Comprehensive Guide to Configuring Your Dashboard Finance and Invoice Settings

23 mins read · Updated 29 Sep, 2025

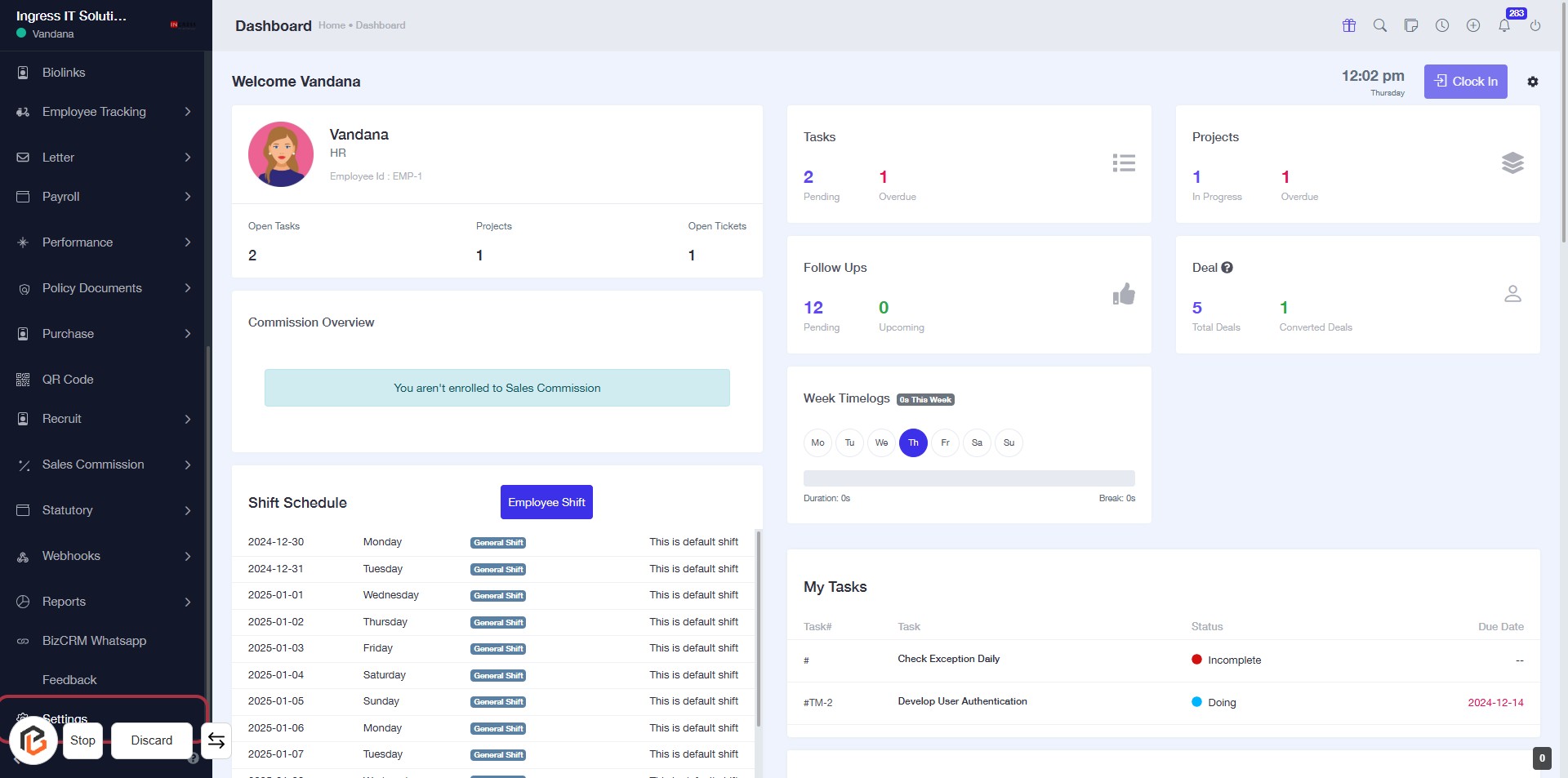

STEP 1: Click on "Settings" to Access Configuration Options

- Navigate to the left sidebar of the dashboard.

- Click on the Settings link to open configuration options.

- Ensure you are ready to proceed to the next step by accessing Finance Settings after this.

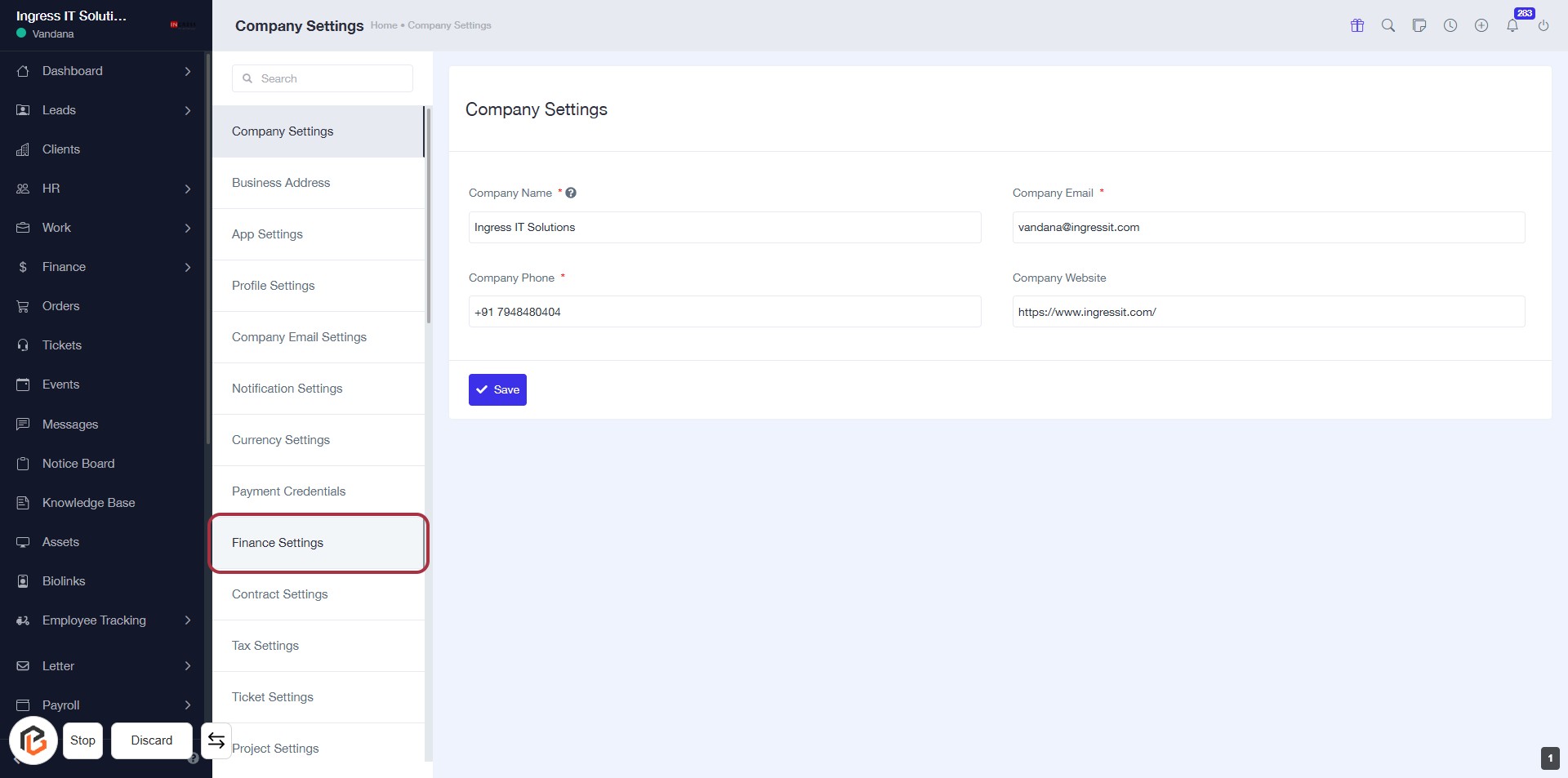

STEP 2: Click on "Finance Settings" to Access Financial Configuration

- Click on the Finance Settings link in the sidebar to open the financial configuration options.

- Ensure you fill in the required fields marked with an asterisk (*) in the Company Settings form.

- Review the fields for Company Name, Company Phone, Company Email, and Company Website.

- After entering the necessary information, click Save to apply changes.

