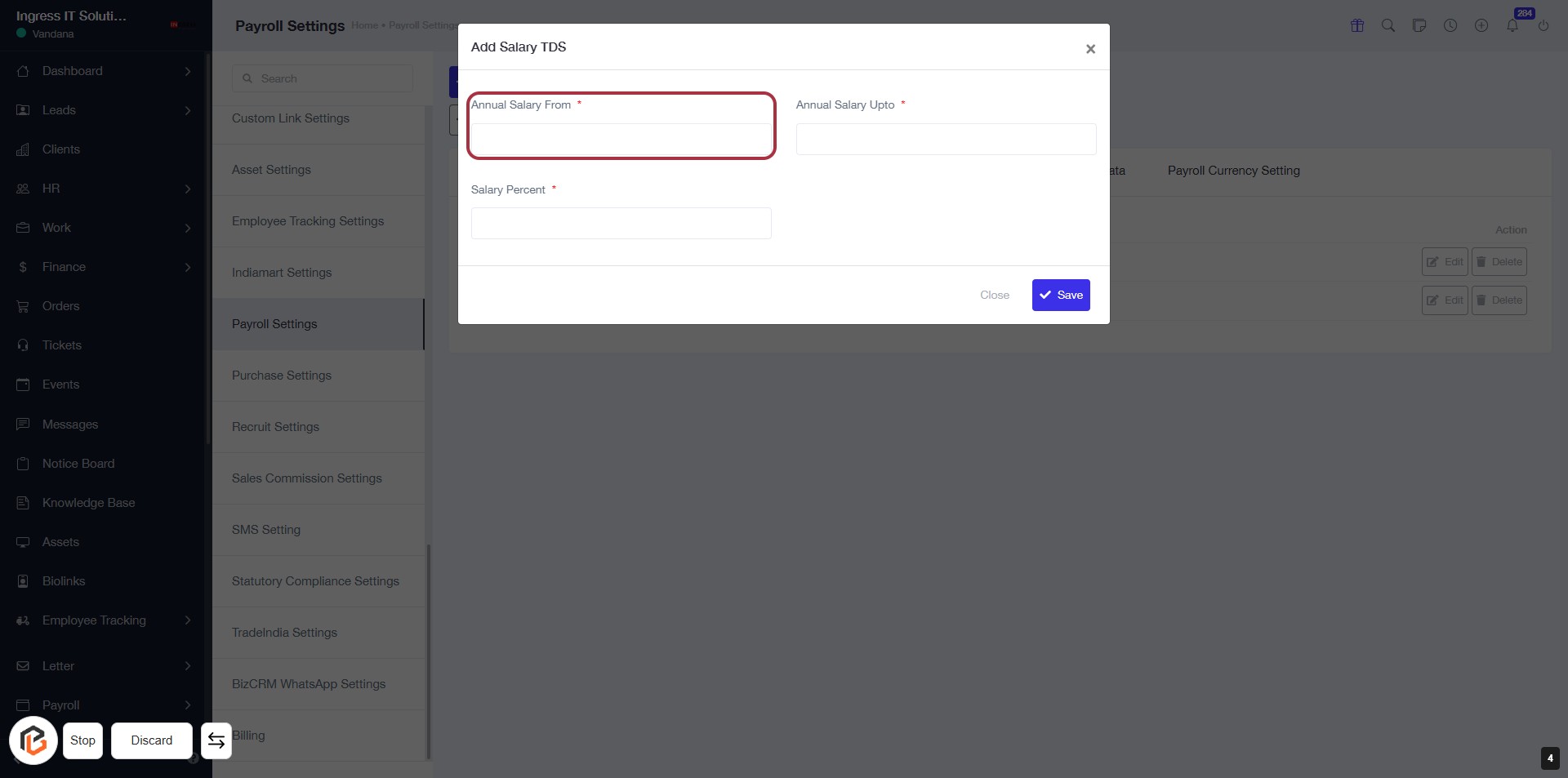

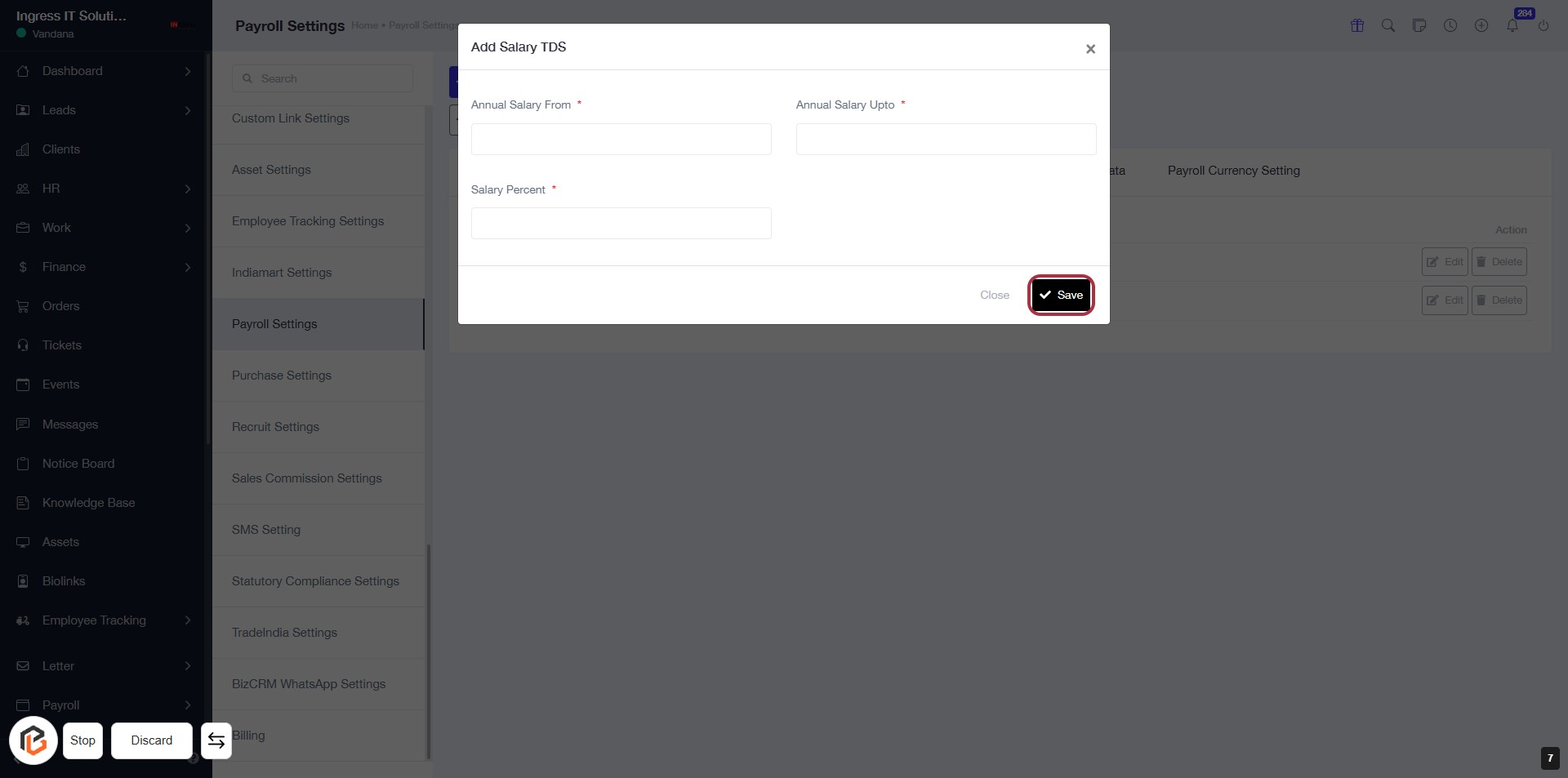

STEP 5: Enter "Annual Salary From"

- Click on the "Annual Salary From" field to input your data.

- Ensure to fill this field as it is marked with an asterisk (*), indicating it is required.

- After entering the value, proceed to the next field, "Annual Salary Upto."

