Comprehensive Guide to Managing Payroll: Step-by-Step Instructions for Payroll Processing and Adjustments

16 mins read · Updated 01 Oct, 2025

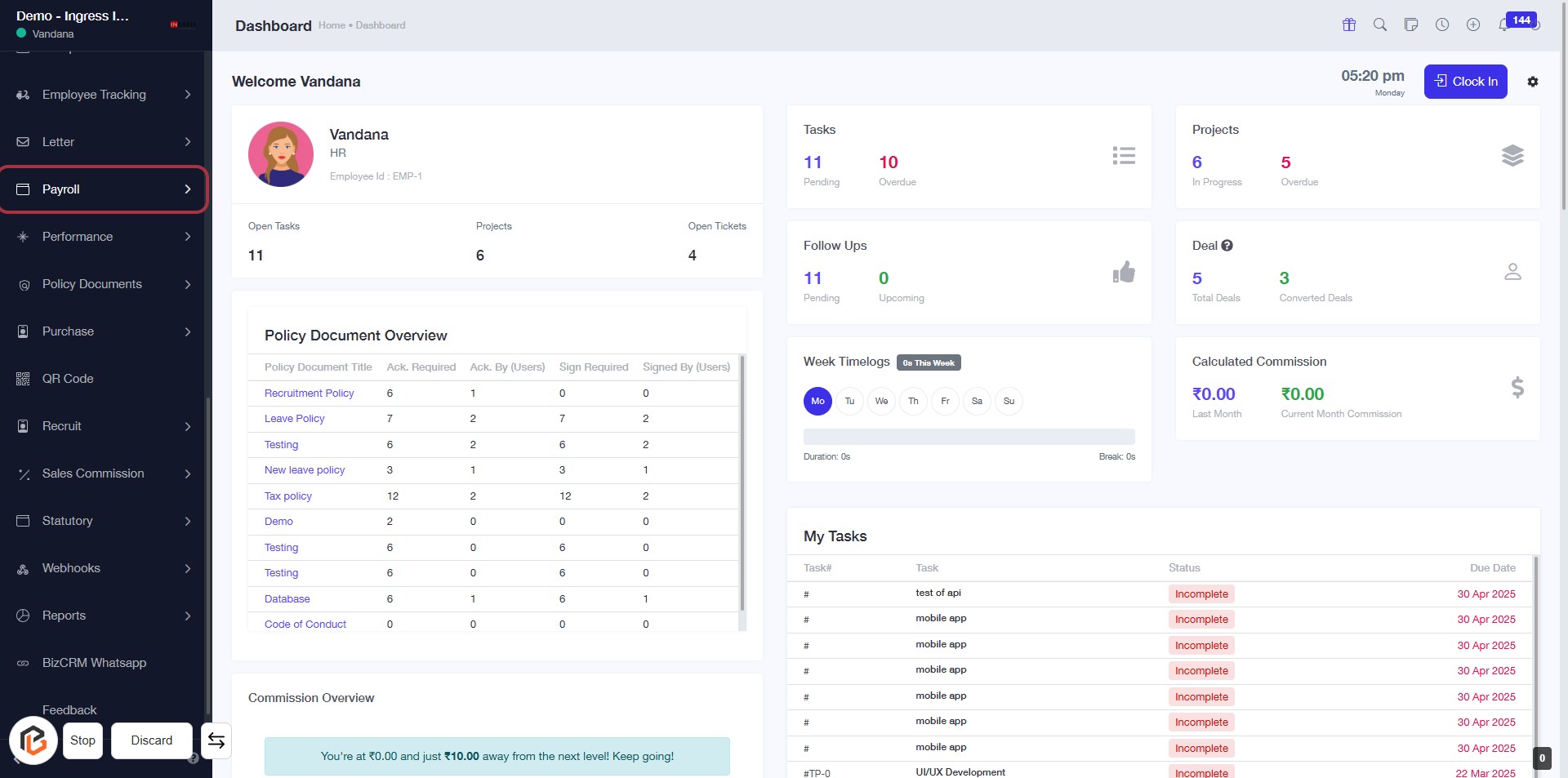

STEP 1: Click on "Payroll" to Access Payroll Features

- Navigate to the left sidebar menu.

- Locate and click on the "Payroll" link.

- This will direct you to the Payroll section where you can manage payroll-related tasks and documents.

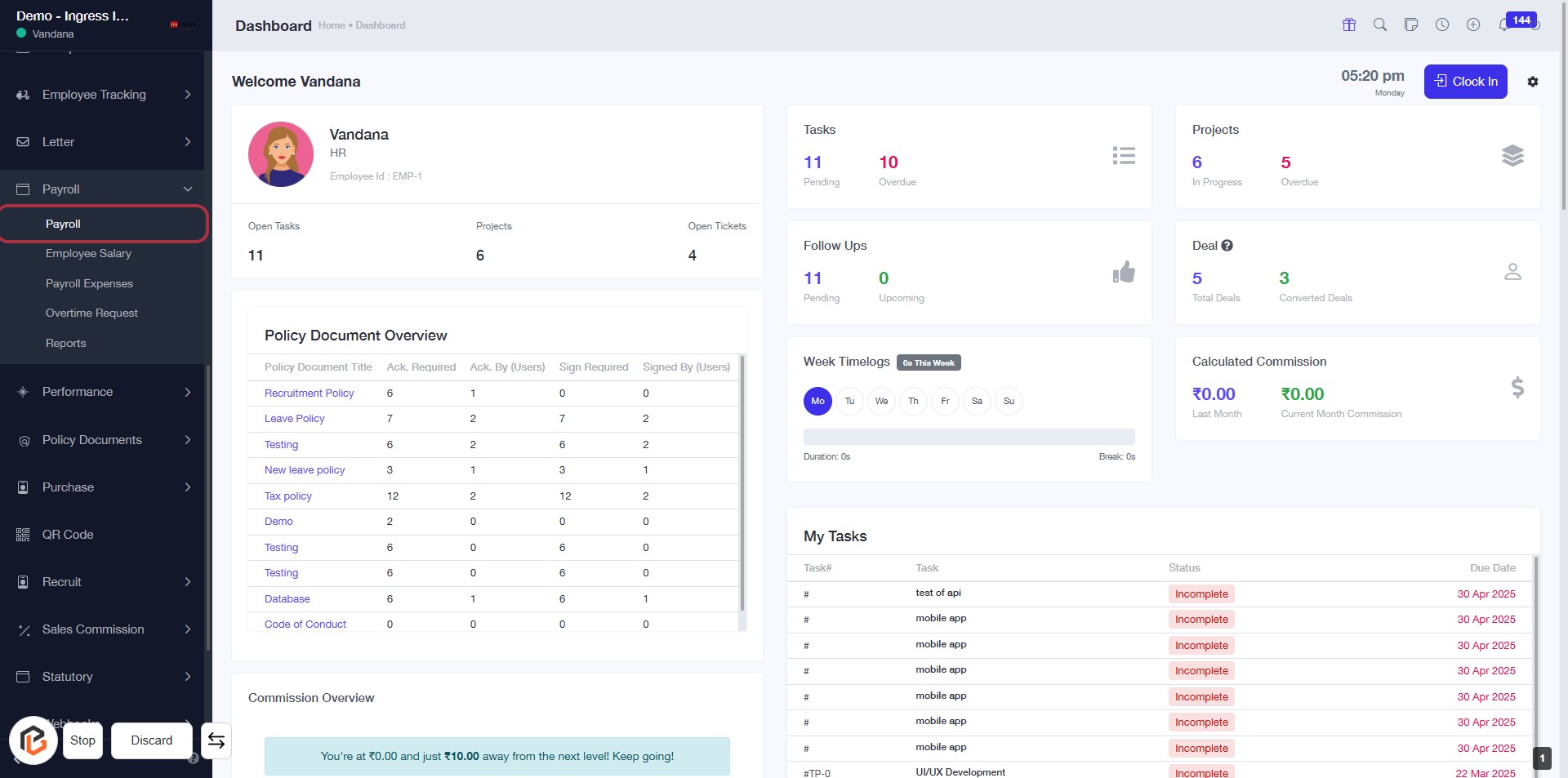

STEP 2: Click on "Payroll" to Access Payroll Features

- Navigate to the sidebar menu and click on the "Payroll" link.

- This will direct you to the Payroll features page.