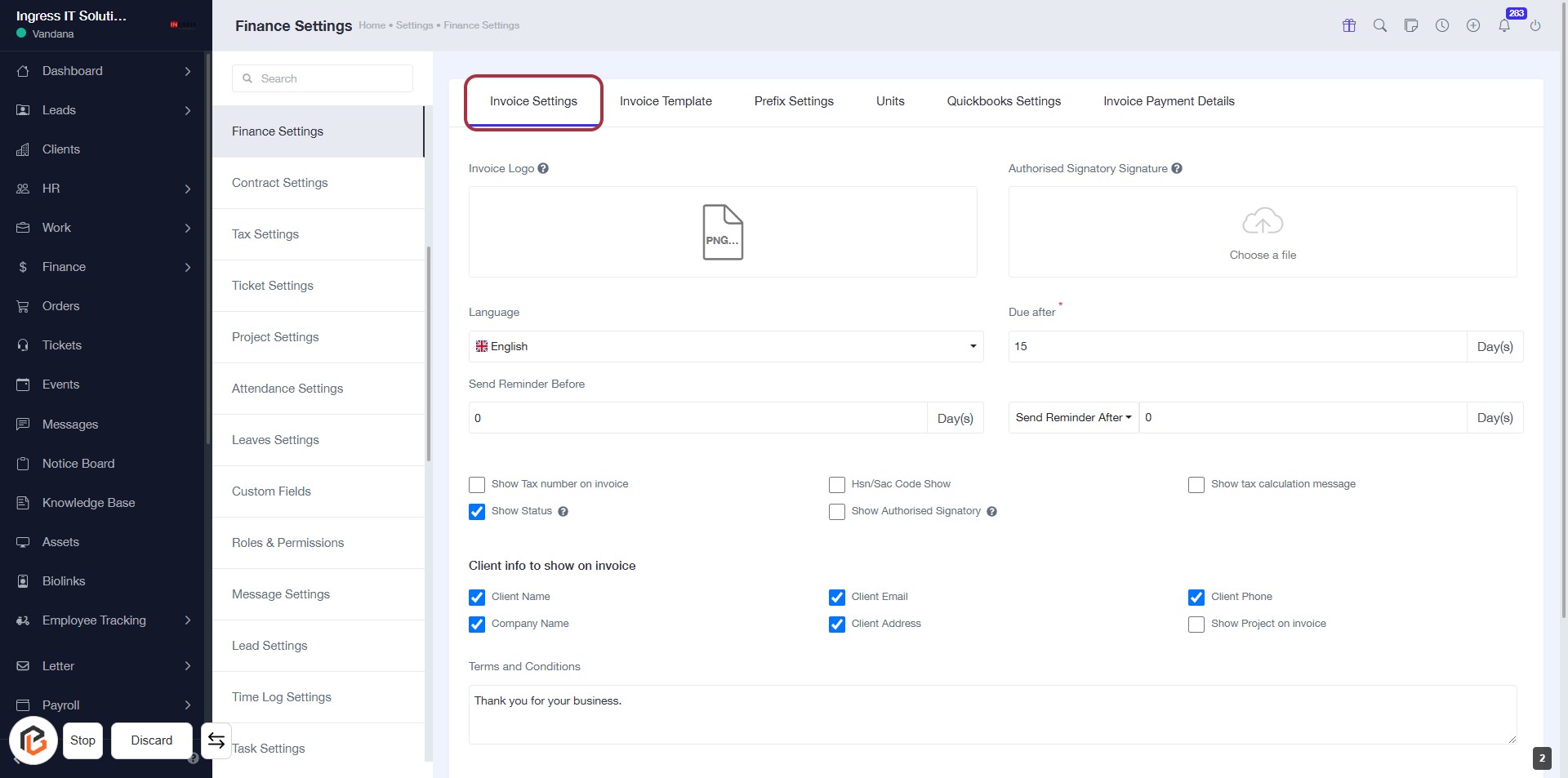

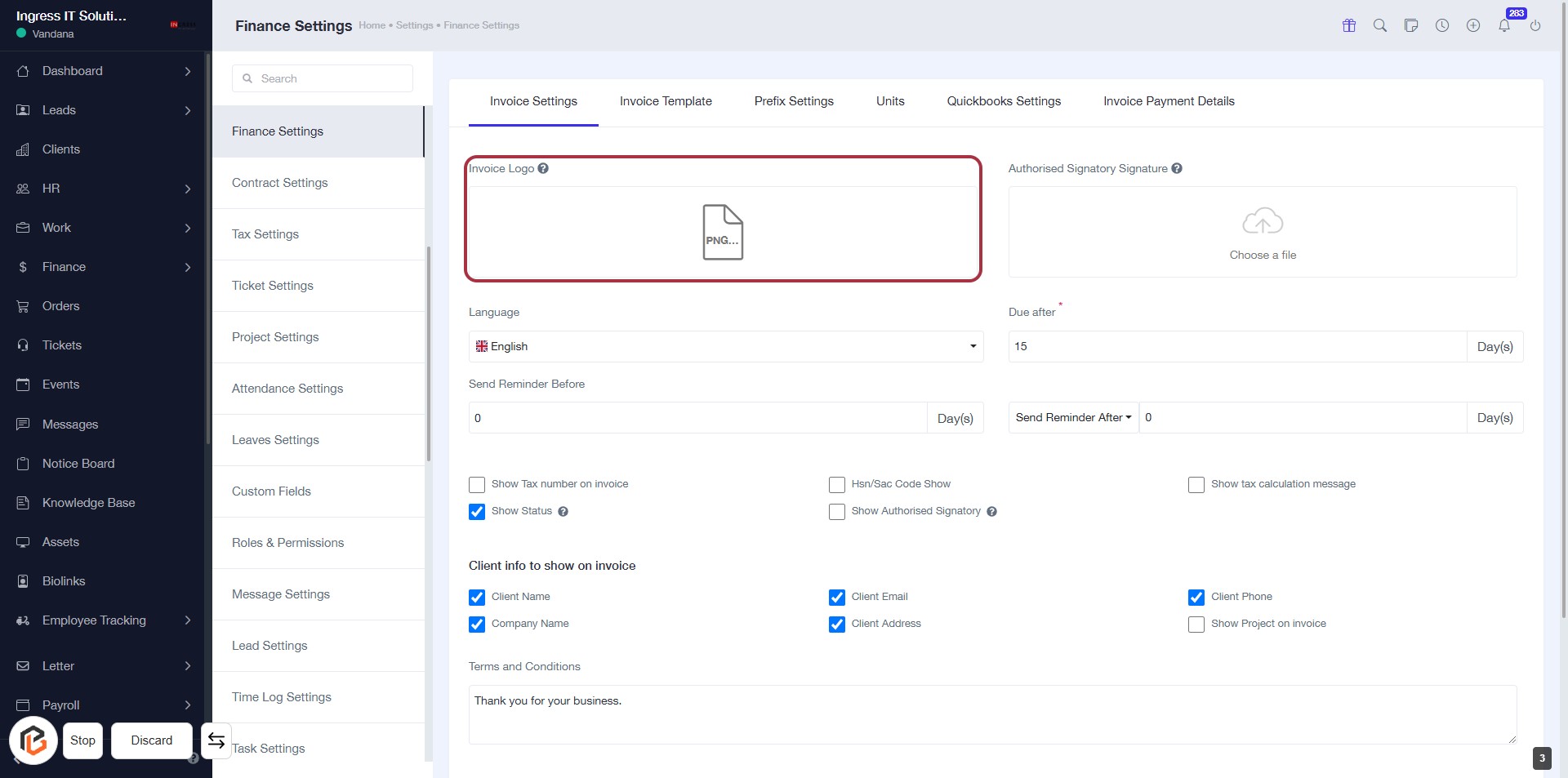

STEP 3: Select "Invoice Settings"

- Click on the Invoice Settings tab to access the invoice configuration options.

- Fill in the required fields:

- Invoice Logo: Upload your logo.

- Language: Choose your preferred language.

- Due After: Specify the number of days until payment is due (required).

- Optional settings include:

- Send Reminder Before: Set reminders for clients.

- Show Tax Number on Invoice: Check if applicable.

- Client Info: Select what client details to display on the invoice.

STEP 4: Upload Invoice Logo

- Click on the "Invoice Logo" area highlighted in red to upload your logo.

- Ensure the logo file is in PNG format.

- After uploading, verify the logo appears correctly in the designated area.

- Proceed to the next step to upload the Authorised Signatory Signature.

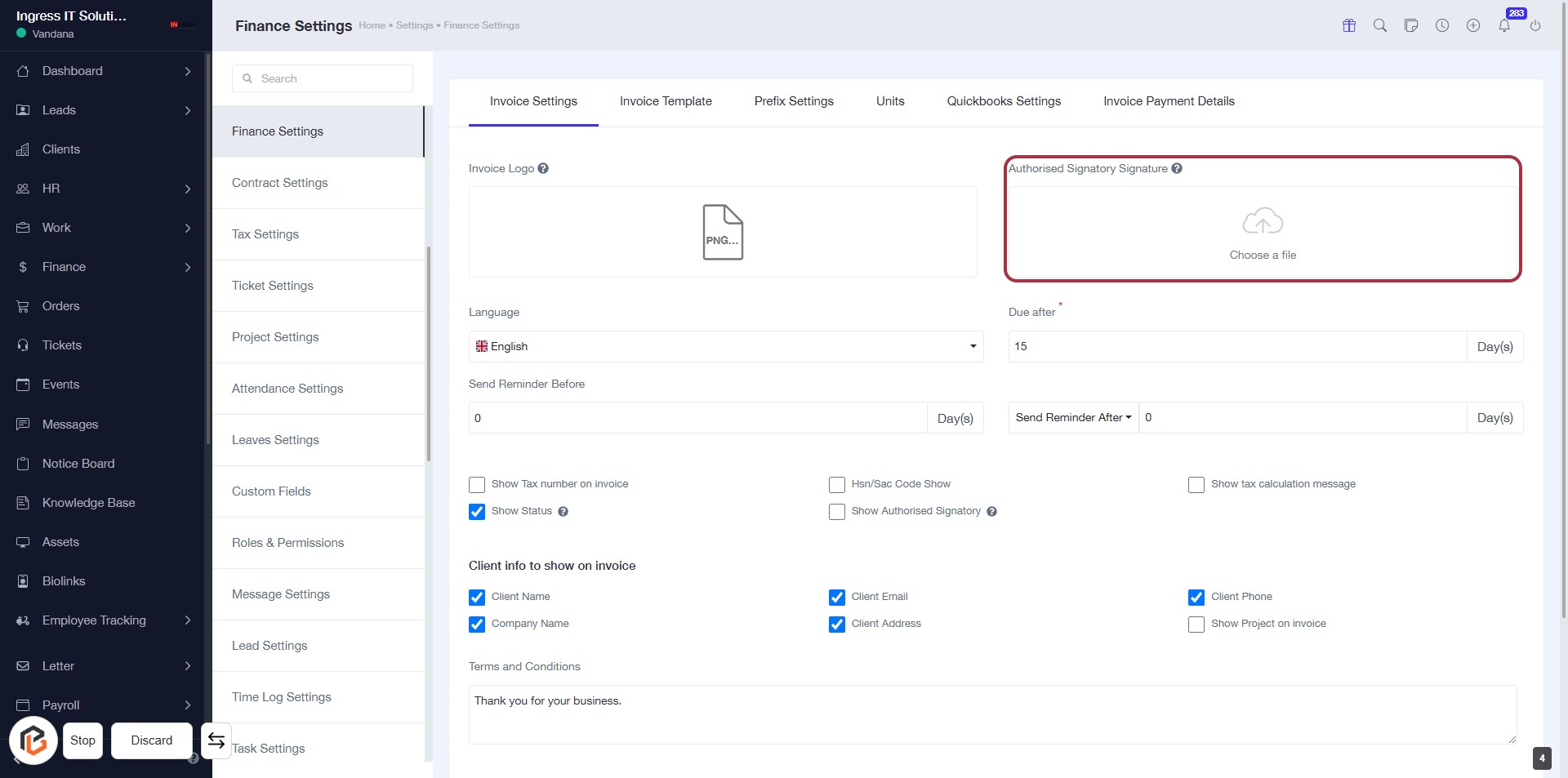

STEP 5: Click to Upload Authorised Signatory Signature

- Navigate to the "Authorised Signatory Signature" section.

- Click on the highlighted area labeled "Choose a file."

- Select the file containing the authorised signatory's signature from your device.

- Ensure the file format is supported (e.g., PNG, JPG).

- Proceed to the next step after uploading.

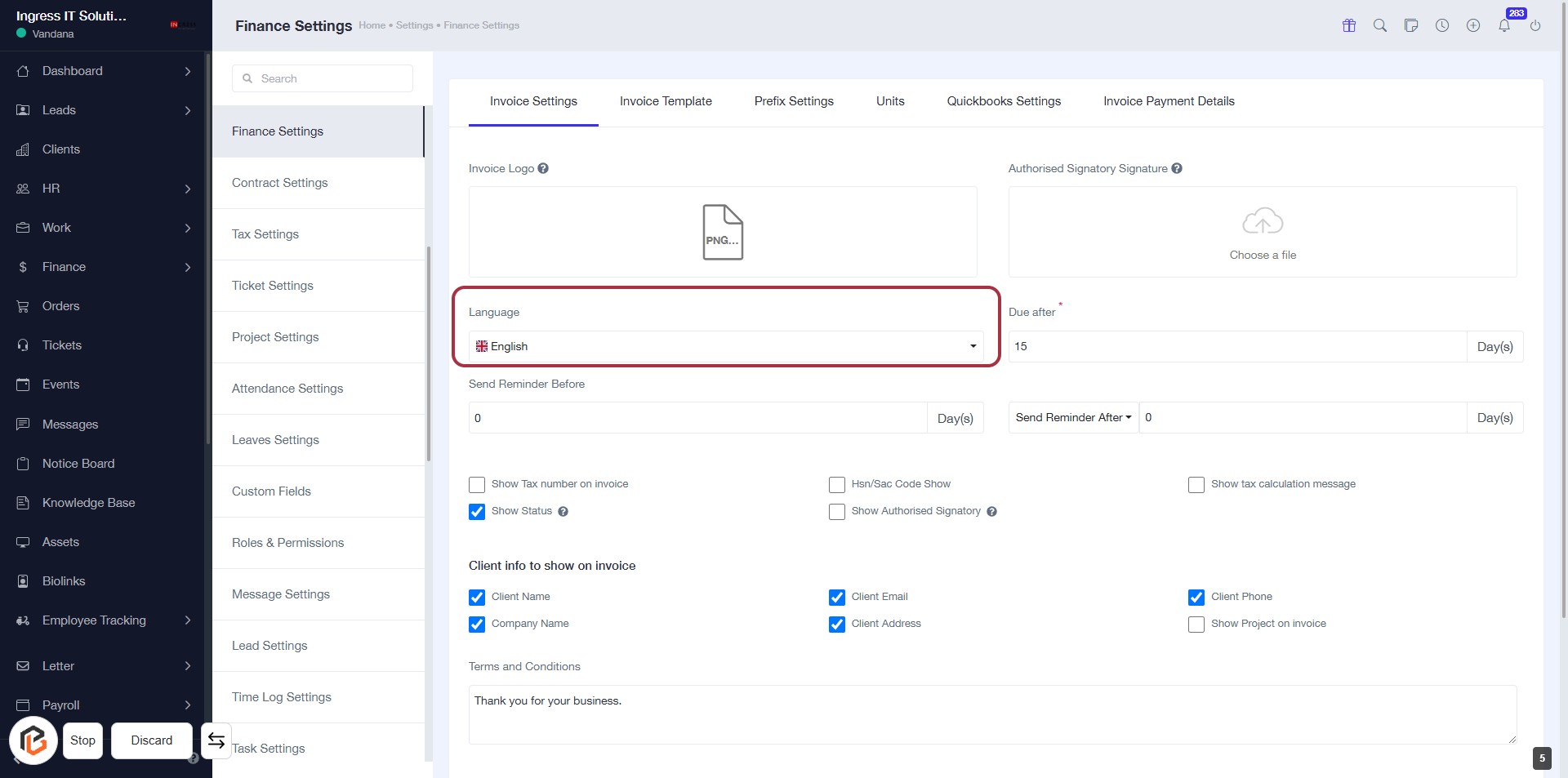

STEP 6: Select Language for Invoice Settings

- Click on the Language field highlighted in red.