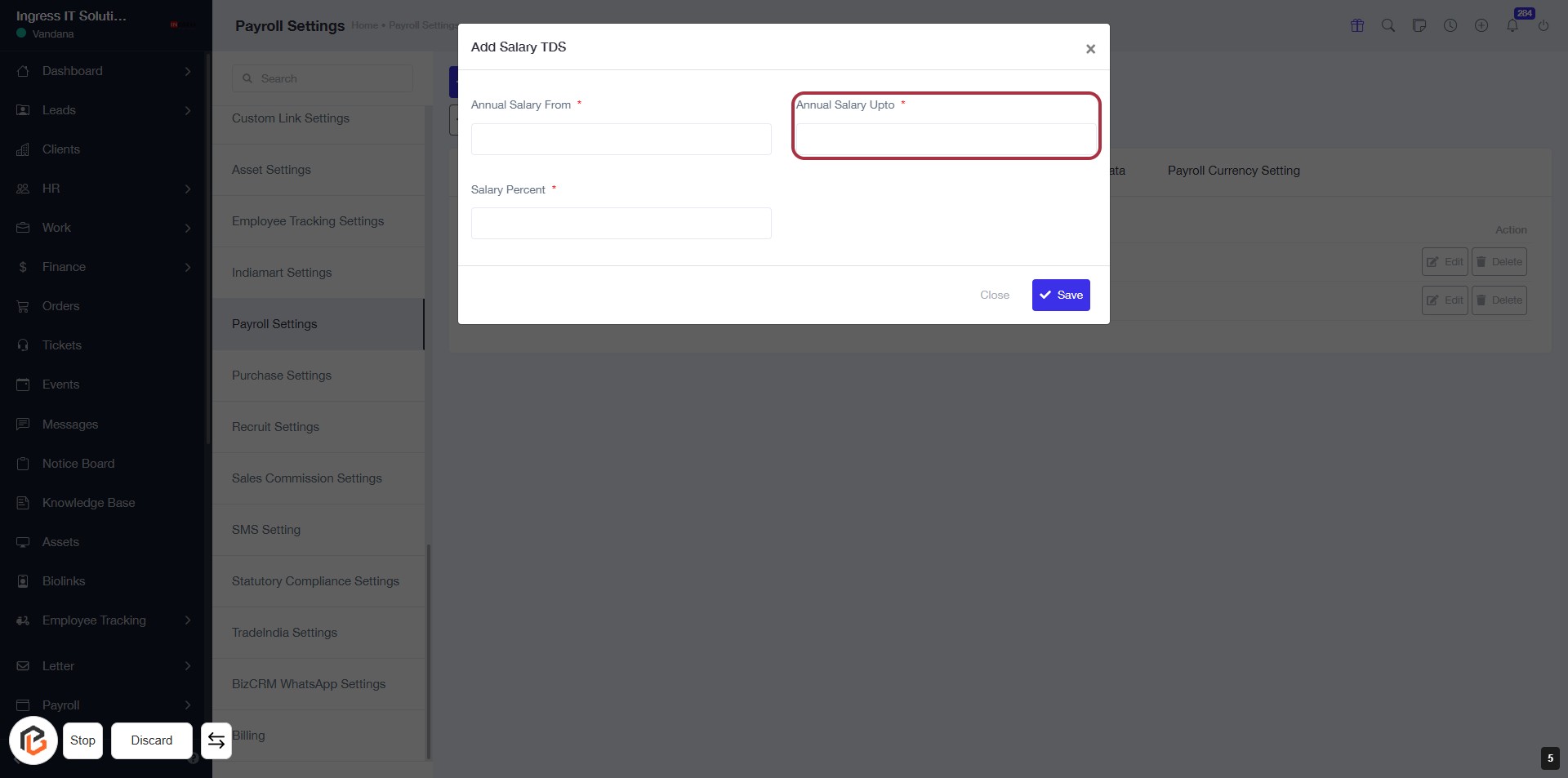

STEP 6: Enter "Annual Salary Upto"

- Click on the "Annual Salary Upto" field (marked with a red border).

- This field is mandatory (indicated by the asterisk '*').

- Ensure you have entered a valid salary amount before proceeding.

- After filling in, continue to the next step by entering "Salary Percent".