- Ensure you have the necessary permissions to access payroll functionalities.

- Look for any highlighted areas or prompts for further actions after accessing the page.

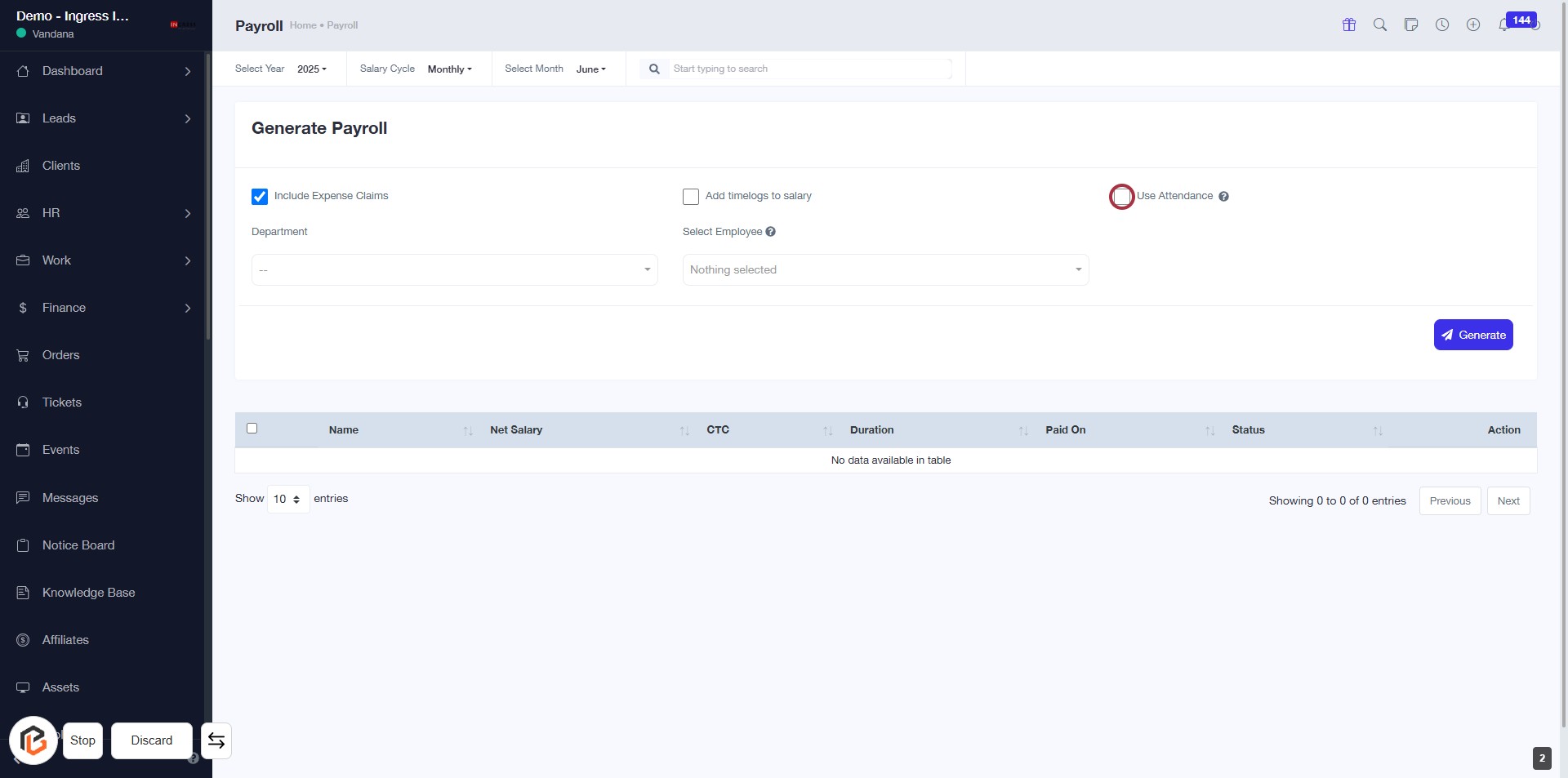

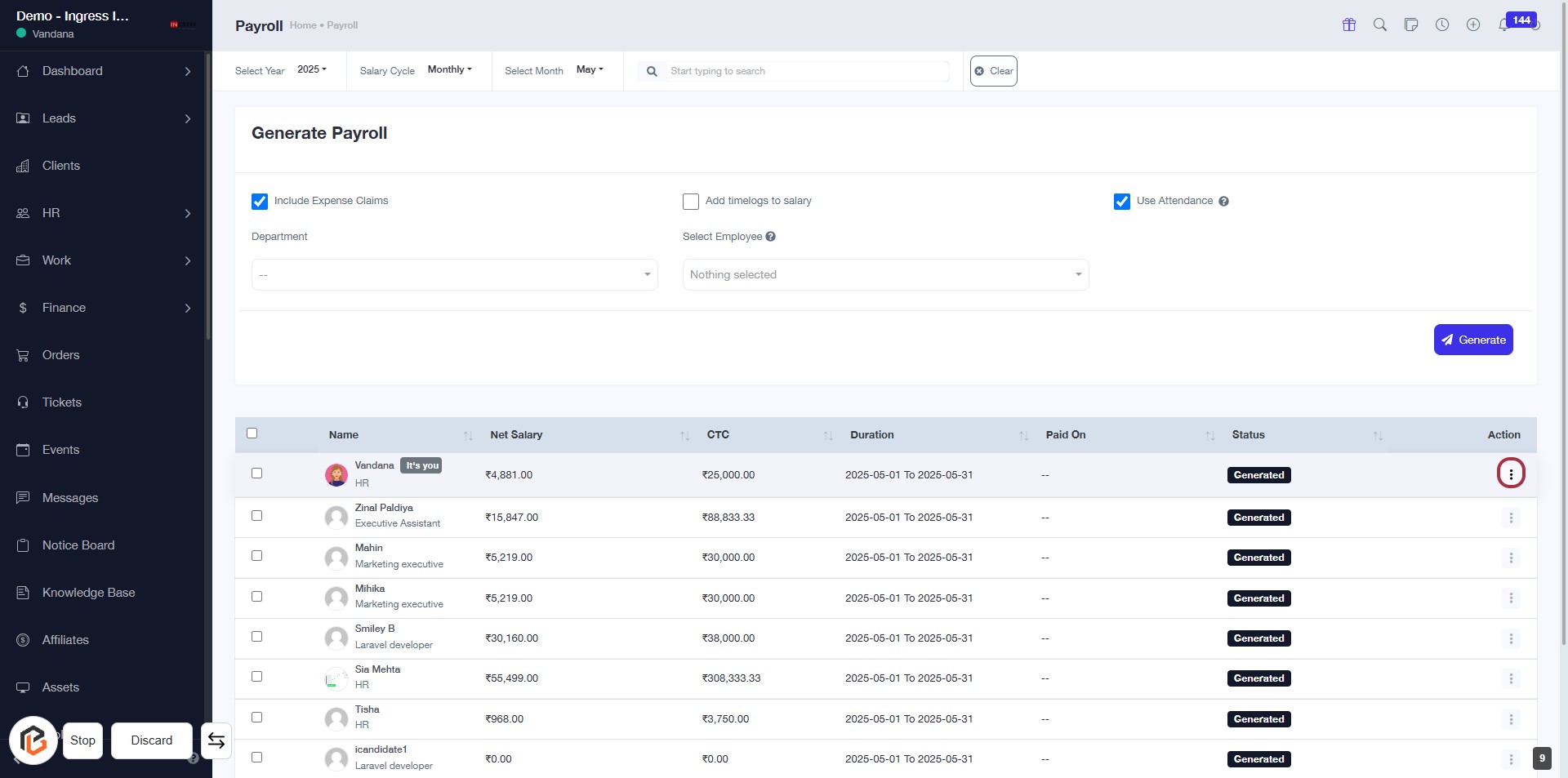

STEP 3: Click "Use Attendance" to Include Attendance Data

- Locate the "Use Attendance" checkbox in the Generate Payroll section.

- Click on the checkbox to enable attendance data for payroll processing.

- Ensure that the checkbox is marked to include attendance information.

- Proceed to the next step by selecting the "Month" for payroll generation.