- Choose your preferred language from the dropdown menu.

- Ensure to review other fields like Send Reminder Before and Due After for completeness.

- Optional inputs are marked with an asterisk (*).

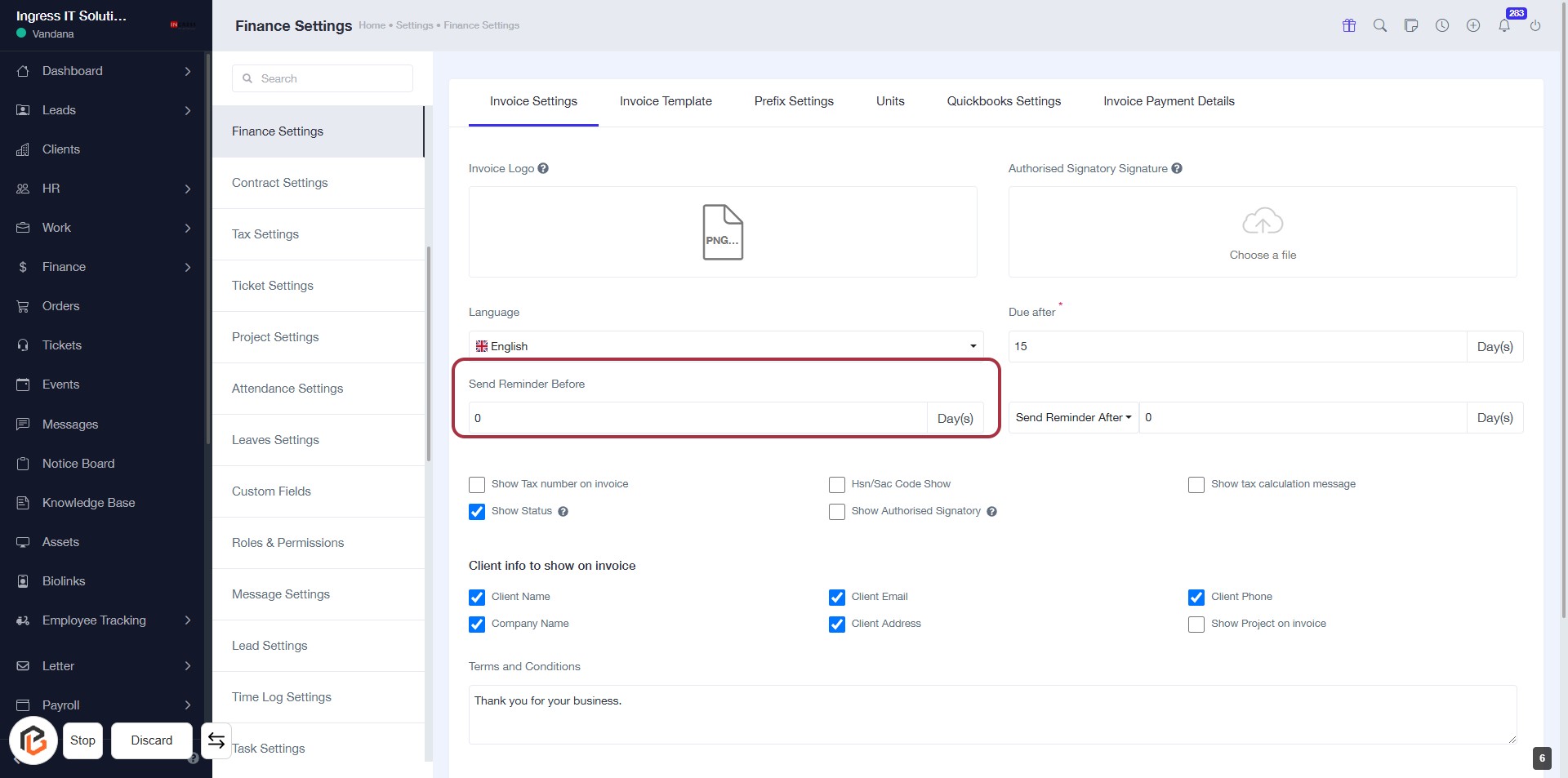

STEP 7: Click "Send Reminder Before" to Set Reminder Preferences

- Click on the "Send Reminder Before" section to set your reminder preferences.

- Enter the number of days before the invoice due date that you want the reminder to be sent.

- Ensure the input field is filled correctly as this will affect your reminder settings.

- Review other related settings in the invoice configuration for completeness.

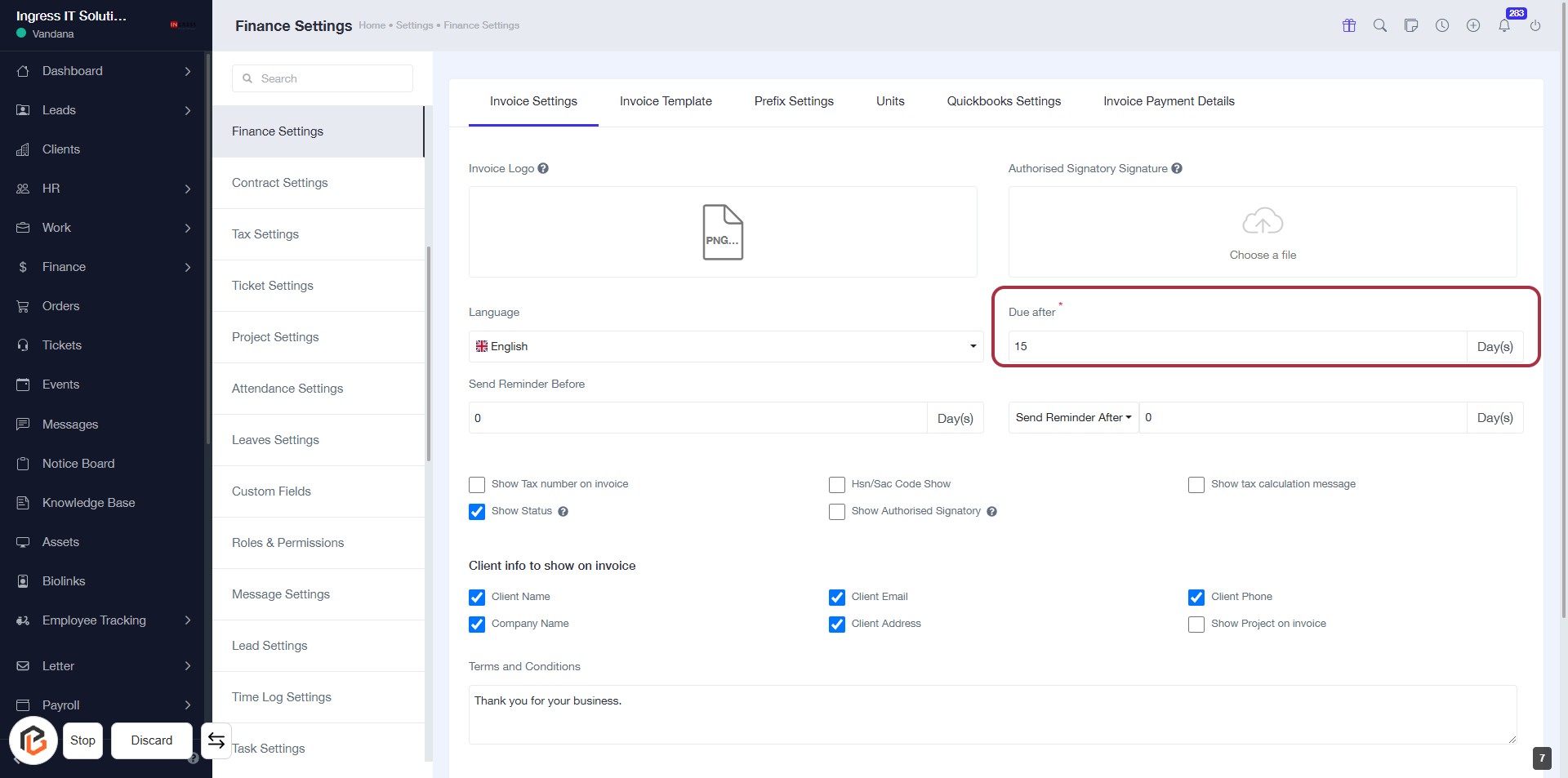

STEP 8: Click "Due After" to Set Invoice Payment Terms

- Locate the "Due after" field in the Invoice Settings section.

- Click on the field to input the number of days after which the invoice is due (required).

- Ensure the field is marked with an asterisk (*) indicating it's mandatory.

- Review other related settings for reminders and payment terms.