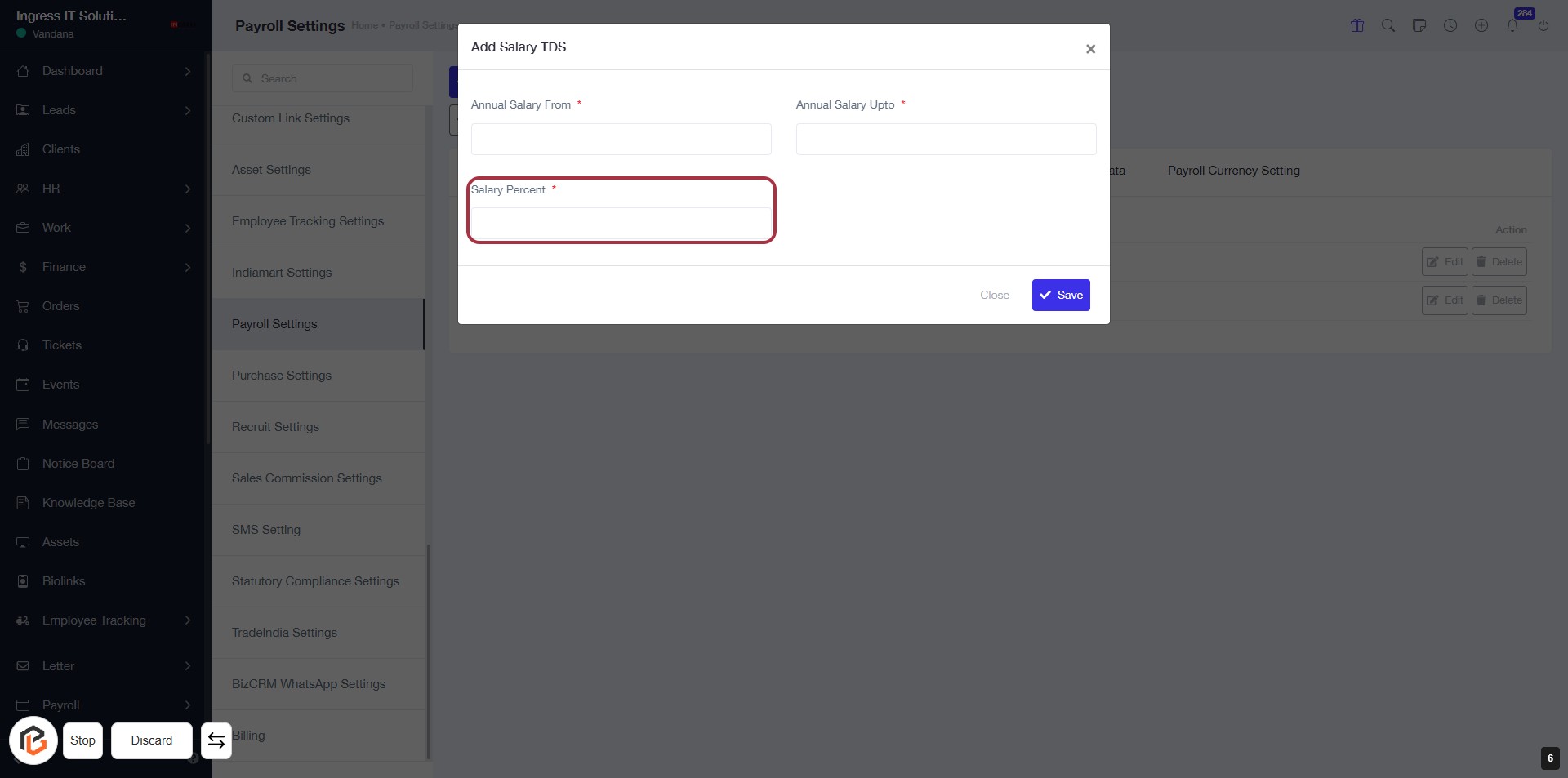

STEP 7: Enter "Salary Percent"

- Click on the "Salary Percent" field (marked with an asterisk) to input the percentage.

- Ensure to fill in this field as it is mandatory.

- Review the previous entry for "Annual Salary Upto" to ensure accuracy.

- After entering the percentage, proceed to the next step by clicking the "Save" button.

STEP 8: Click on "Save" to Finalize Salary TDS Settings

- Ensure all required fields are filled:

- Annual Salary From (mandatory)

- Annual Salary Upto (mandatory)

- Salary Percent (mandatory)

- Click the Save button at the bottom right to save your entries.

- After saving, proceed to the next step by clicking on Salary TDS Status.