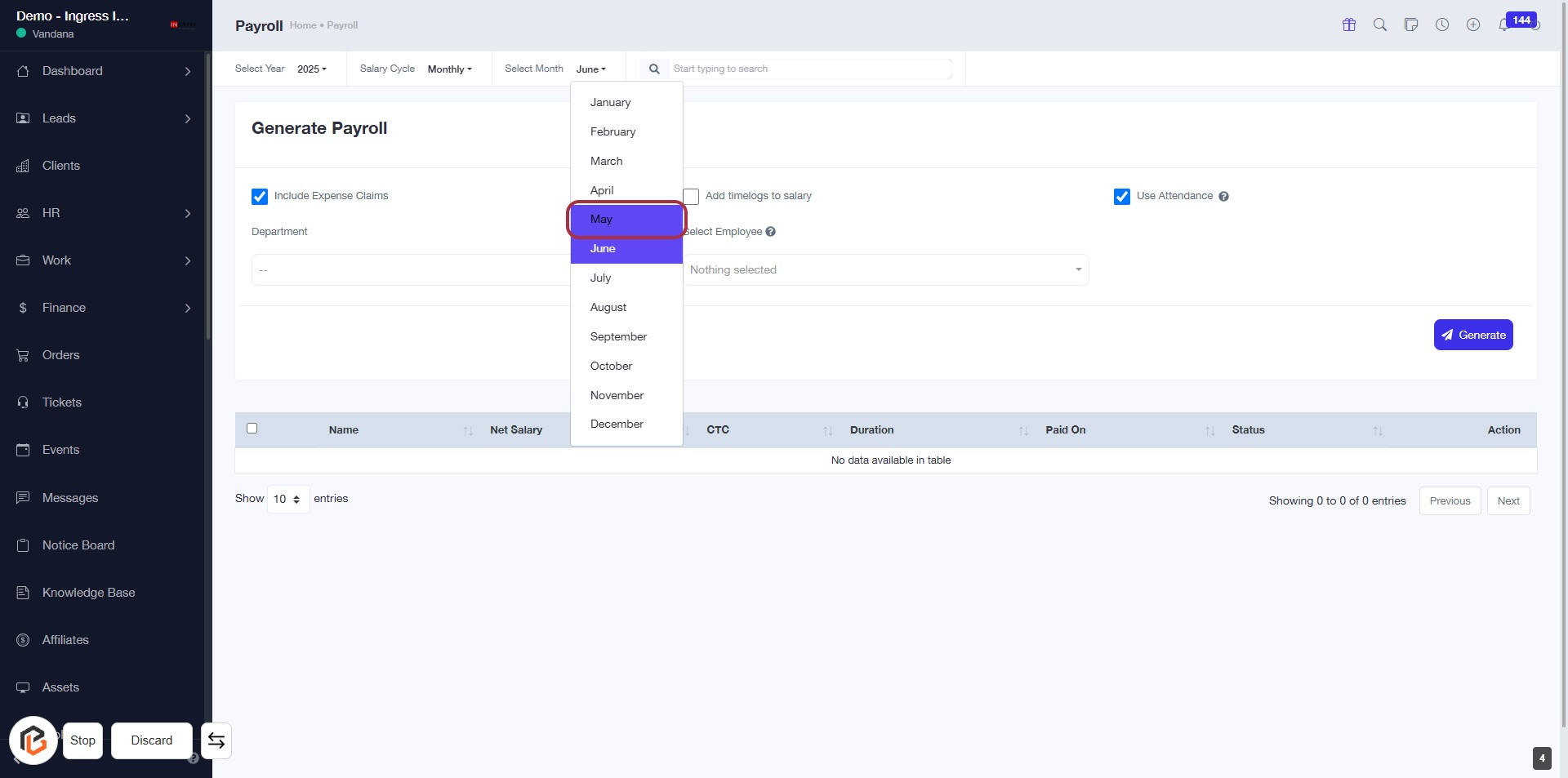

STEP 4: Select "Month" for Payroll Generation

- Click on the dropdown menu labeled "Select Month."

- Choose "May" from the list of options.

- Ensure that the selection is highlighted to confirm your choice.

- Proceed to the next step by selecting the "Employee" from the dropdown.

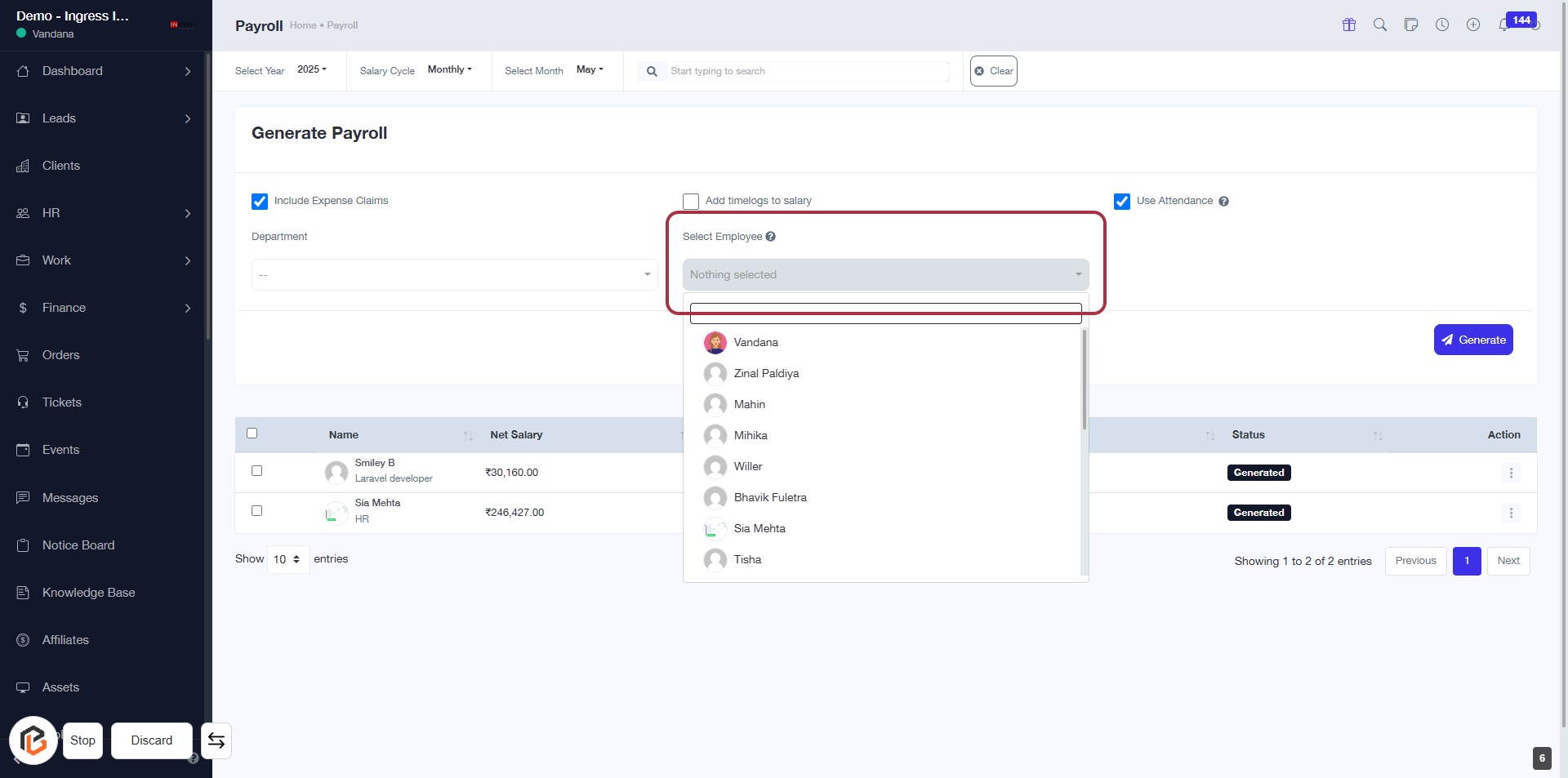

STEP 5: Select Employee for Payroll Generation

- Click on the Select Employee dropdown.

- Choose an employee from the list that appears.

- Ensure that the selected employee is displayed in the dropdown.

- Proceed to the next step by selecting the Department.