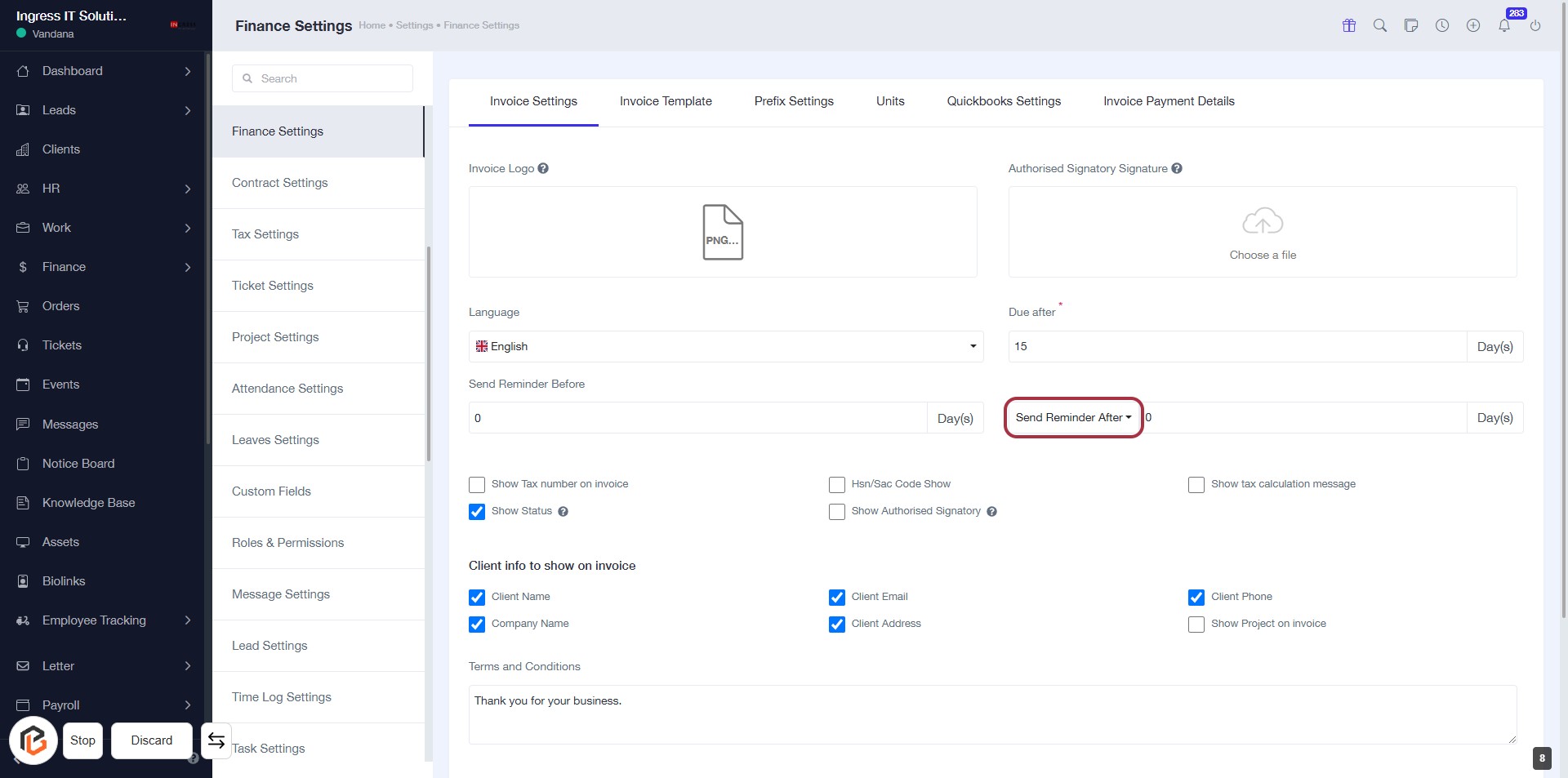

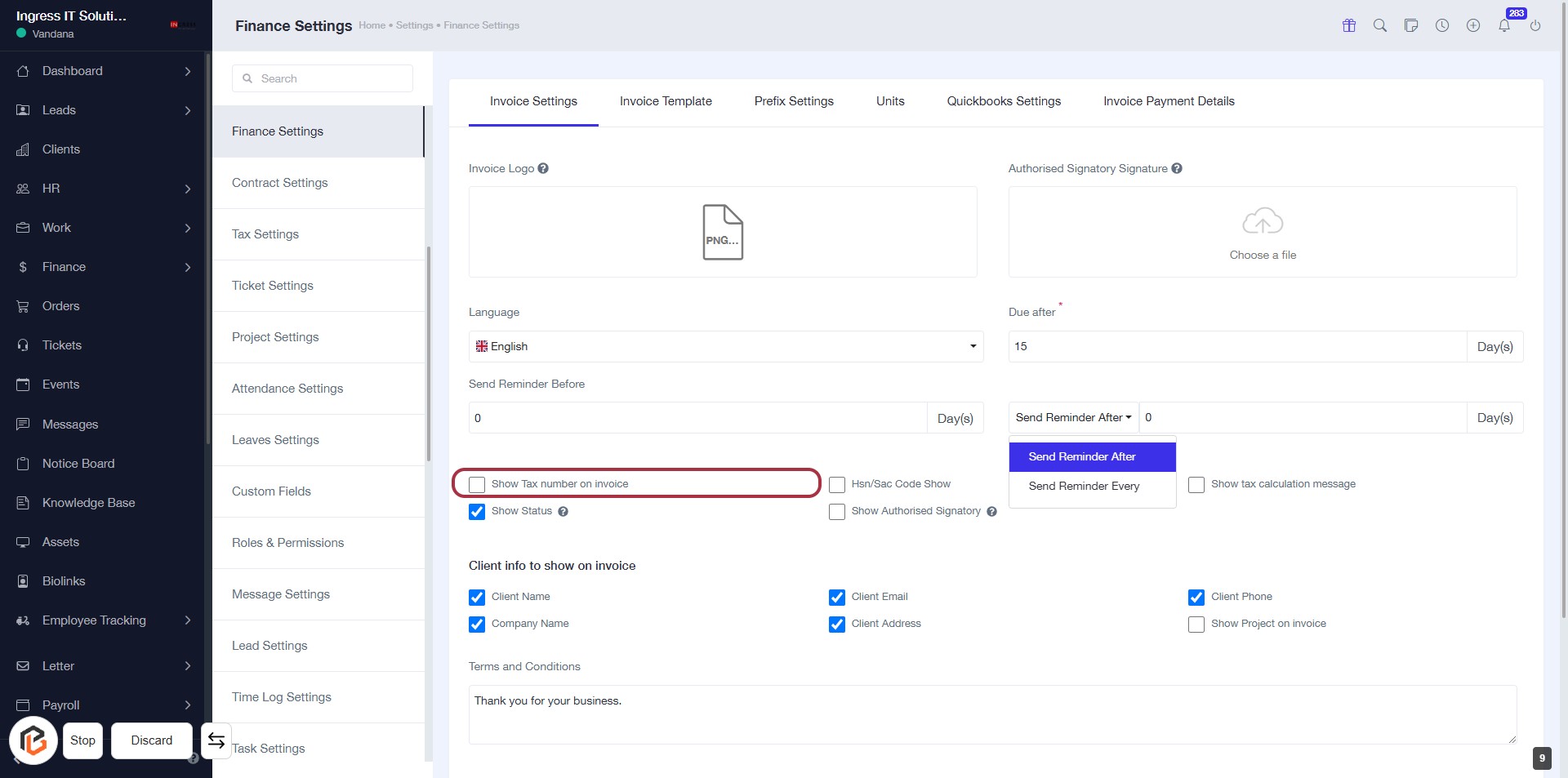

STEP 9: Click "Send Reminder After" to Configure Reminder Settings

- Click the "Send Reminder After" button to open the reminder settings.

- Ensure to fill in the "Send Reminder Before" and "Due After" fields as needed.

- Review optional settings like "Show Tax number on invoice" and "Show Status".

- Complete any additional fields required for your invoice settings.

STEP 10: Select "Show Tax number on invoice"

- Click on the checkbox labeled "Show Tax number on invoice" to enable it.

- Ensure that any required fields marked with an asterisk (*) are filled out.

- Review other options available in the invoice settings for completeness.

- Proceed to the next step by selecting "Show Status."

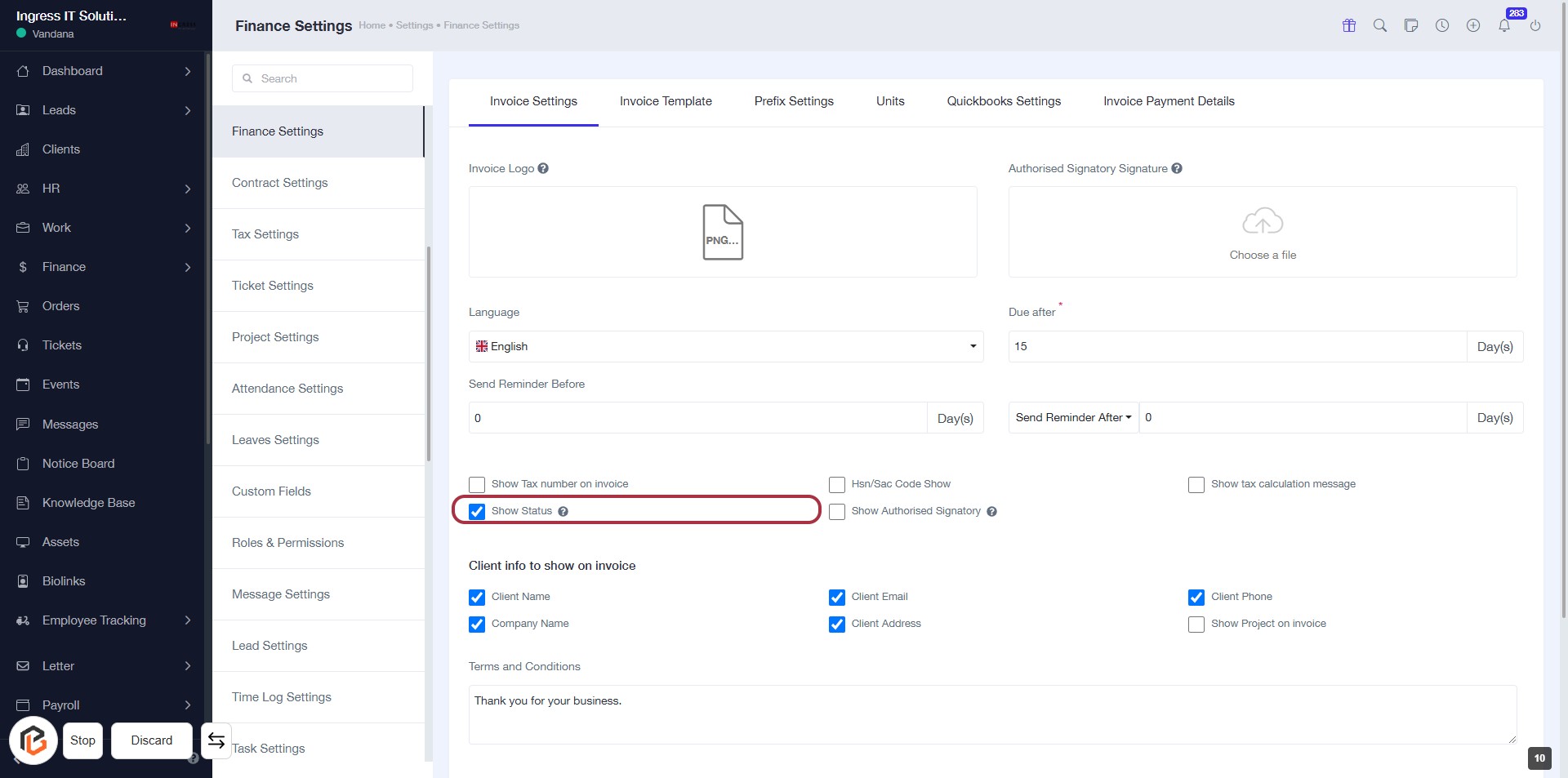

STEP 11: Select "Show Status"

- Click on the "Show Status" checkbox to enable it.

- This option allows you to display the status on the invoice.

- Ensure other relevant fields are filled out as needed.

- Review the settings before proceeding to the next step.