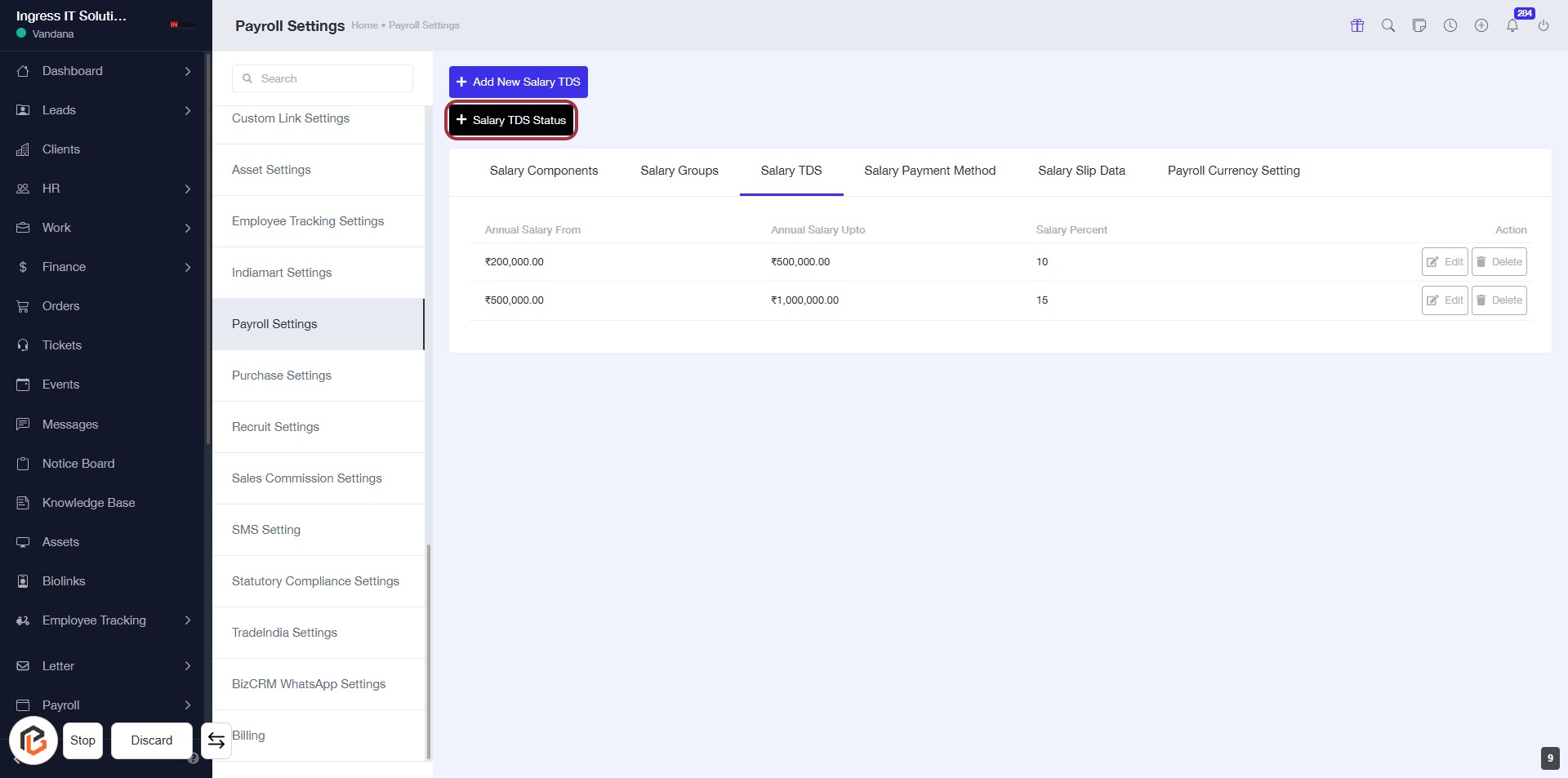

STEP 9: Click on "Salary TDS Status"

- Navigate to the Payroll Settings page.

- Locate and click the "Salary TDS Status" button to access TDS settings.

- Ensure all required fields marked with an asterisk (*) are filled out.

- Review the Salary TDS table for existing entries before proceeding.