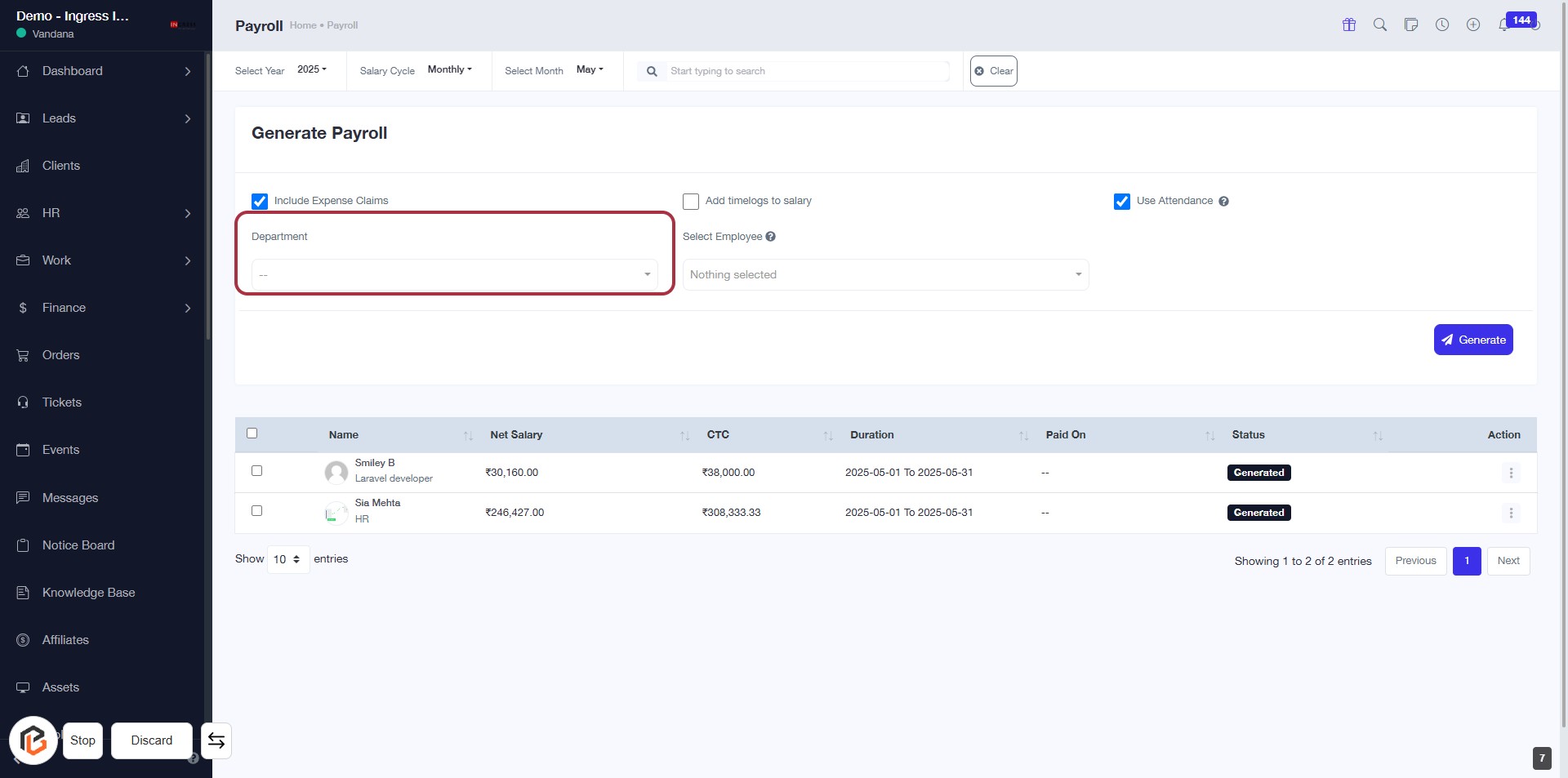

STEP 6: Select Department for Payroll Generation

- Click on the "Department" field highlighted in red.

- A dropdown will appear; select the appropriate department from the list.

- Ensure all required fields marked with an asterisk (*) are filled out.

- Review your selections before proceeding to the next step.

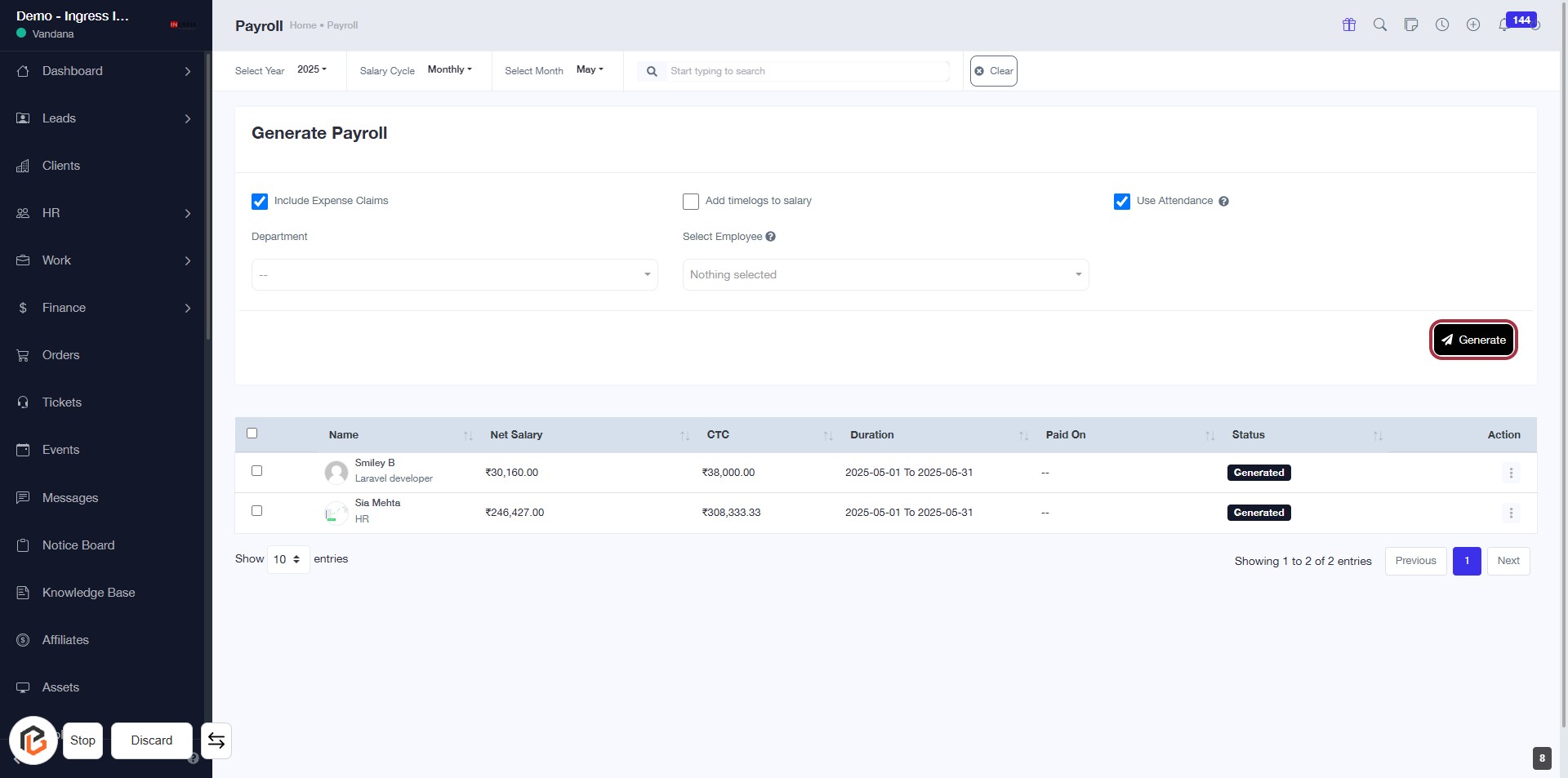

STEP 7: Click on "Generate" to Create Payroll

- Ensure all required fields are filled, including "Include Expense Claims" and "Select Employee."

- Review the payroll details displayed in the table below.

- Click the Generate button located in the highlighted area to proceed with payroll creation.

- Confirm the action if prompted to finalize the process.