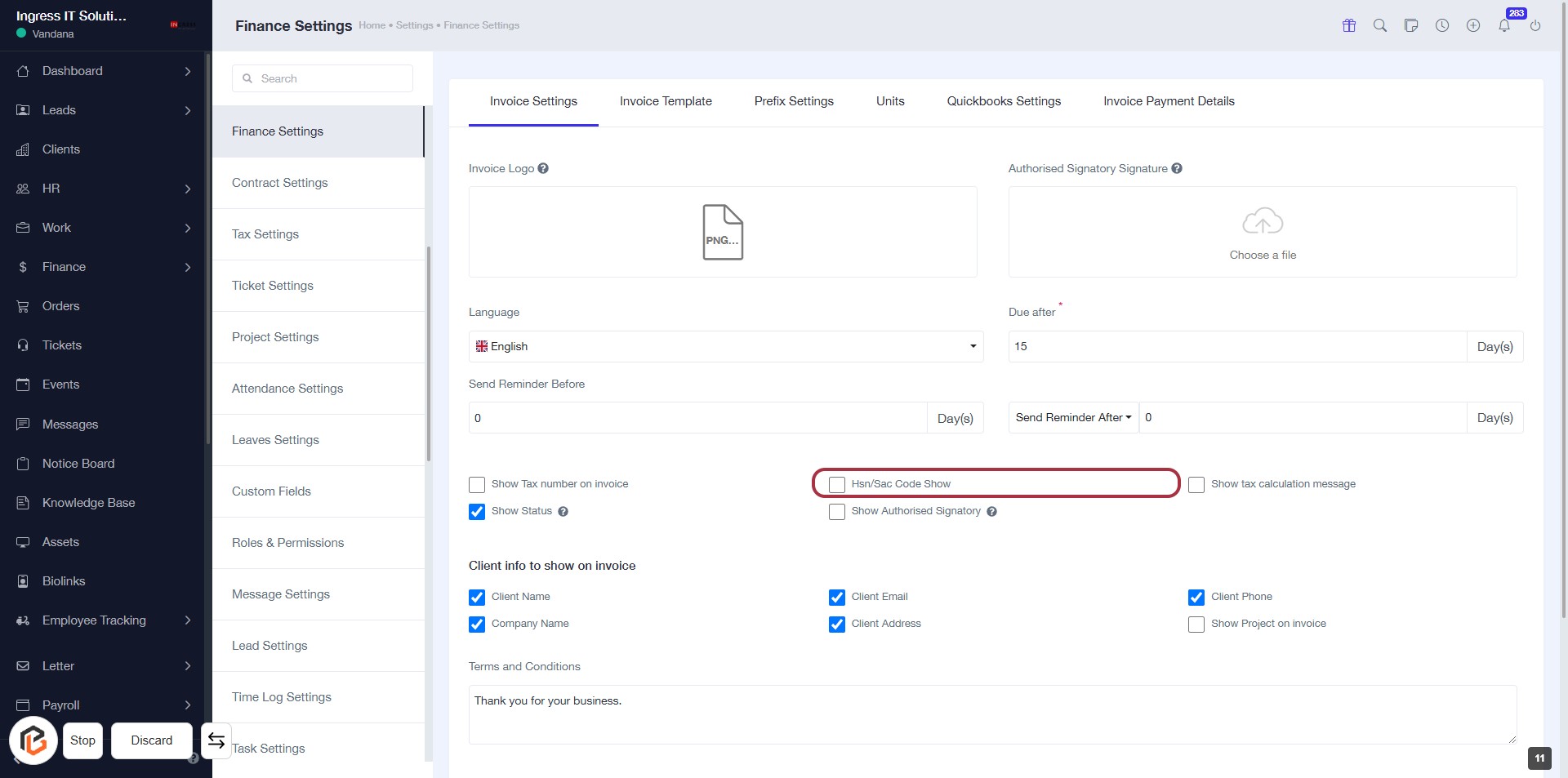

STEP 12: Select "Hsn/Sac Code Show"

- Click on the "Hsn/Sac Code Show" option to enable or disable its visibility on invoices.

- Ensure that other relevant settings, such as "Show Tax number on invoice" and "Show Status," are also configured as needed.

- Review the "Client info to show on invoice" section for additional options.

- Proceed to the next step to select "Show Authorised Signatory."

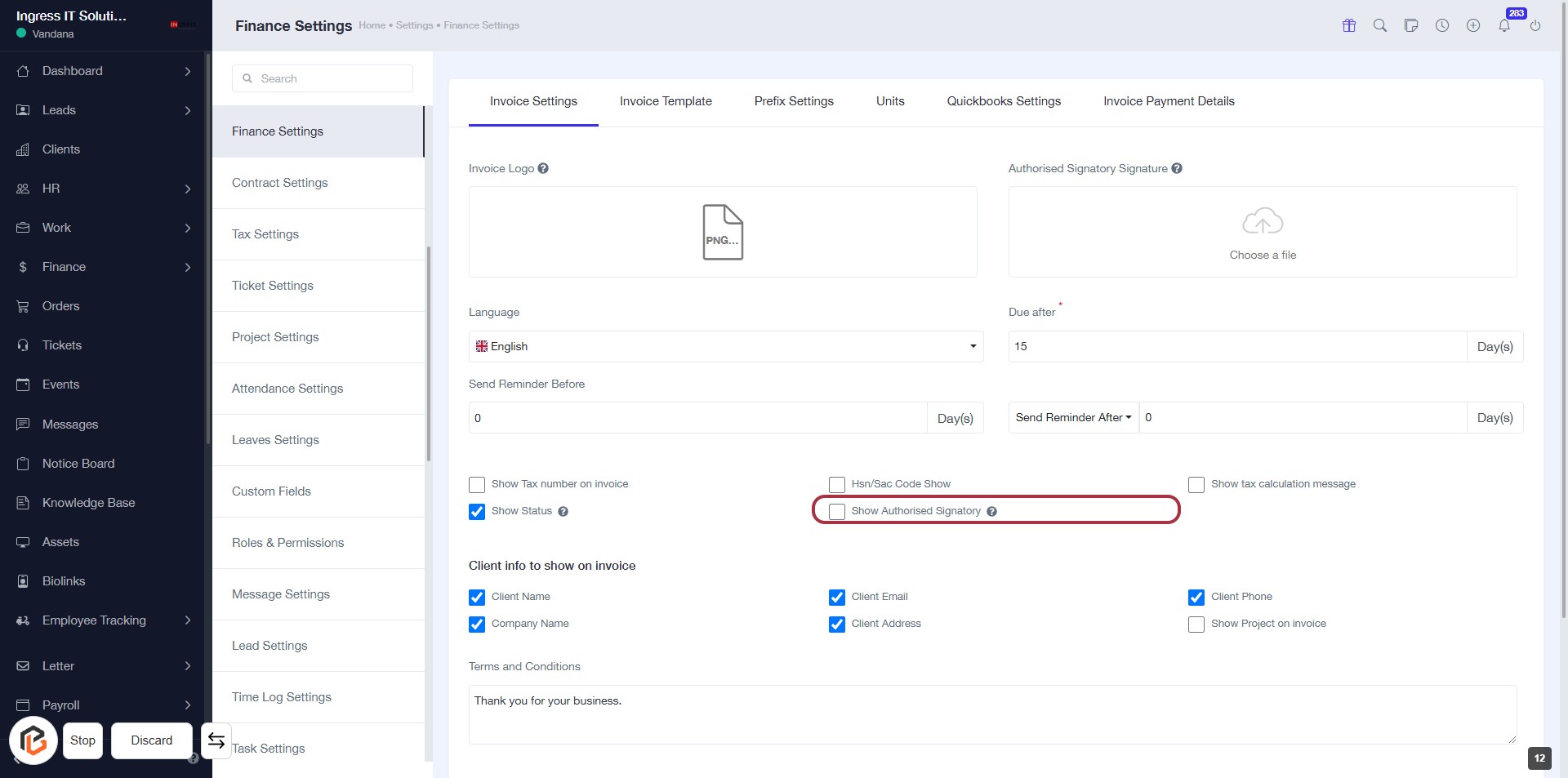

STEP 13: Select "Show Authorised Signatory"

- Click on the "Show Authorised Signatory" option in the Invoice Settings section.

- Ensure that the checkbox is selected to include the authorized signatory on invoices.

- Review other related options like "Show Tax number on invoice" and "Show Status" for completeness.

- Proceed to the next step by selecting "Show tax calculation message."

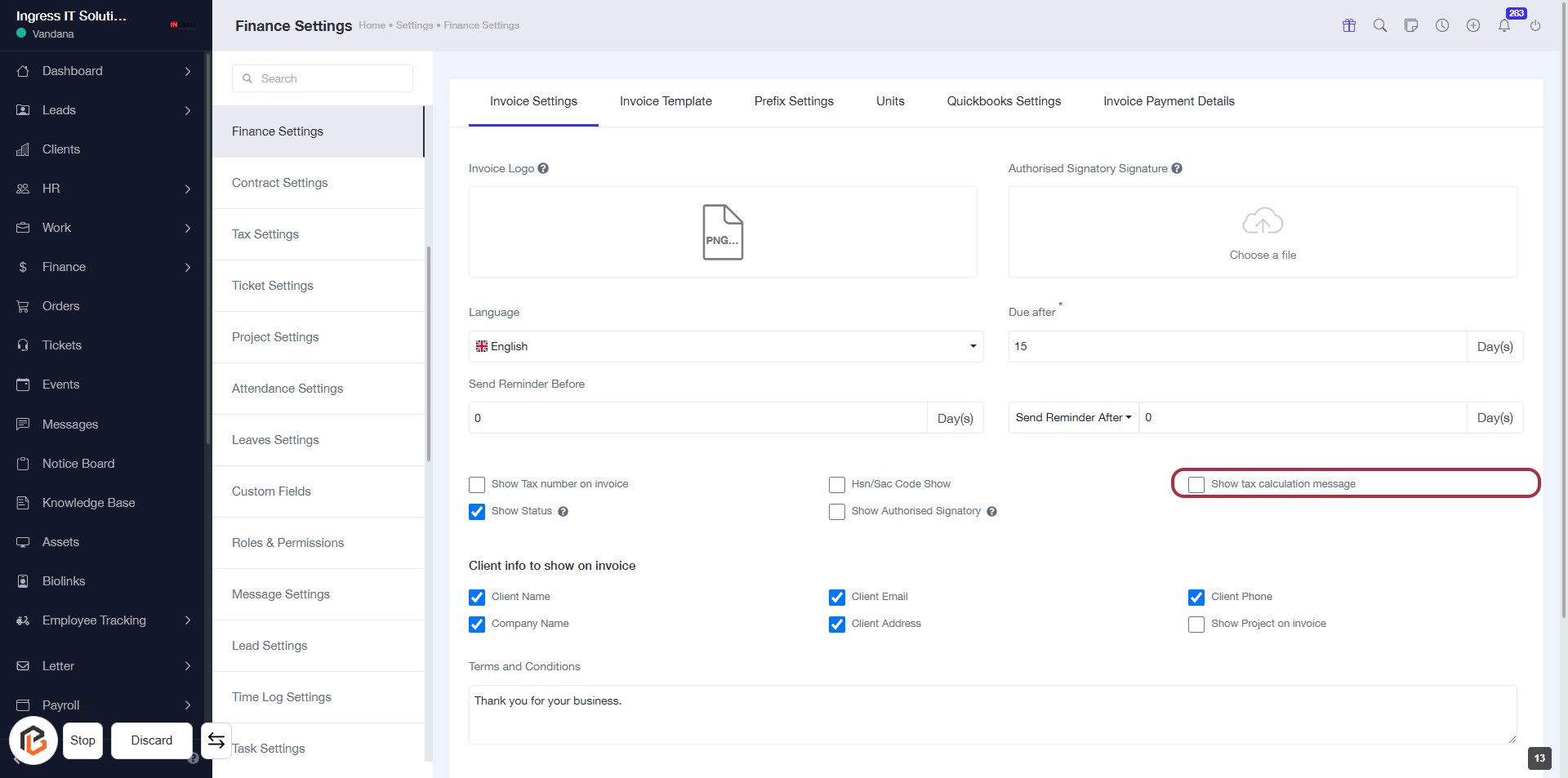

STEP 14: Select "Show tax calculation message"

- Click on the checkbox labeled Show tax calculation message to enable or disable the tax calculation message on invoices.

- Ensure that any required fields marked with an asterisk (*) are filled out before proceeding.

- Review other options in the invoice settings for completeness.