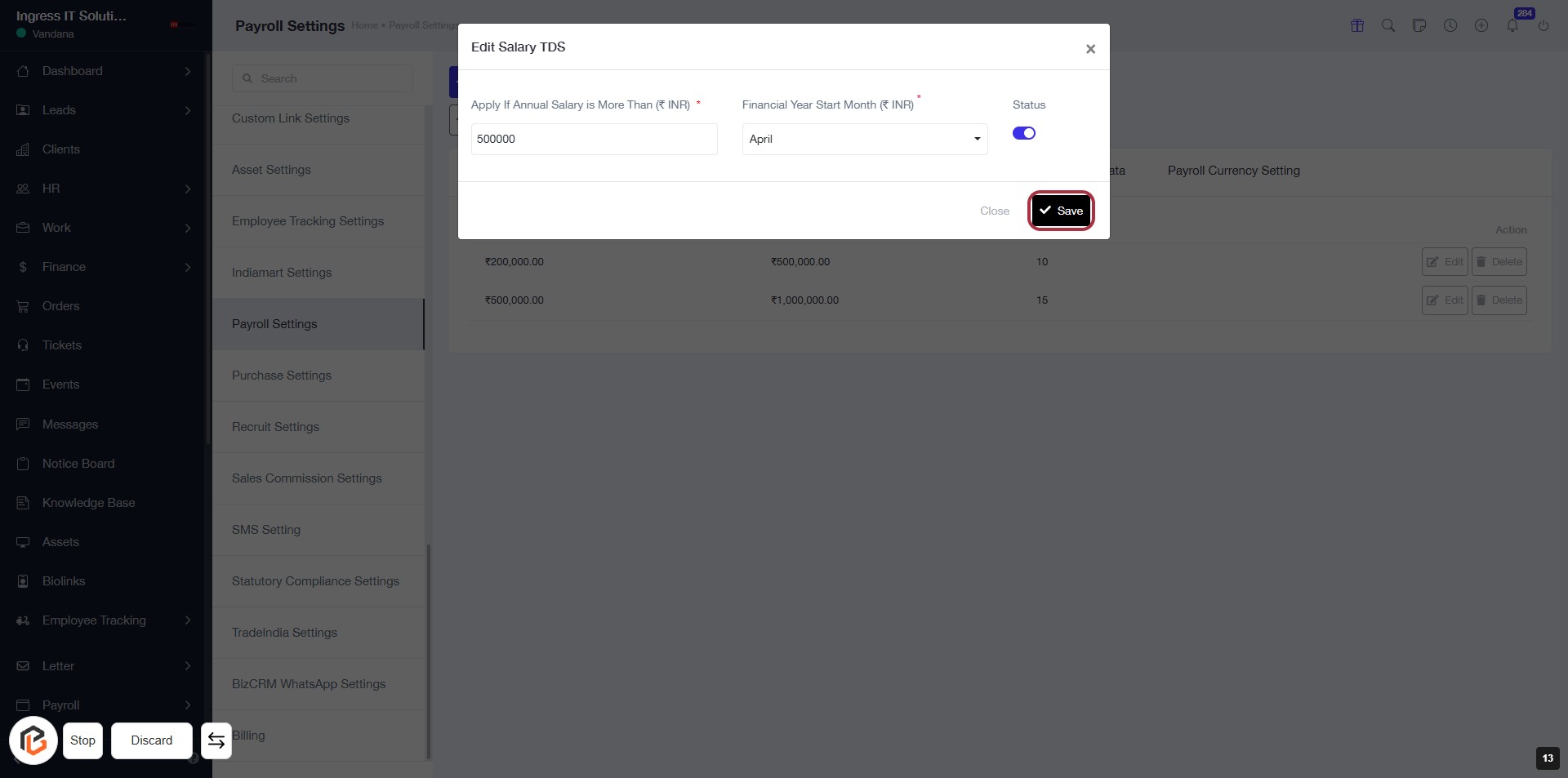

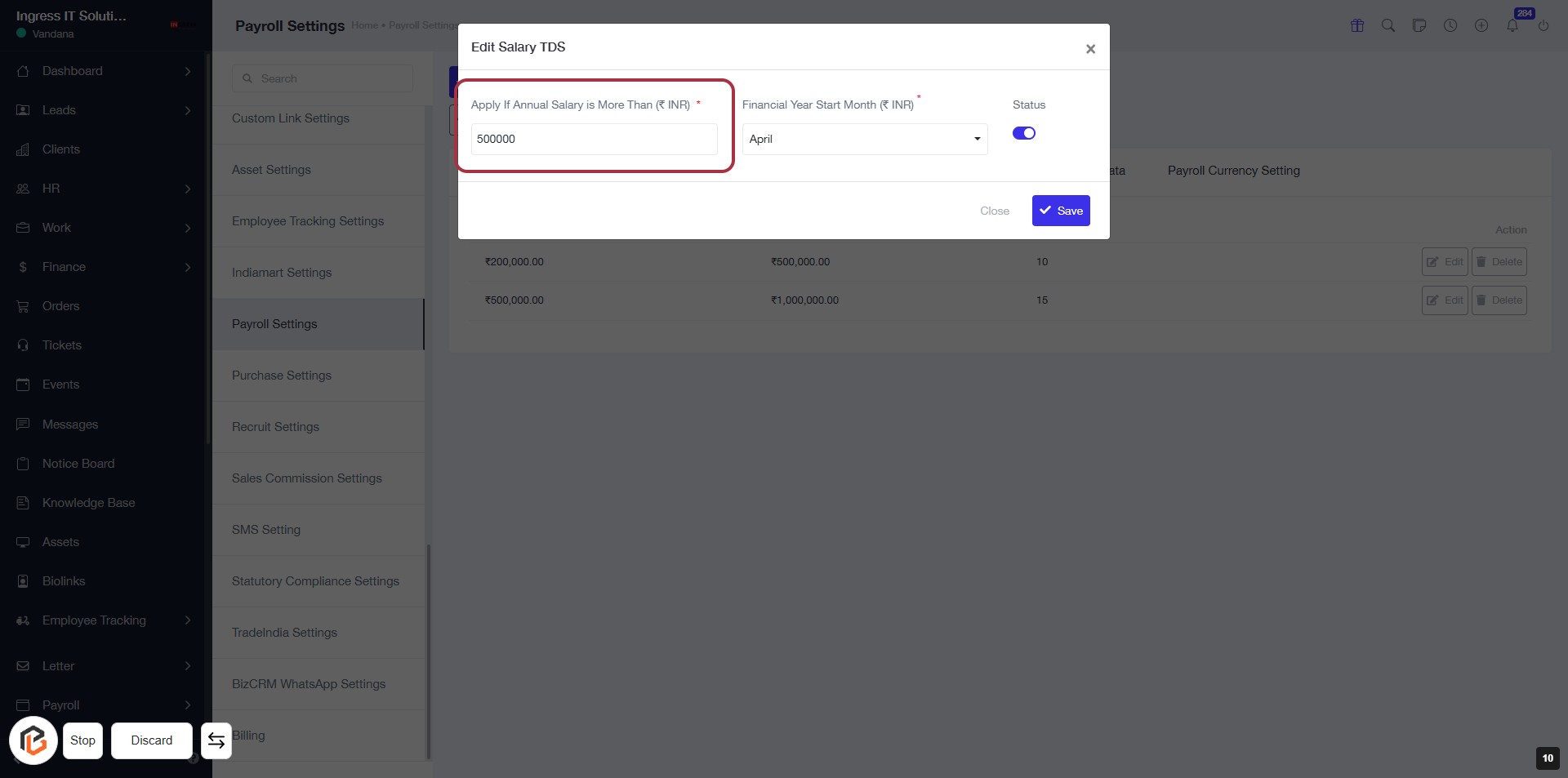

STEP 10: Click on "Apply If Annual Salary is More Than (₹ INR)"

- Locate the highlighted area labeled "Apply If Annual Salary is More Than (₹ INR)".