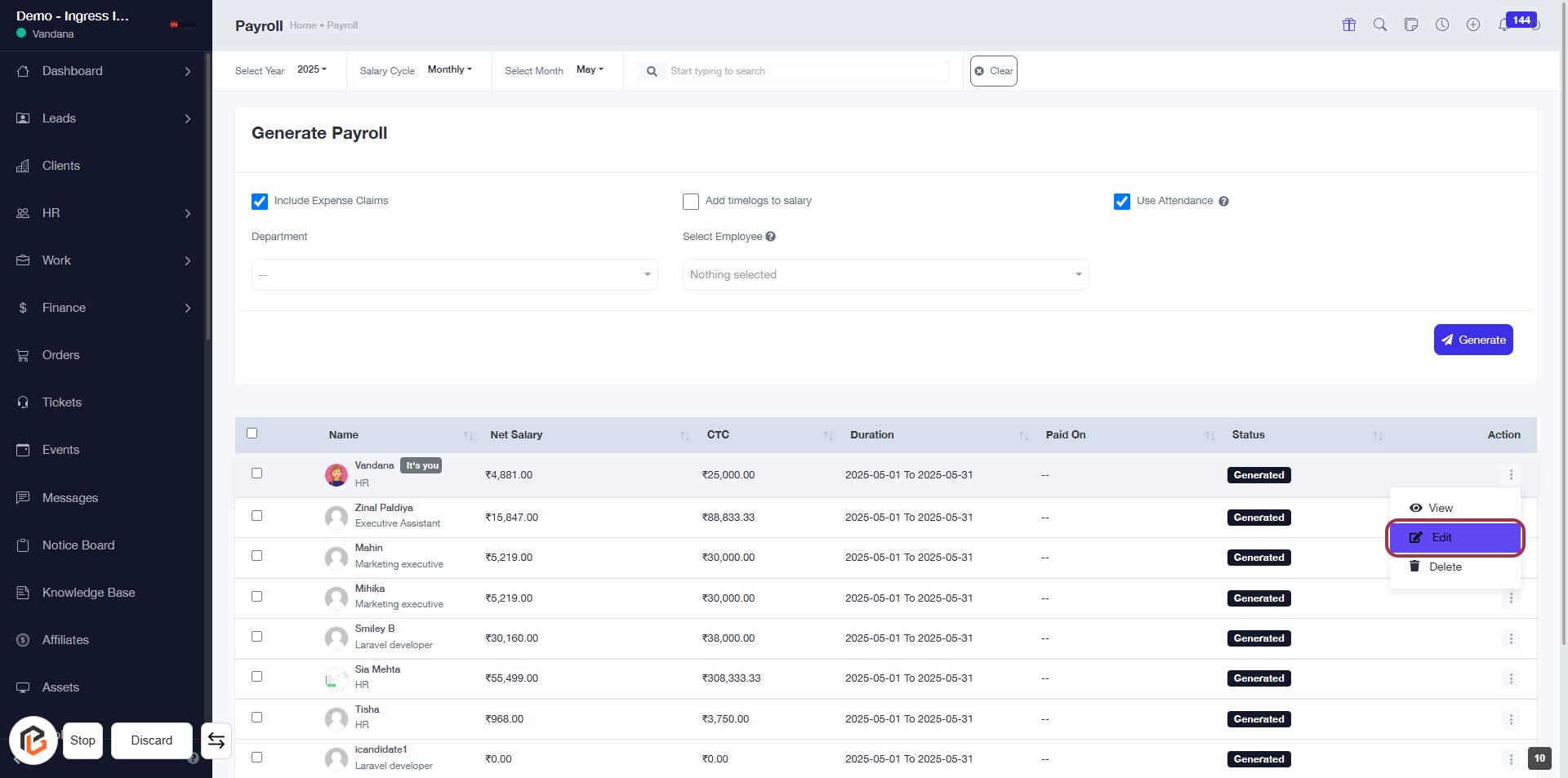

STEP 8: Click on "Action Button"

- Locate the highlighted area on the right side of the table under the "Action" column.

- Click on the action button (represented by three dots) for the desired employee.

- This will open a dropdown menu with options for managing payroll details.

- Ensure you have selected the correct employee before proceeding.

STEP 9: Click on "Edit" to Modify Payroll Details

- Locate the "Edit" option in the Action column of the payroll table.

- Click on the "Edit" link to open the payroll details for the selected employee.

- Ensure all necessary fields are filled out, especially those marked with an asterisk (*).

- Review the information before proceeding to the next step.