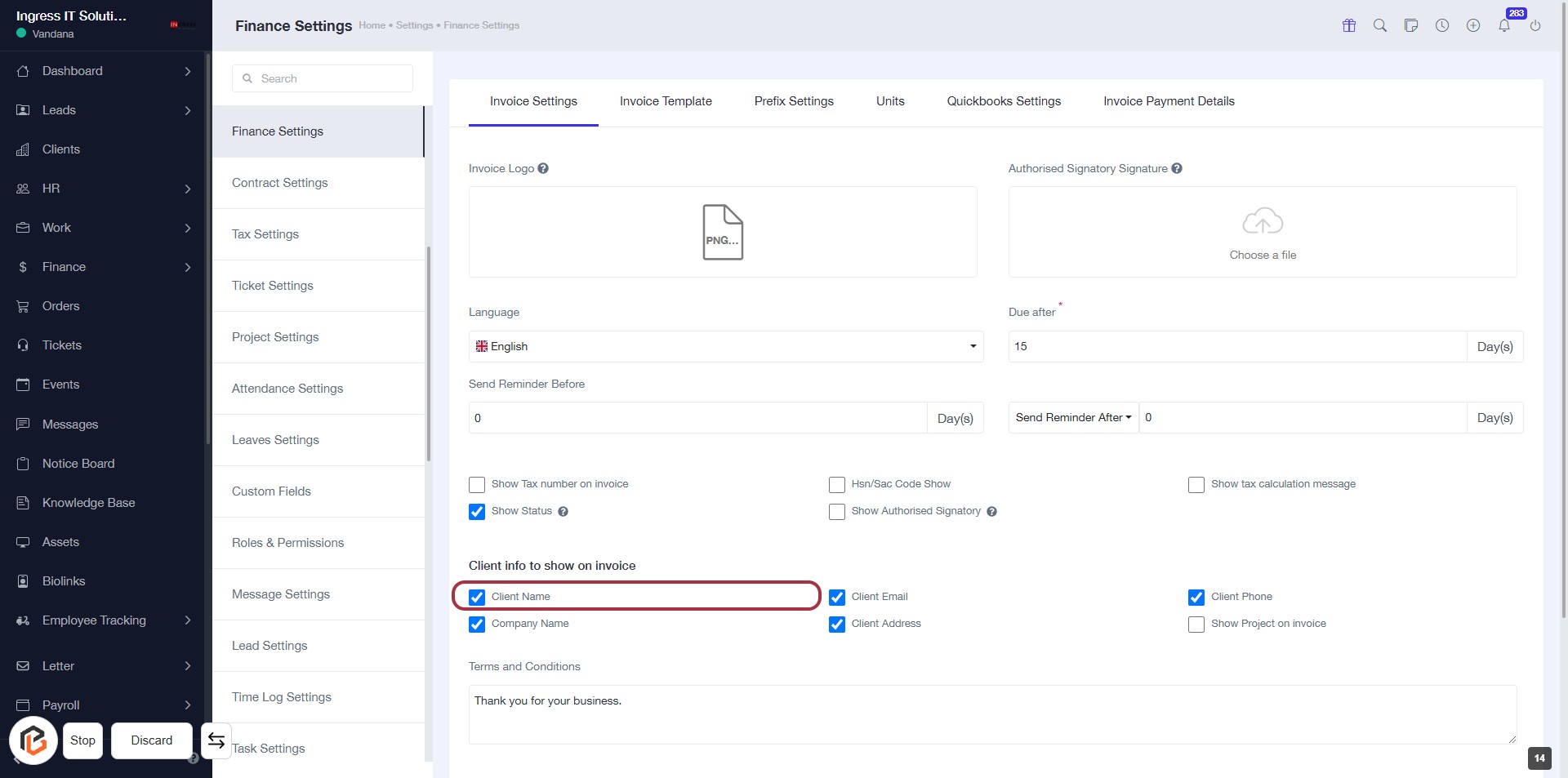

STEP 15: Select "Client Name"

- Click on the "Client Name" checkbox to include it in the invoice.

- Ensure that the checkbox is marked to display the client's name.

- Review other options under "Client info to show on invoice" for additional selections.

- Proceed to the next step by selecting "Company Name".

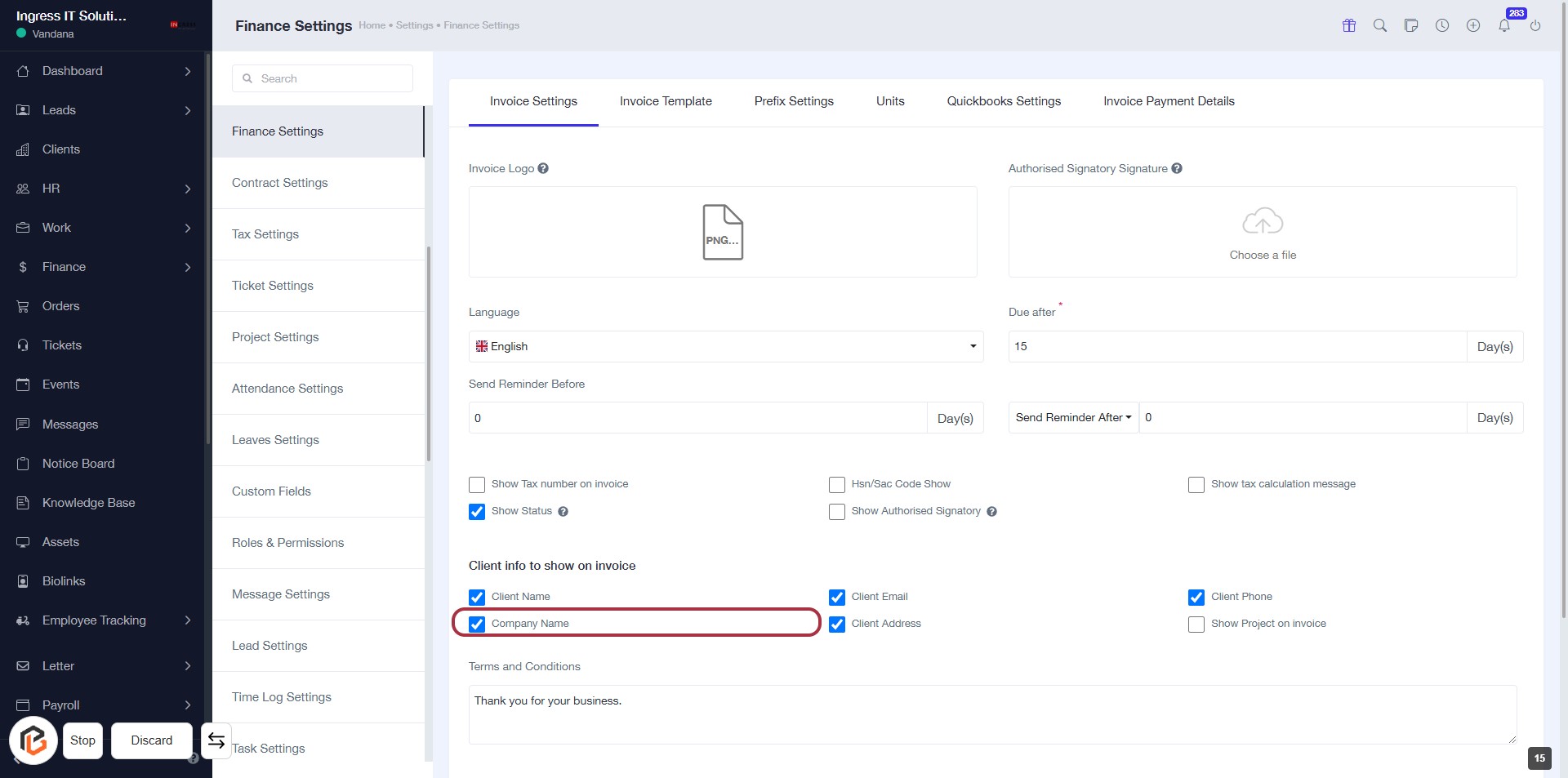

STEP 16: Select "Company Name"

- Click on the "Company Name" checkbox to include it in the invoice.

- Ensure that any required fields marked with an asterisk (*) are filled out.

- Review other options available under "Client info to show on invoice" for additional selections.

- Proceed to the next step by selecting "Client Email."

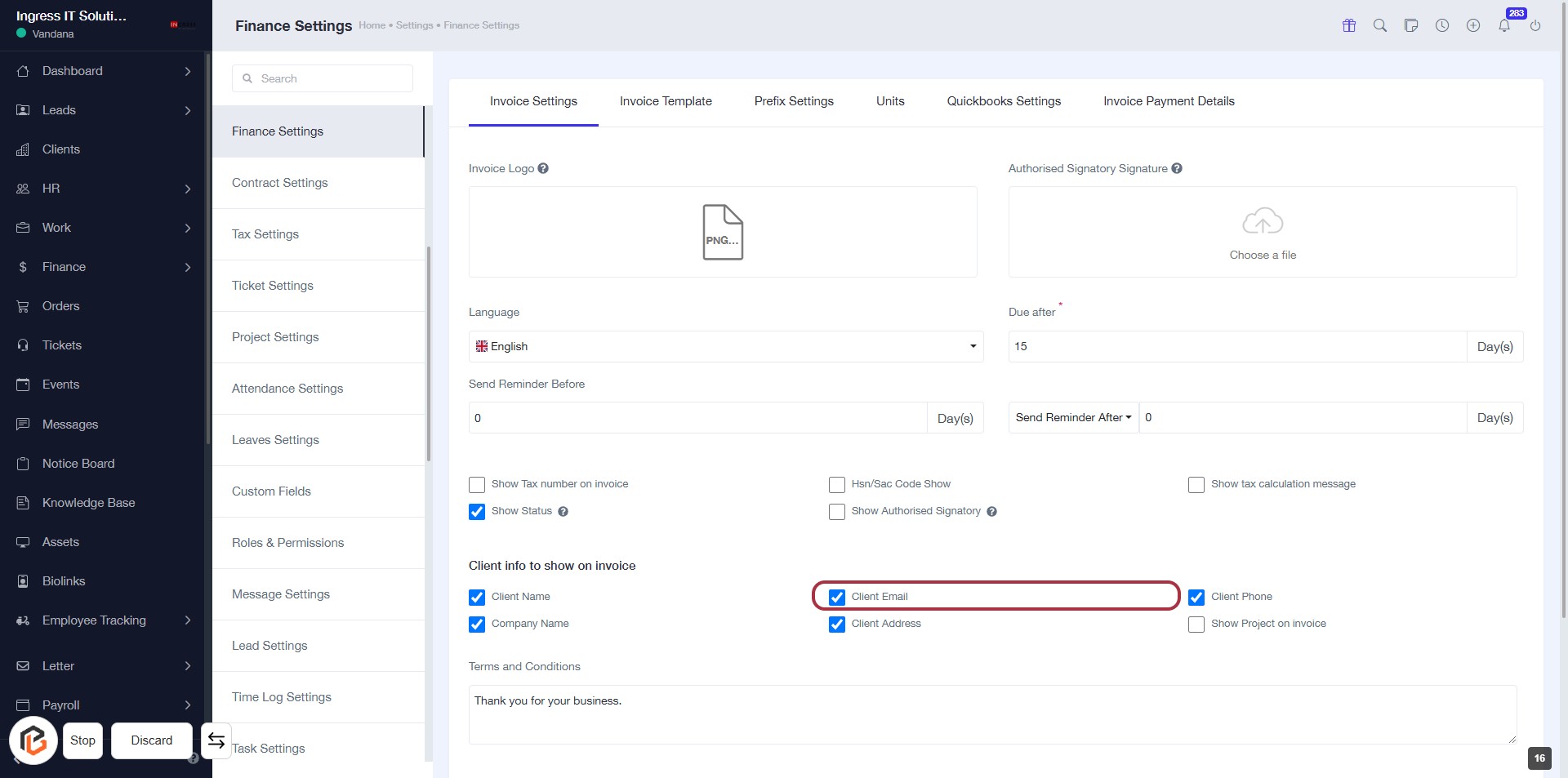

STEP 17: Select "Client Email"

- Click on the "Client Email" option in the invoice settings.

- Ensure that the checkbox next to "Client Email" is selected to display it on the invoice.

- Review other options like "Client Name" and "Company Name" for completeness.

- Proceed to the next step by selecting "Client Address."