- Click on the field to enter the desired annual salary amount.

- Ensure that the field marked with an asterisk (*) is filled, as it is required.

- After entering the value, proceed to the next step by selecting "Financial Year Start Month (₹ INR)".

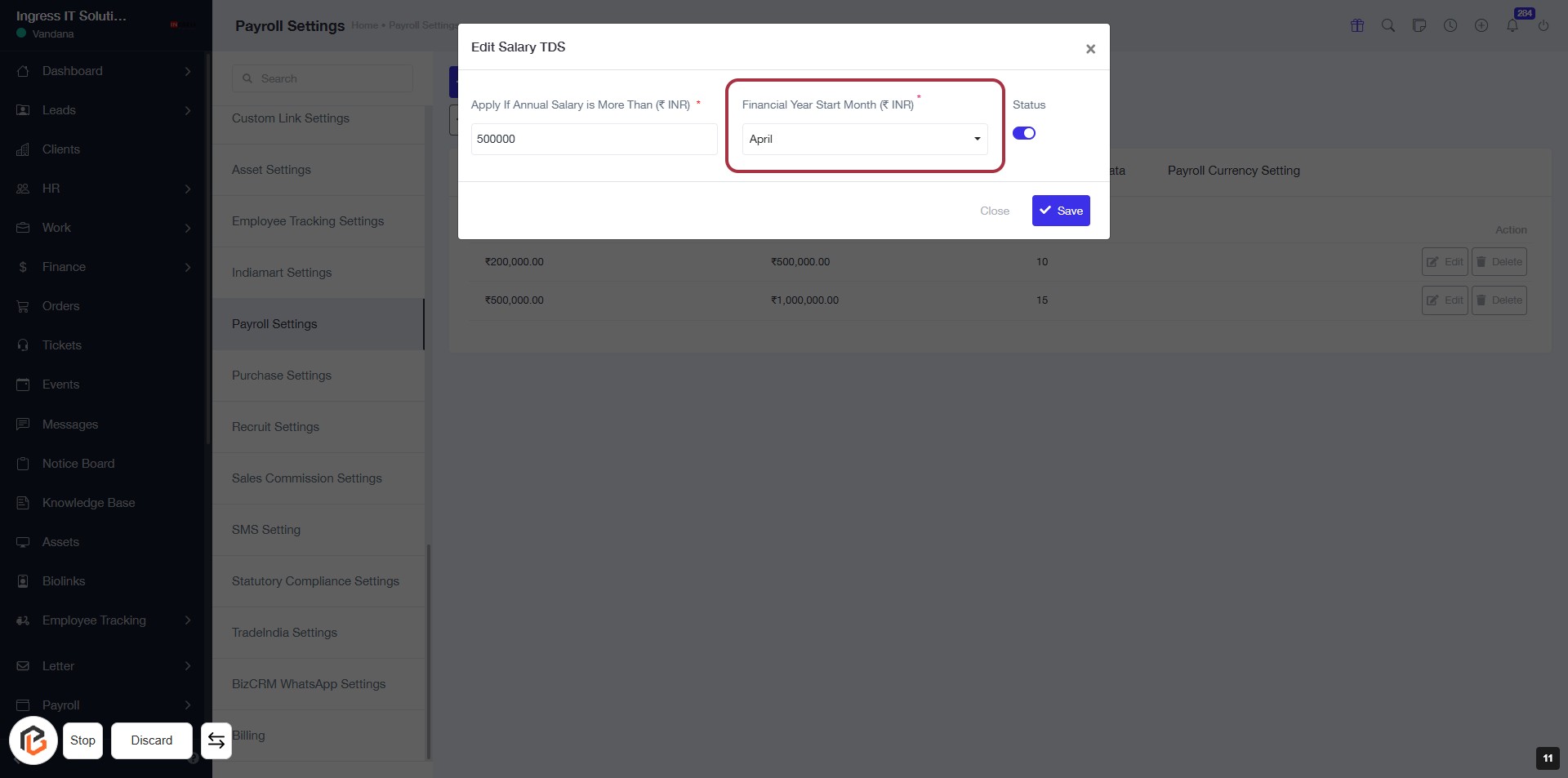

STEP 11: Select "Financial Year Start Month (₹ INR)"

- Click on the "Financial Year Start Month (₹ INR)" field.