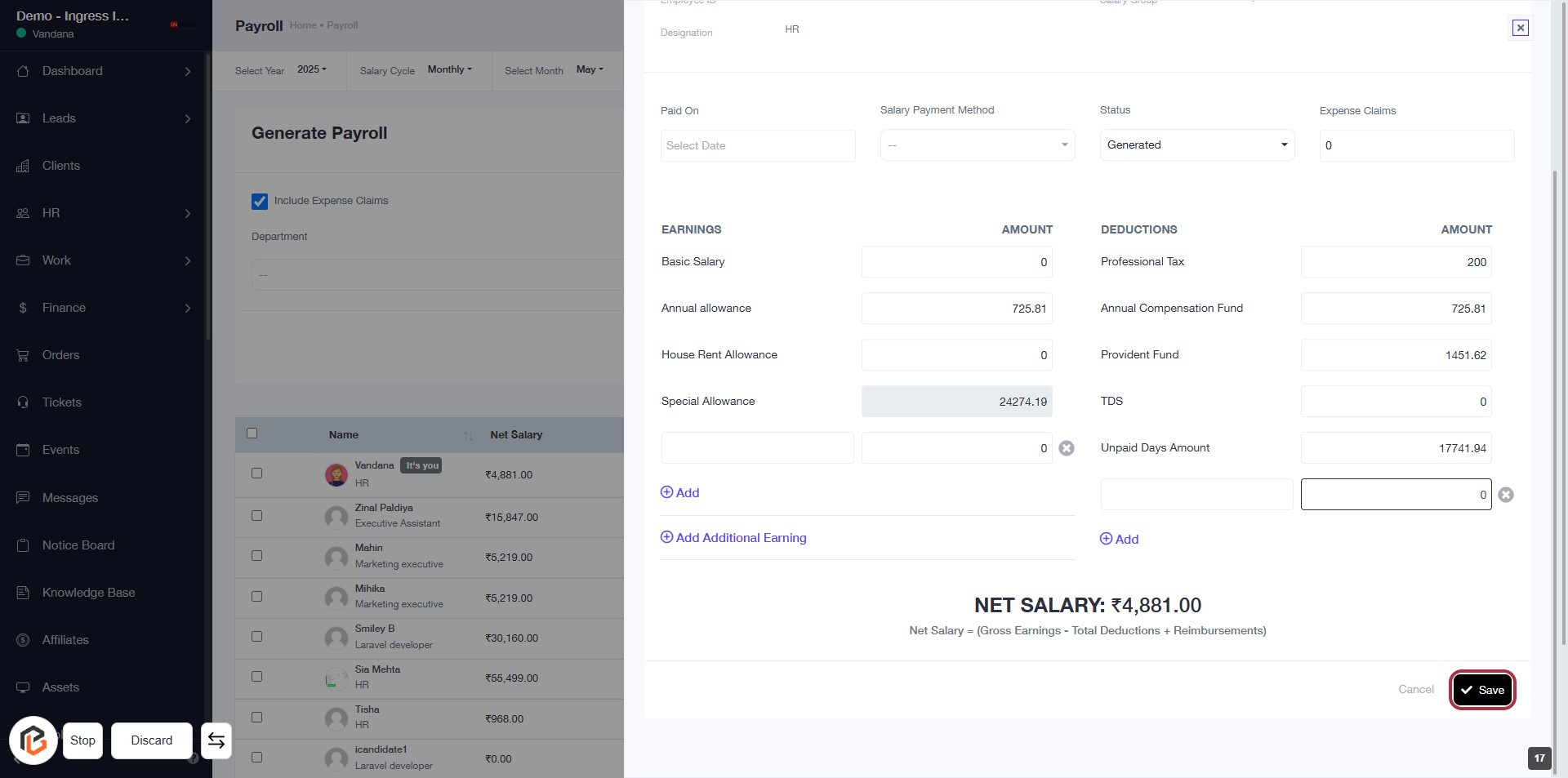

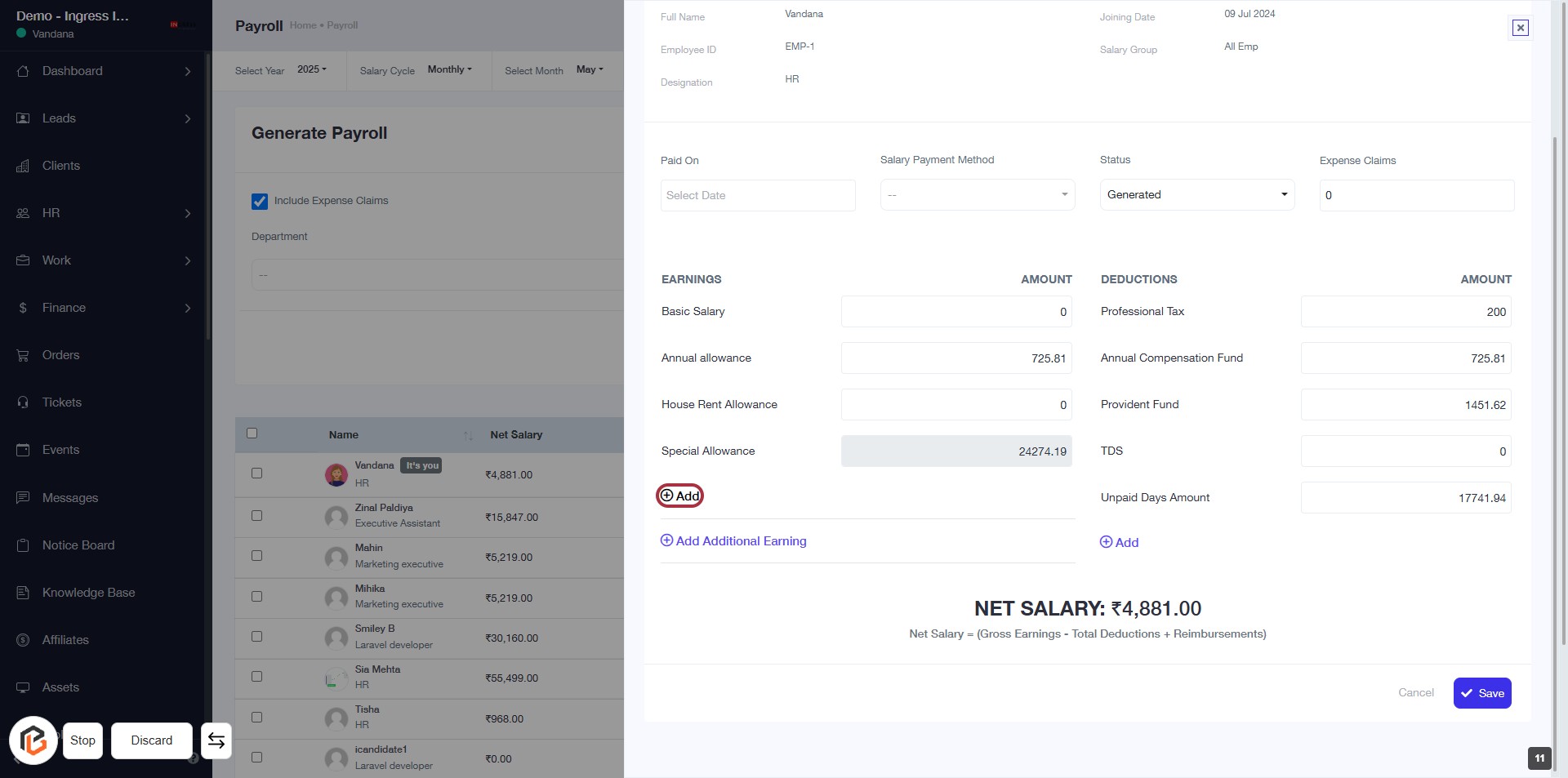

STEP 10: Click on "Add" Earnings (If Any)

- Click the "Add" link to include additional earnings.

- Ensure all required fields marked with an asterisk (*) are filled out.

- Review existing earnings before adding new ones.

- Proceed to the next step to insert the "Earning Type."

STEP 11: Insert "Earning Type"

- Click on the input field highlighted in red to enter the earning type.

- Ensure to fill in any required fields marked with an asterisk (*).

- Review the existing earnings listed above for context.

- Proceed to the next step to insert the "Earning Value."

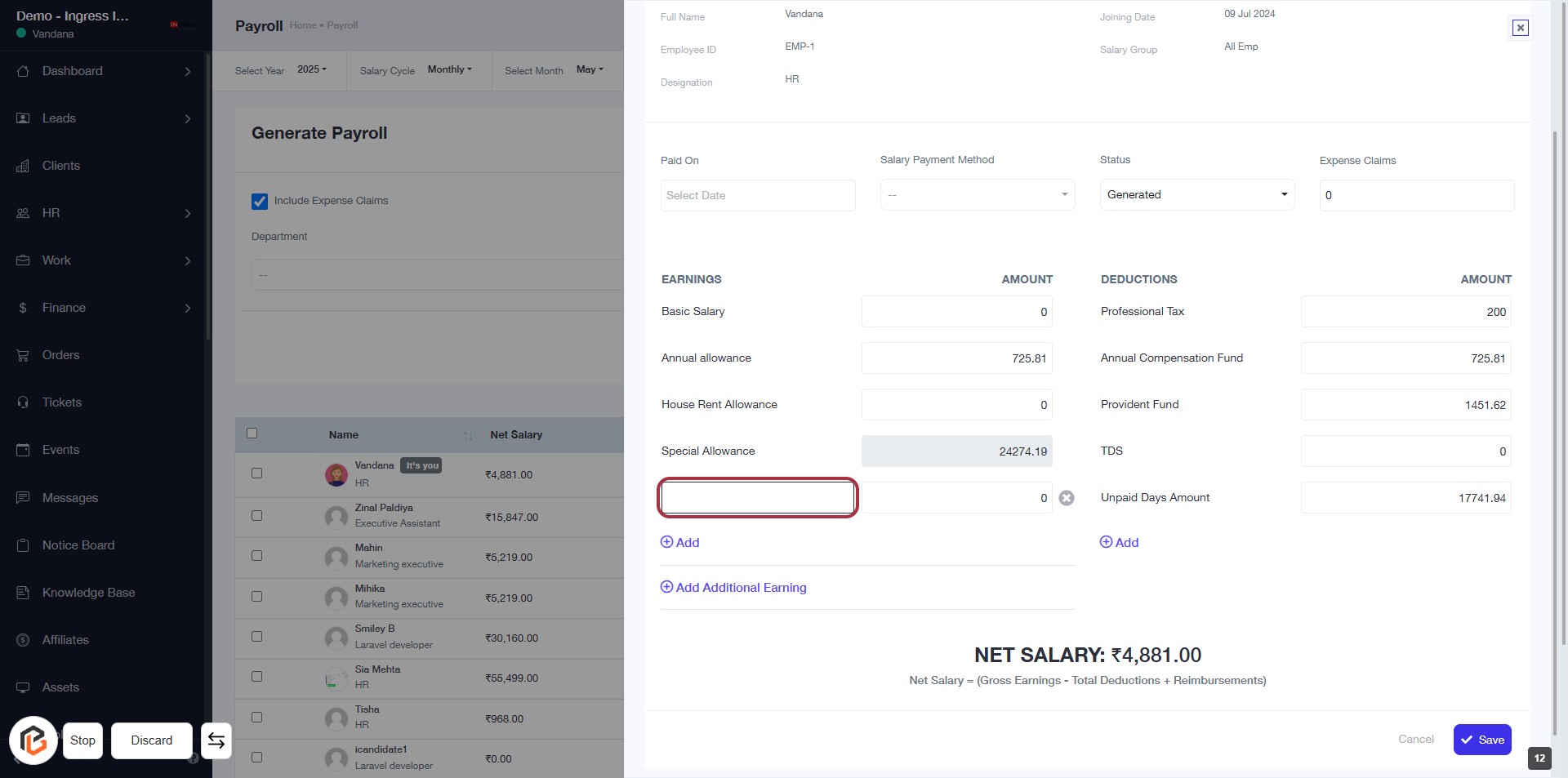

STEP 12: Insert "Earning Value"

- Click on the input field for "Special Allowance" to enter the earning value.

- Ensure to fill in the amount as required.

- Look for any fields marked with an asterisk (*) to identify mandatory inputs.

- After entering the value, proceed to the next step by clicking on "Add" Deductions if applicable.