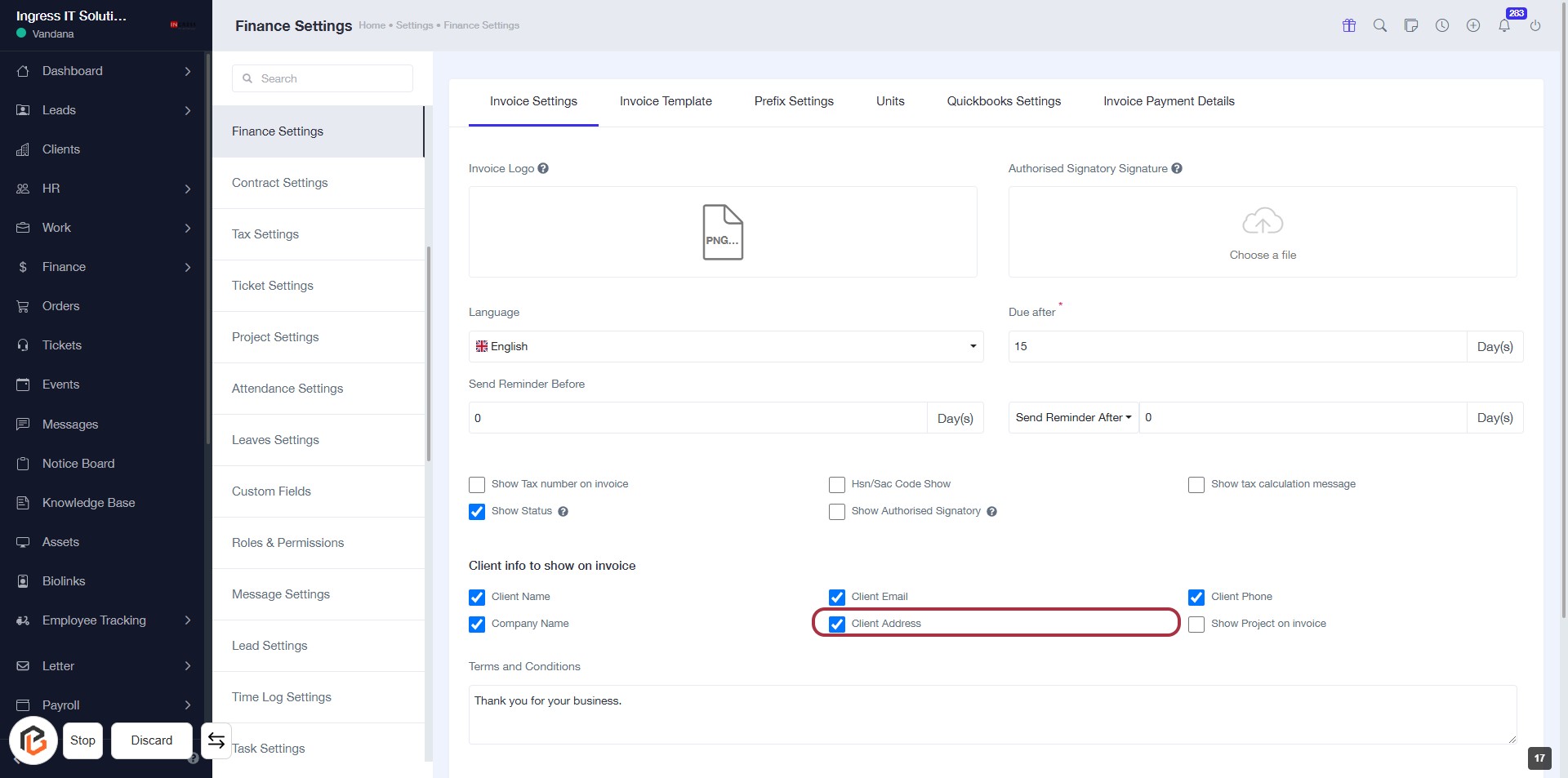

STEP 18: Select "Client Address"

- Click on the Client Address option in the invoice settings.

- Ensure that the checkbox next to Client Address is selected to include it on the invoice.

- Review other options like Client Name and Company Name for completeness.

- Proceed to the next step by selecting Client Phone.

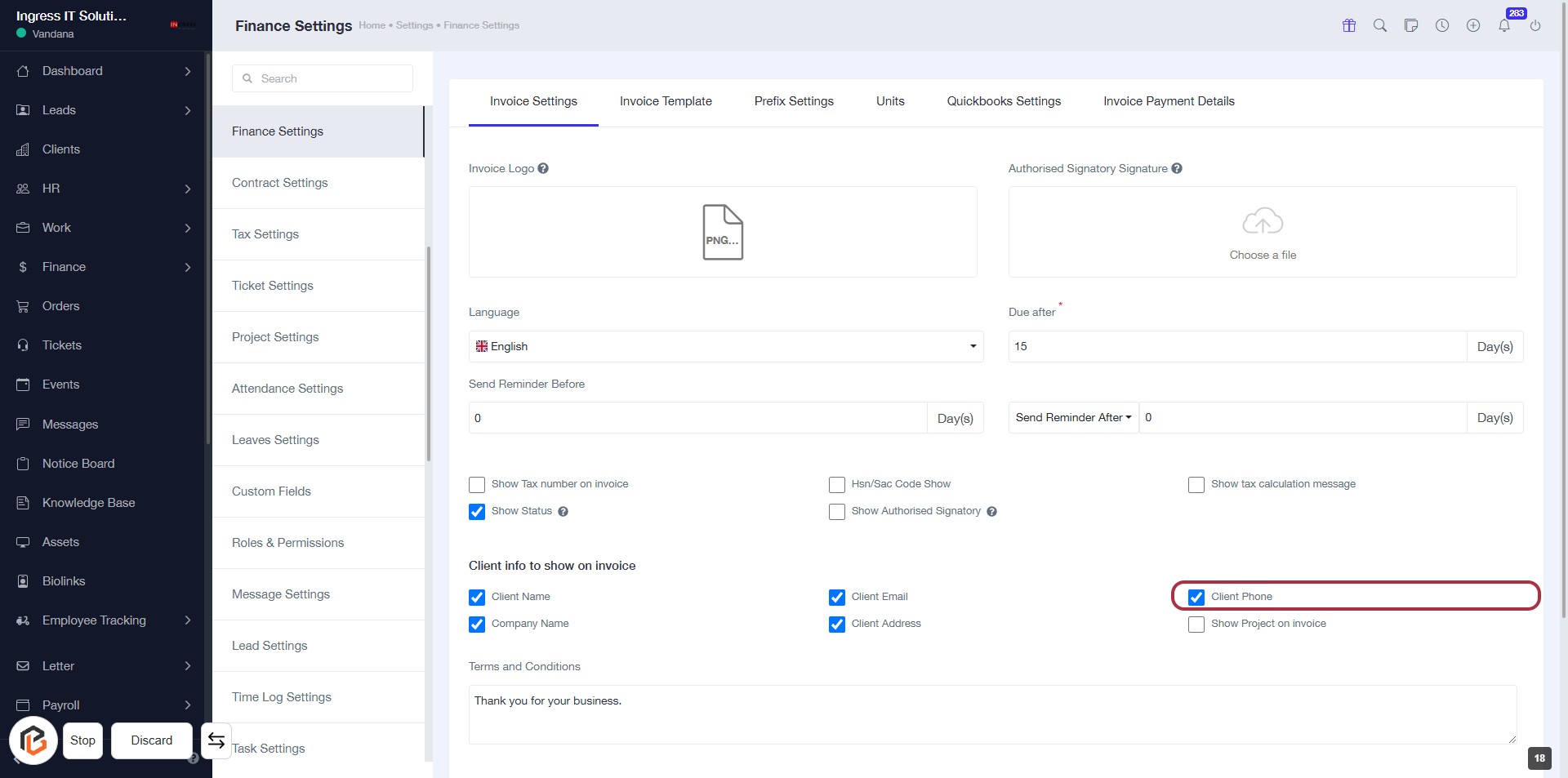

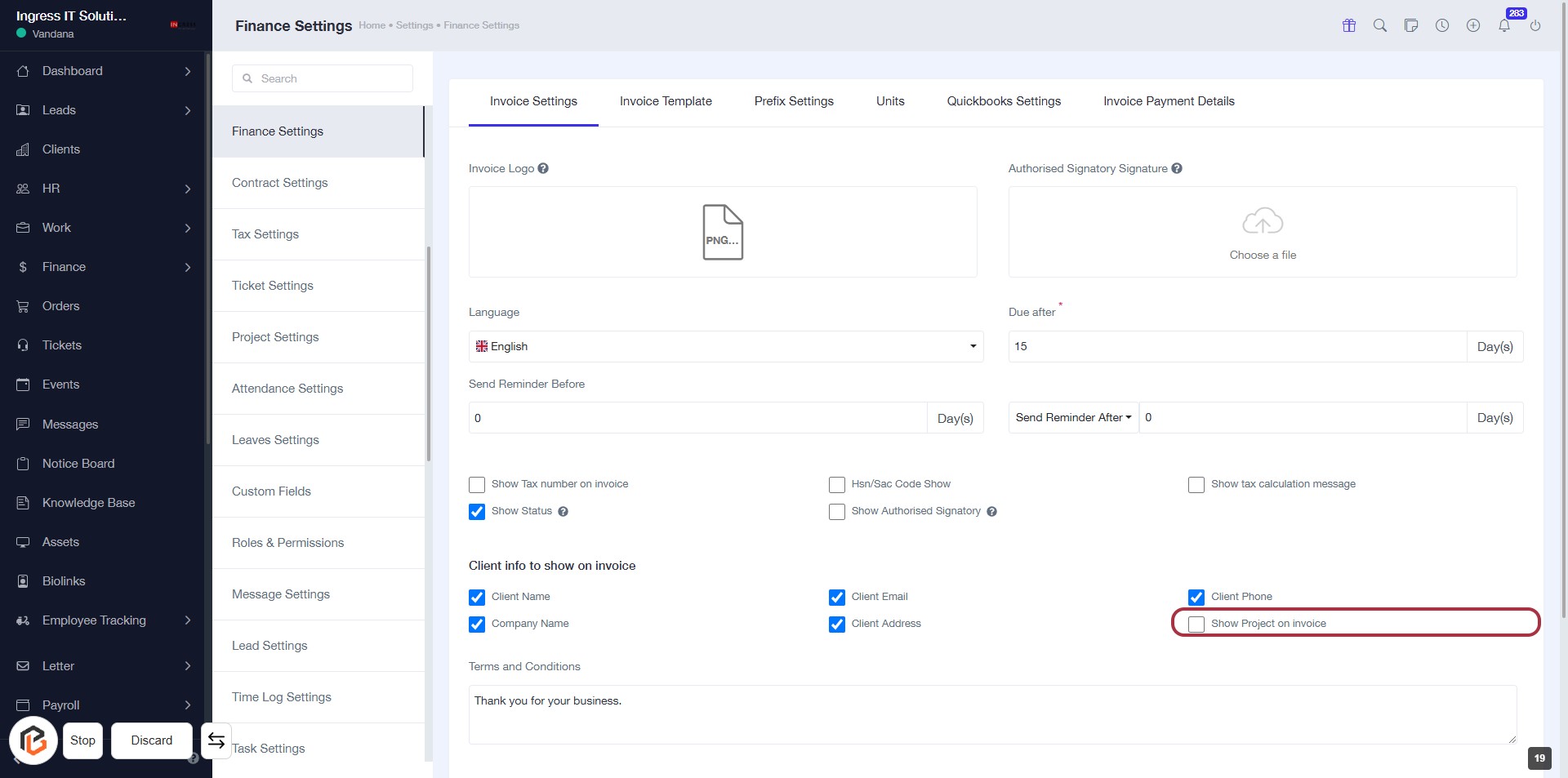

STEP 19: Select "Client Phone"

- Click on the "Client Phone" checkbox to include the client's phone number on the invoice.

- Ensure that other relevant options like "Client Email" and "Client Address" are also checked if needed.

- Review your selections before proceeding to the next step.

STEP 20: Select "Show Project on invoice"

- Click on the checkbox labeled Show Project on invoice to include project details on your invoices.

- Ensure other relevant options are selected as needed, such as Client Name and Client Phone.

- Review the settings before proceeding to the next step.