- Choose the appropriate month from the dropdown menu.

- Ensure the field is marked with an asterisk (*) indicating it is required.

- Proceed to the next step by turning on the "Status" toggle.

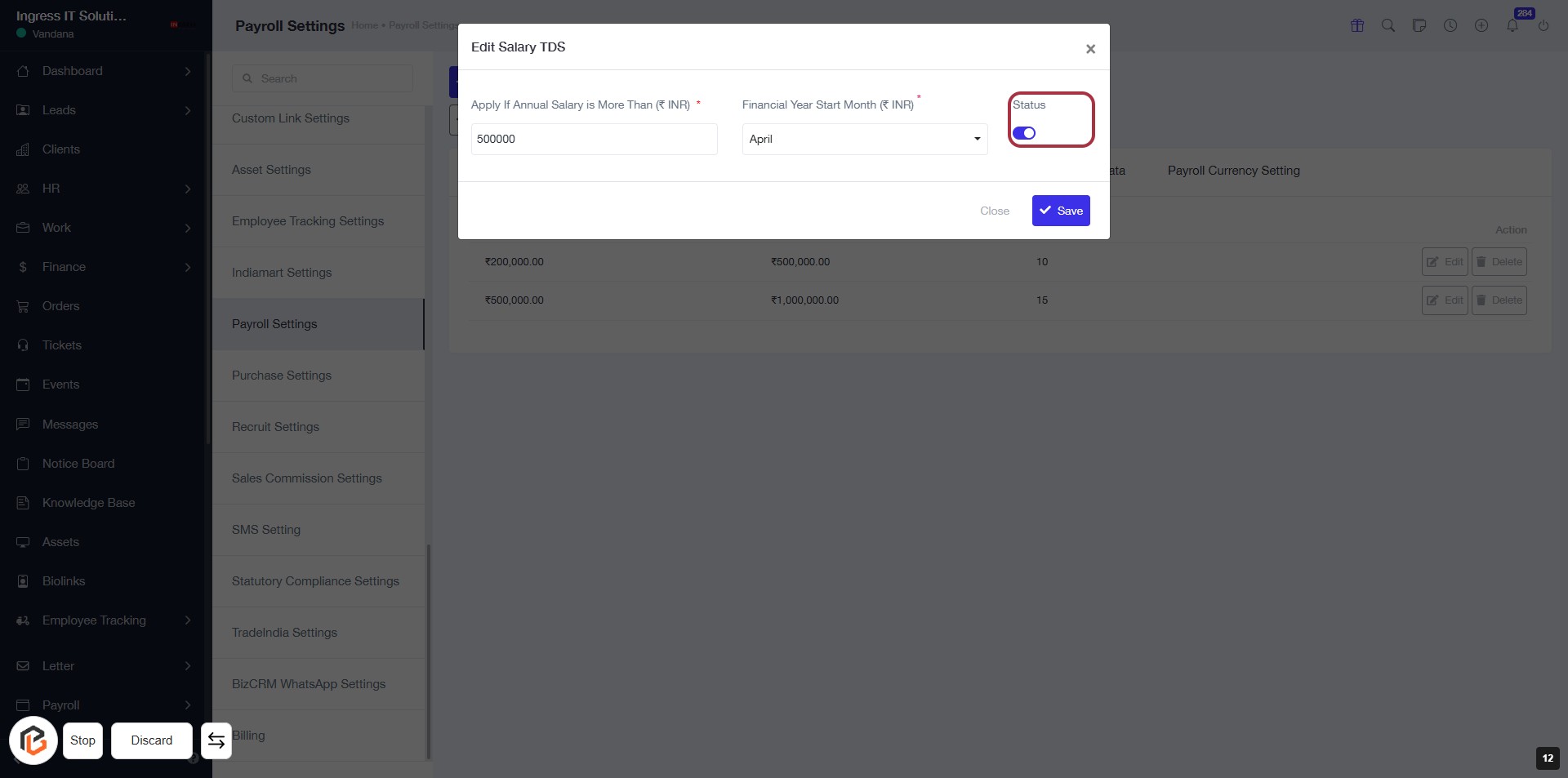

STEP 12: Click on "Status" to Enable or Disable

- Locate the "Status" toggle in the "Edit Salary TDS" dialog.

- Click on the toggle to switch it on or off.

- Ensure that the toggle reflects your desired status before proceeding.

- Review other fields:

- Apply If Annual Salary Is More Than (₹ INR)*

- Financial Year Start Month (₹ INR)*

- After adjusting, proceed to the next step by clicking the "Save" button.

STEP 13: CLICK on "Save Button"