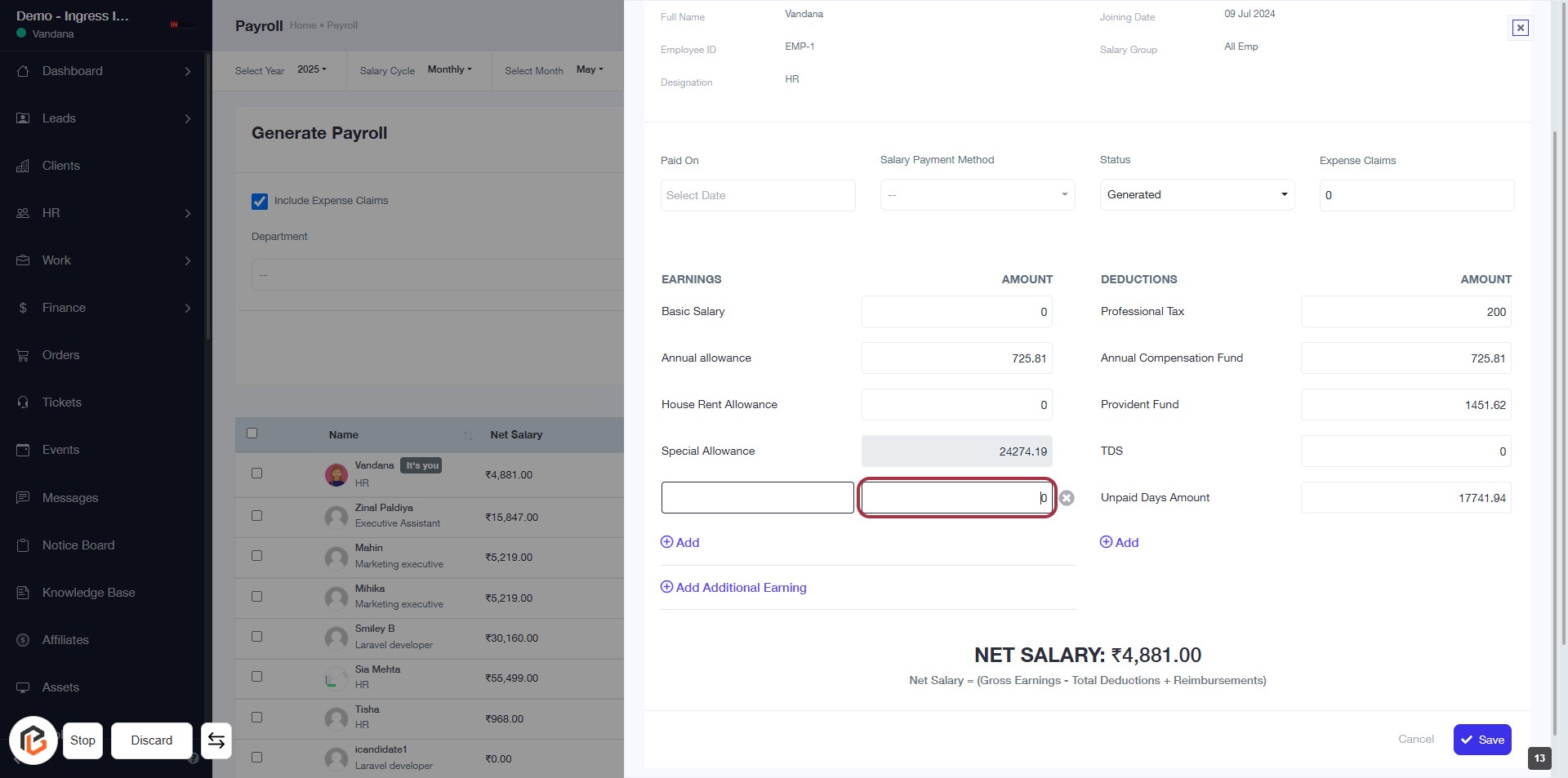

STEP 13: Click on "Add" to Include Deductions

- Locate the "Add" link under the Deductions section.

- Click on the "Add" button to initiate the process of adding deductions.

- Ensure all required fields marked with an asterisk (*) are filled out in the subsequent form.

- Review the deductions you wish to include before proceeding to the next step.

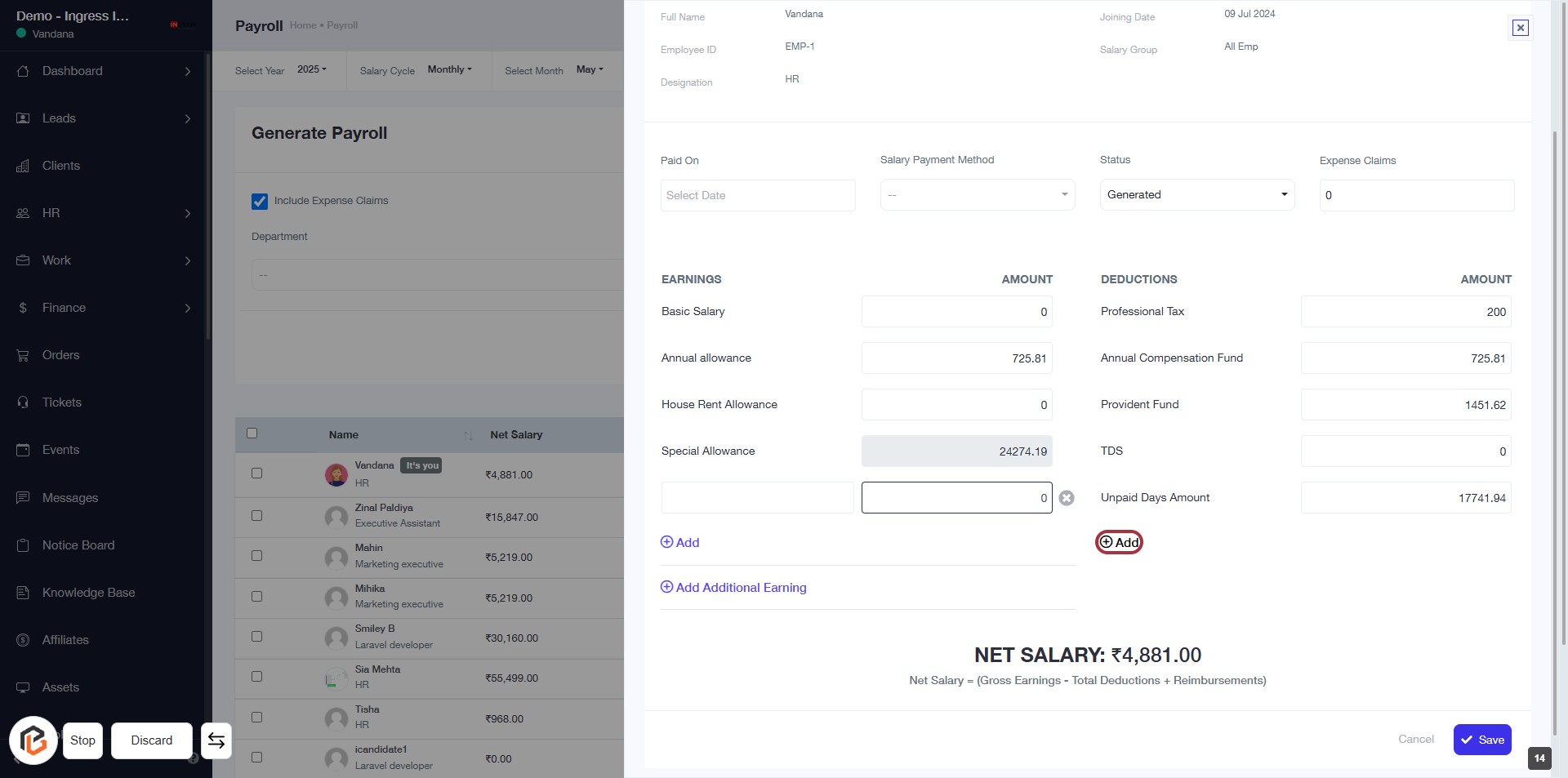

STEP 14: Insert "Deduction Type"

- Click on the input field for "Deduction Type" highlighted in red.

- Ensure to enter the appropriate deduction type as required.

- Review other deduction fields for accuracy.

- Proceed to the next step to insert the "Deduction Value."