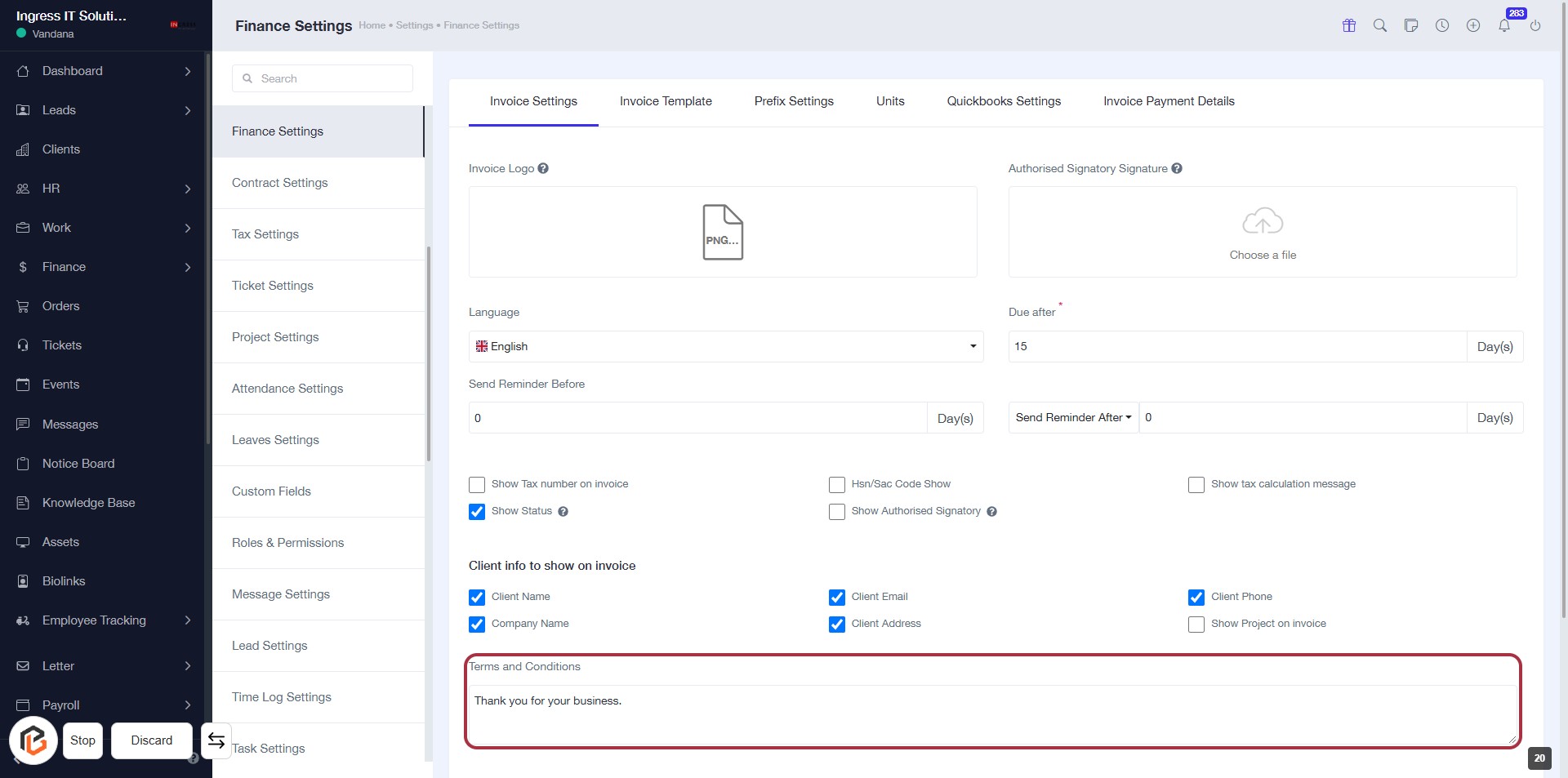

STEP 21: Enter "Terms and Conditions"

- Click on the "Terms and Conditions" section in the invoice settings.

- Fill in the text area with your desired terms and conditions.

- Ensure to include any necessary details relevant to your business.

- Review the content for clarity and completeness before proceeding.

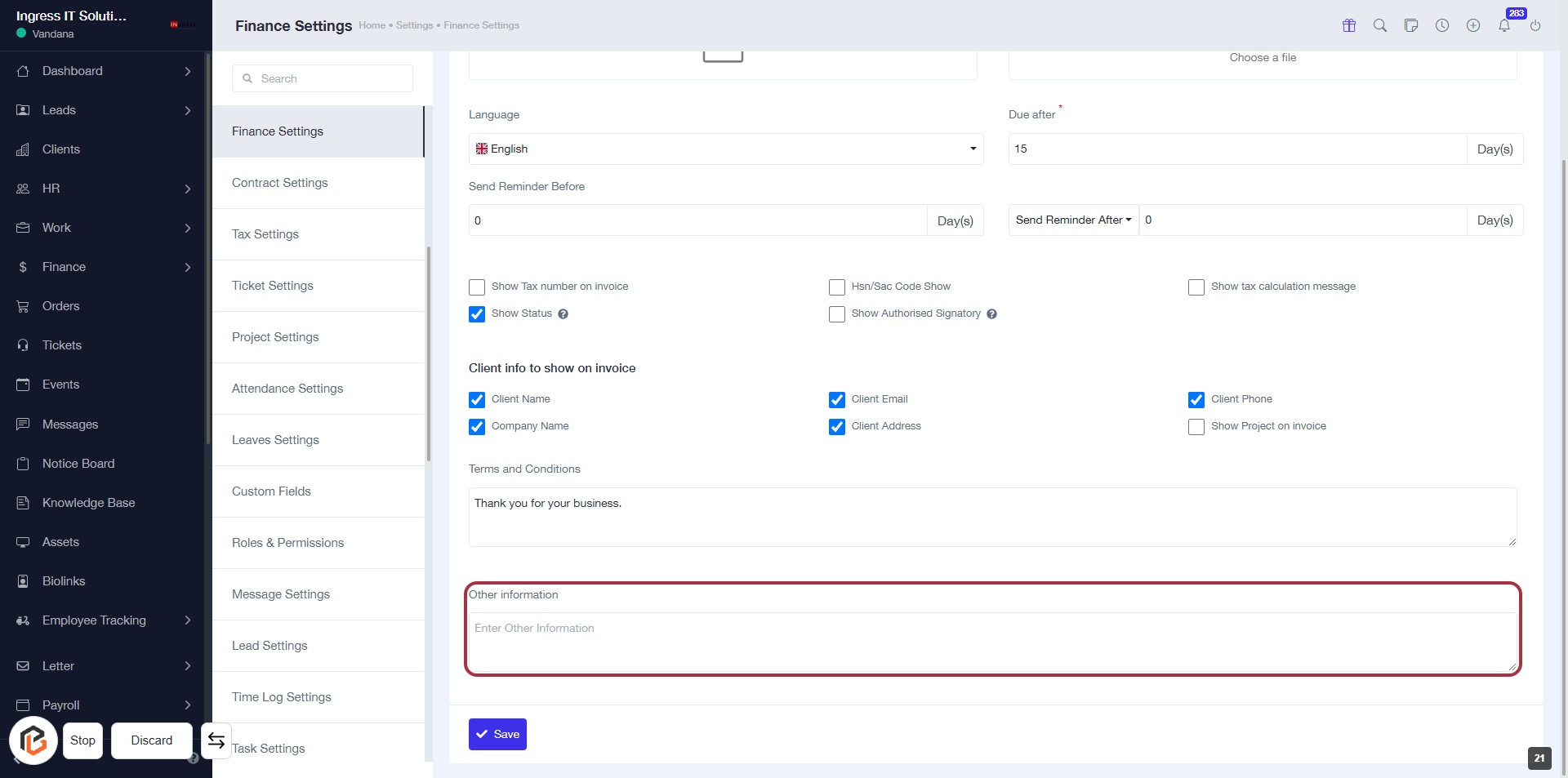

STEP 22: Enter "Other information"

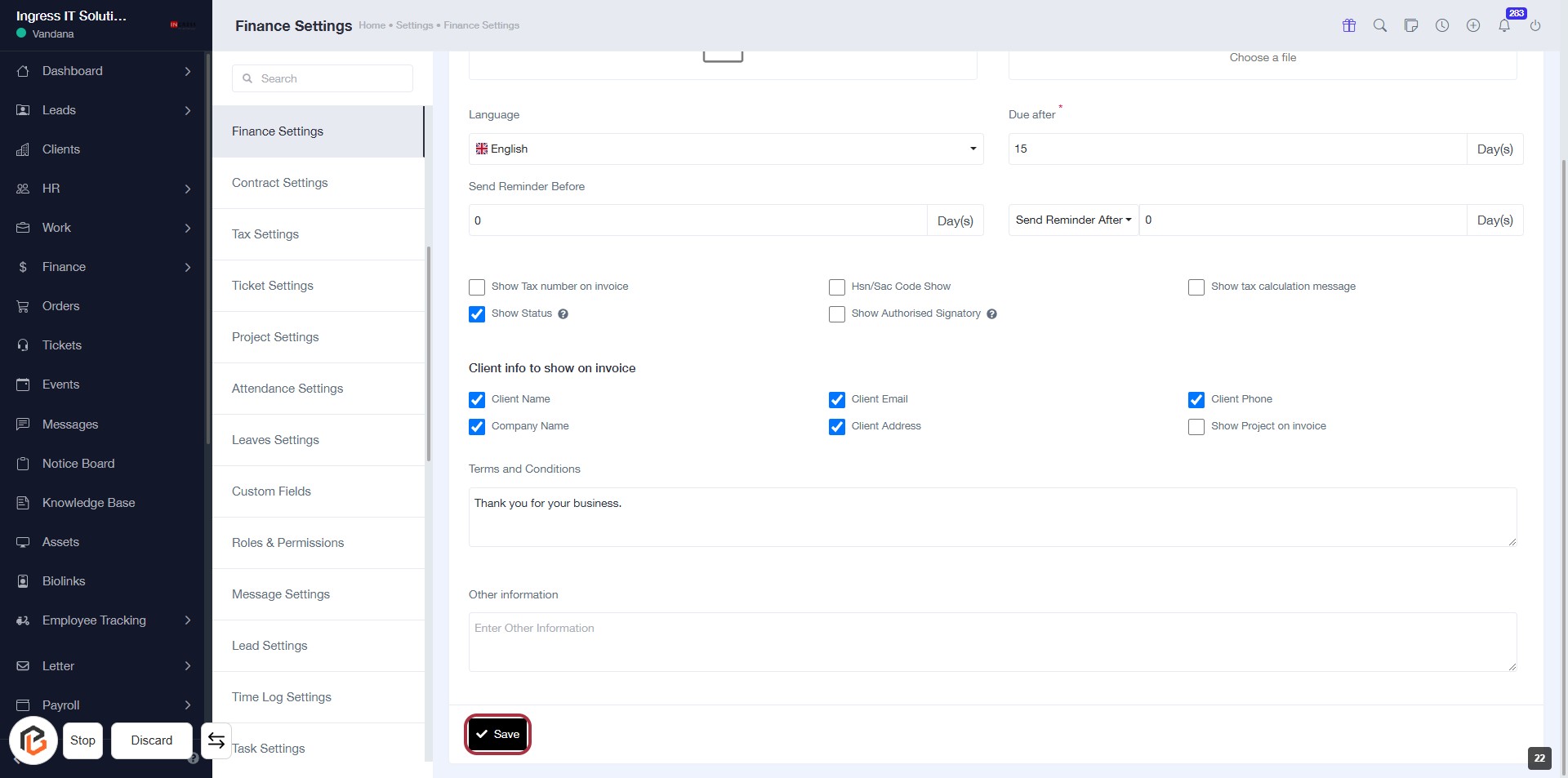

STEP 23: Click "Save" to Finalize Settings

- Ensure all required fields are filled out.

- Review the "Other information" section for any additional details.

- Click the Save button at the bottom of the form to save your changes.

- Confirm that a success message appears to indicate the settings have been saved.