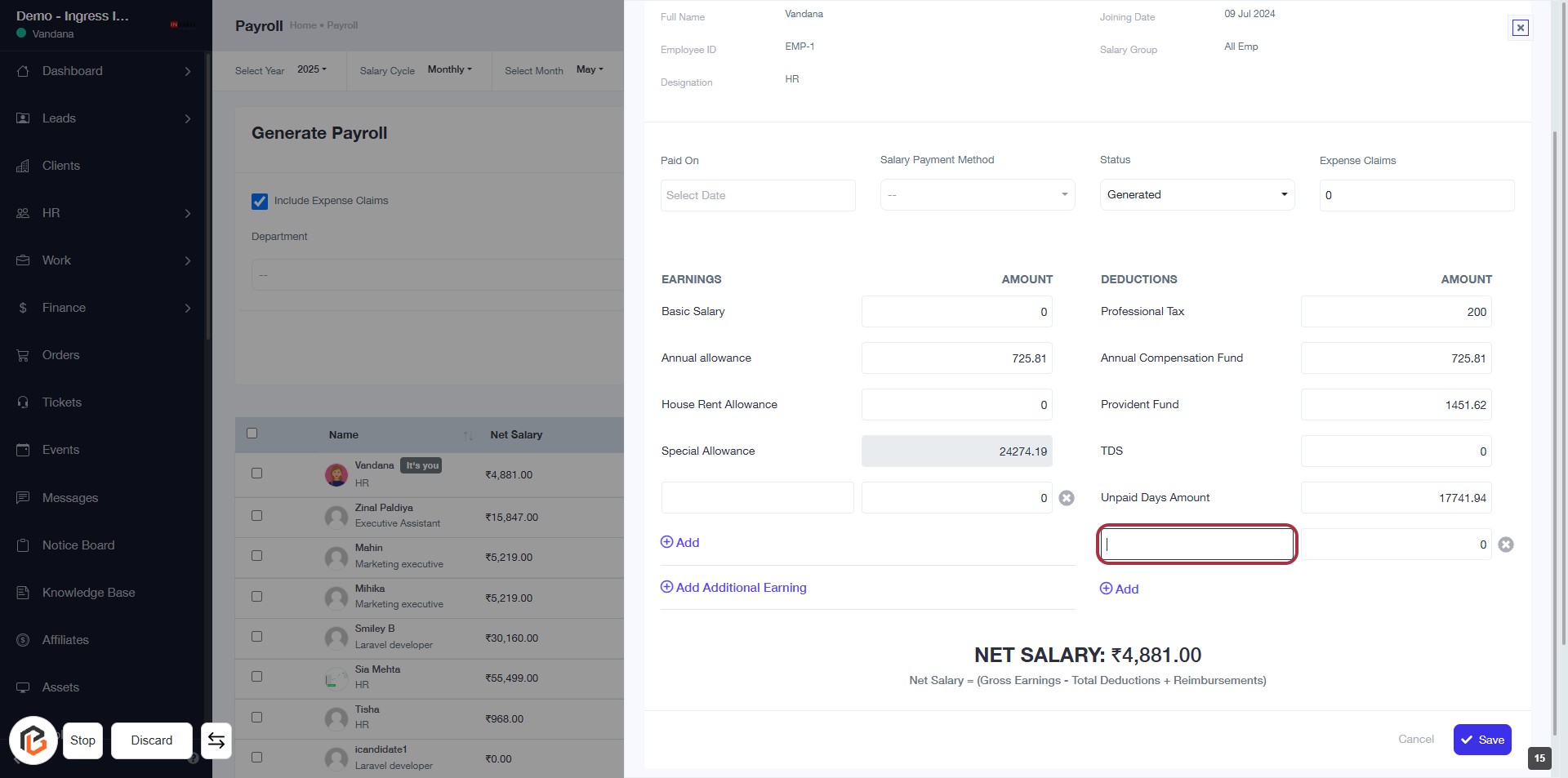

STEP 15: Insert "Deduction Value"

- Click on the input field for "Unpaid Days Amount" highlighted in red.

- Enter the deduction value as required.

- Ensure all mandatory fields marked with an asterisk (*) are filled.

- Review the entered value before proceeding to the next step.

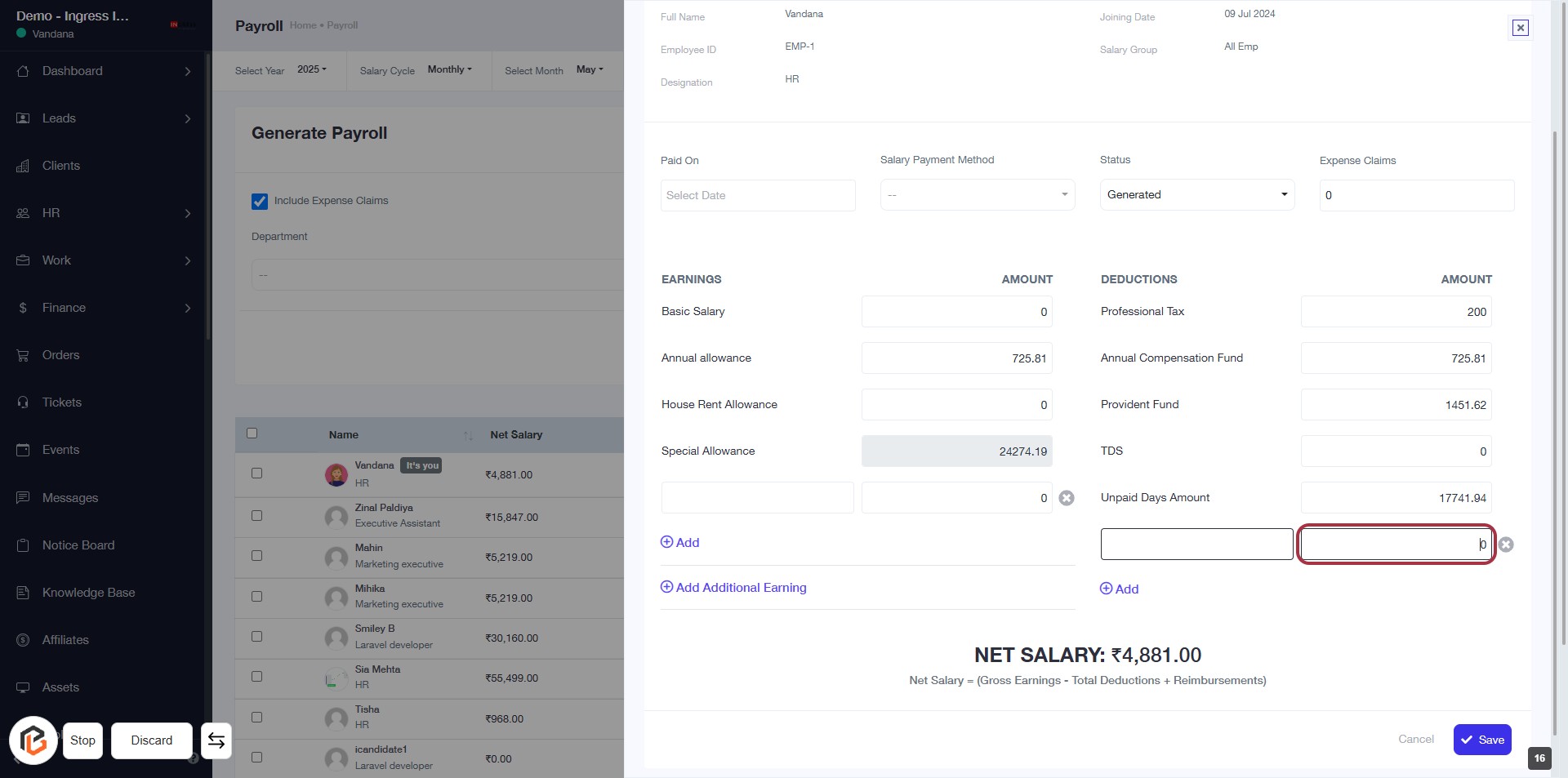

STEP 16: Click on "Save" to Finalize Payroll Entry

- Ensure all required fields are filled out correctly.

- Review the entered values for earnings and deductions.

- Click the Save button located at the bottom right of the form to finalize your payroll entry.

- Confirm that the system acknowledges your action and displays a success message.